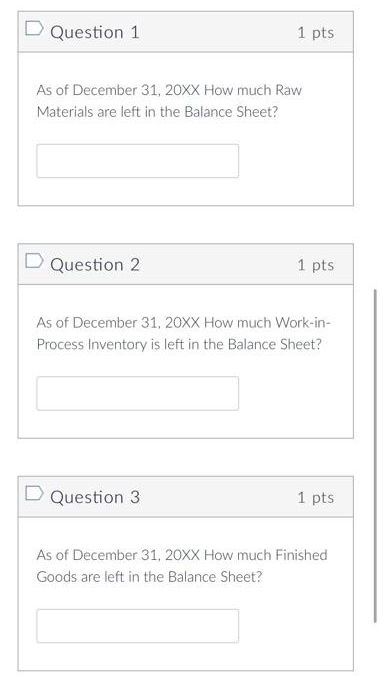

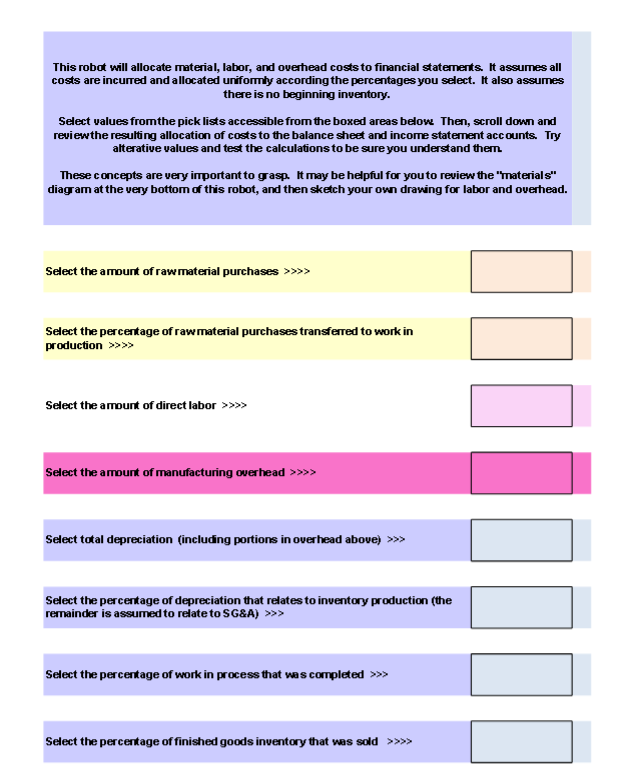

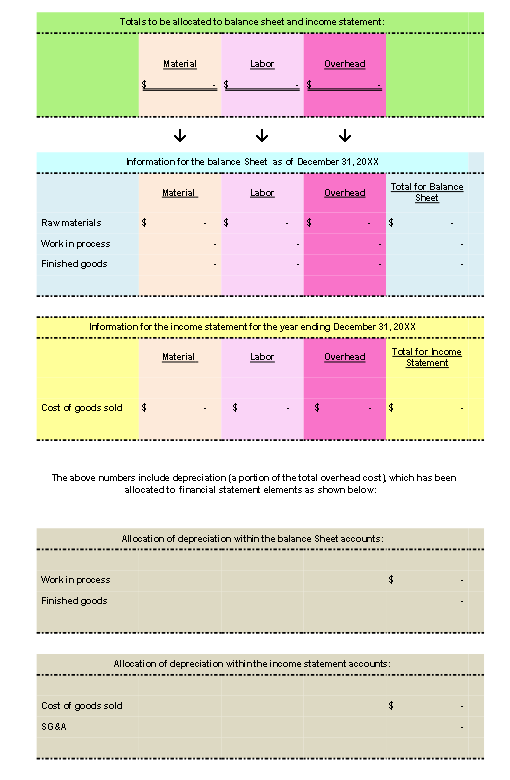

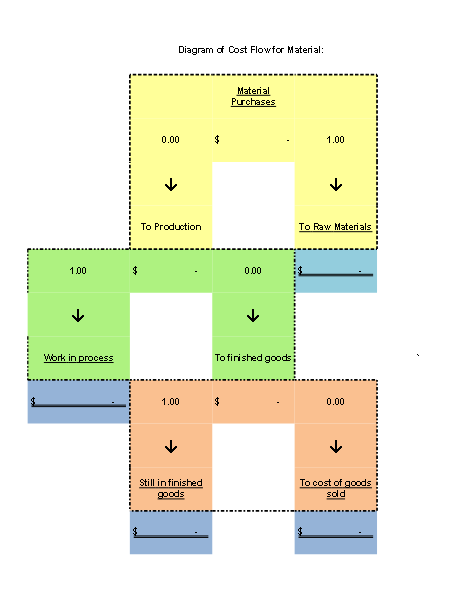

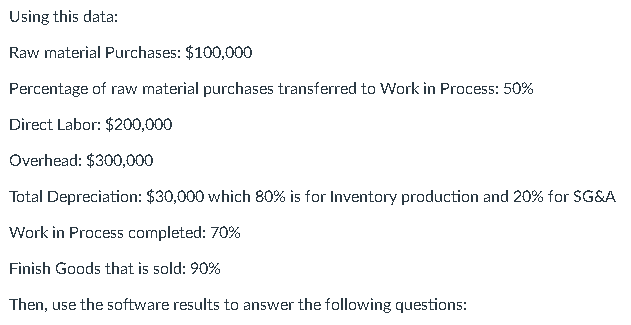

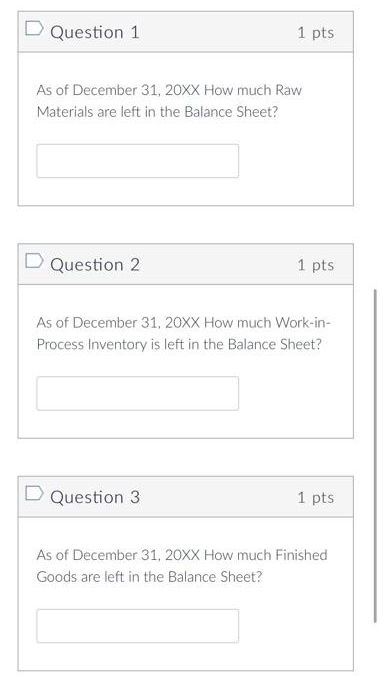

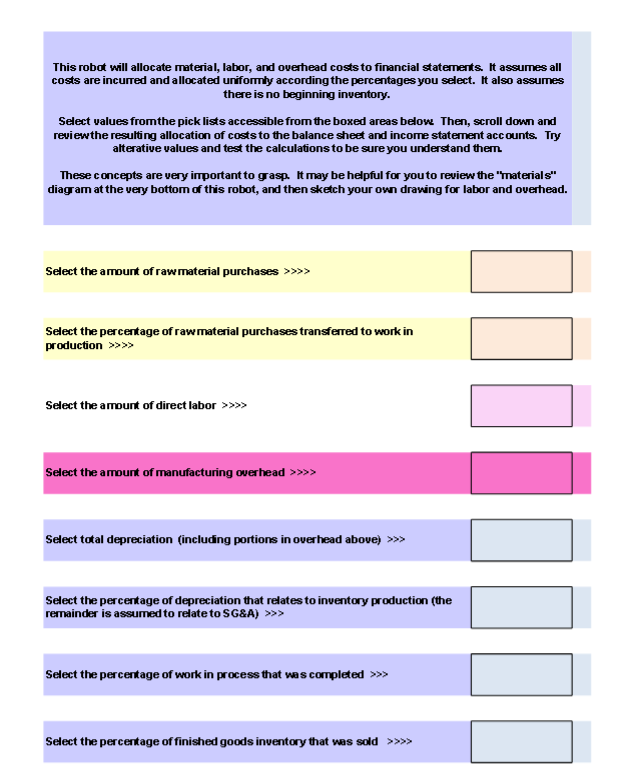

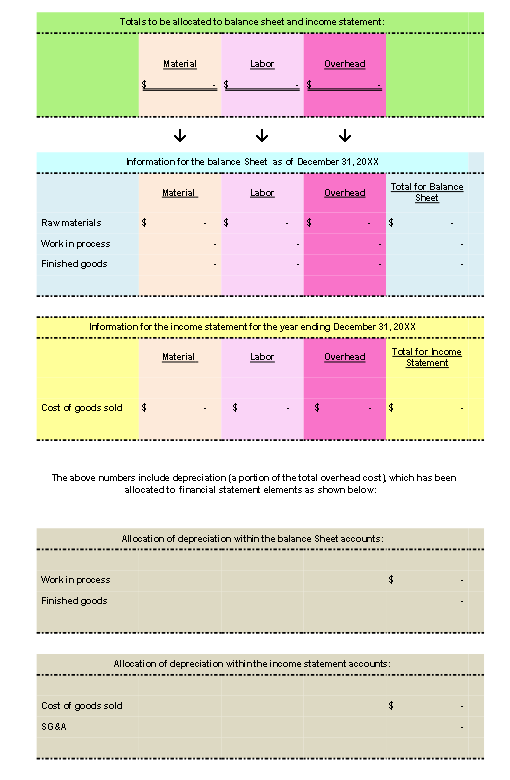

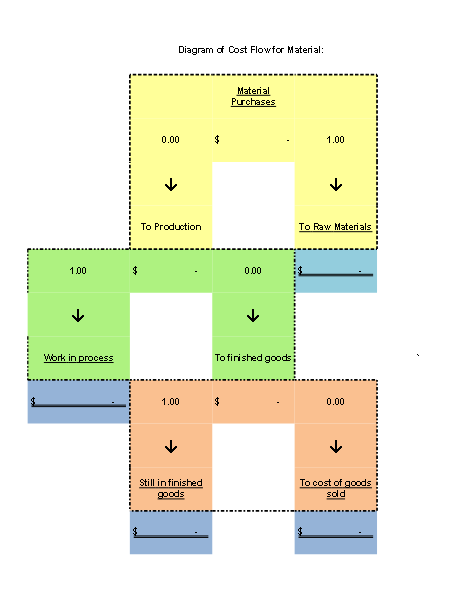

Information for the balance Sheet as of December 31,20XX Irformation for the income statement for the year ending December 31, 20: x The above numbers include depreciation [a portion of the total overhead cost] which has been allocated to firancial statemert elements as shown below: Allocation of depreciation within the balance Sheet accounts: As of December 31, 20XX How much Raw Materials are left in the Balance Sheet? Question 2 1 pts As of December 31, 20XX How much Work-inProcess Inventory is left in the Balance Sheet? Question 3 1 pts As of December 31, 20XX How much Finished Goods are left in the Balance Sheet? Using this data: Raw material Purchases: $100,000 Percentage of raw material purchases transferred to Work in Process: 50\% Direct Labor: $200,000 Overhead: $300,000 Total Depreciation: $30,000 which 80% is for Inventory production and 20% for $G&A Work in Proces5 completed: 70% Finish Goods that is sold: 90% Then, use the software results to answer the following questions: This robot will allocate material, labor, and overhead costs to financial statermerts. It assumes all costs are incurred and allocated uniformby according the percentages you select. It also assumes there is no beginning inventory. Select values fromthe pick lists accessible from the boxed areas below Then, scroll down and review the resulting allocation of costs to the balance sheet and income statement accounts. Try alterative values and test the calculations to be sure you understand them. These concepts are very important to grasp. It may be helpful for you to review the "materials" diagram at the very bottom of this robot, and then sketch your own drawing for labor and overhead. Select the amount of rawmaterial purchases >>>> Select the percentage of rawmaterial purchases transferred to work in production >>> Select the amount of direct labor > Select the amourt of manufacturing overhead > Select the percentage of depreciation that relates to inventory production (the remainder is assumed to relate to SG\&A) > Select the percentage of work in process that was completed > Select the percentage of finished goods inventory that was sold >