Answered step by step

Verified Expert Solution

Question

1 Approved Answer

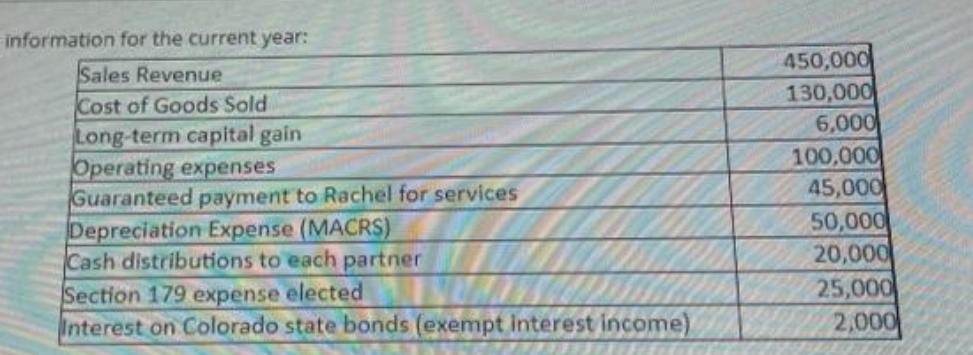

information for the current year: Sales Revenue Cost of Goods Sold 450,000 130,000 6,000 Long-term capital gain Operating expenses 100,000 Guaranteed payment to Rachel

information for the current year: Sales Revenue Cost of Goods Sold 450,000 130,000 6,000 Long-term capital gain Operating expenses 100,000 Guaranteed payment to Rachel for services 45,000 Depreciation Expense (MACRS) 50,000 Cash distributions to each partner 20,000 Section 179 expense elected 25,000 Interest on Colorado state bonds (exempt interest income) 2,000 Rachel is a 40% general partner in partnership capital, profits, and losses. a. Compute Ordinary Income for the Partnership. Label each item in your calculation. b. List the items (description and amount) from the above information that Rachel (40% owner) must report on her 1040. c What is the amount of Rachel's earnings that are subject to self-employment tax assuming this is her only business income? d. What is Rachel's tentative Qualified Business Income deduction? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph 8 - Arial 10pt A "NO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started