Answered step by step

Verified Expert Solution

Question

1 Approved Answer

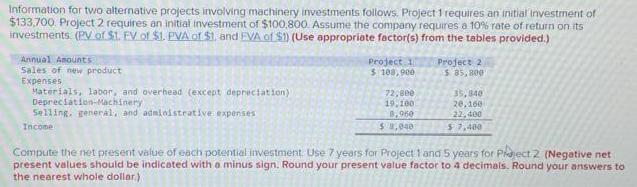

Information for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $133,700 Project 2 requires an initial investment of

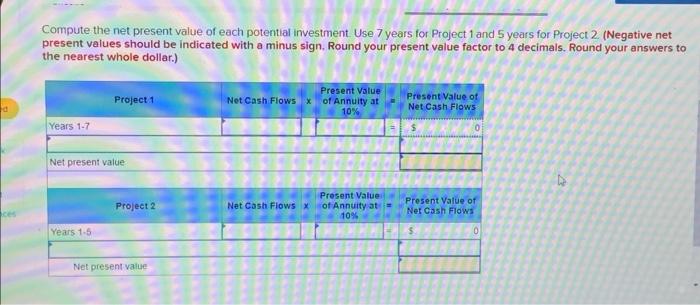

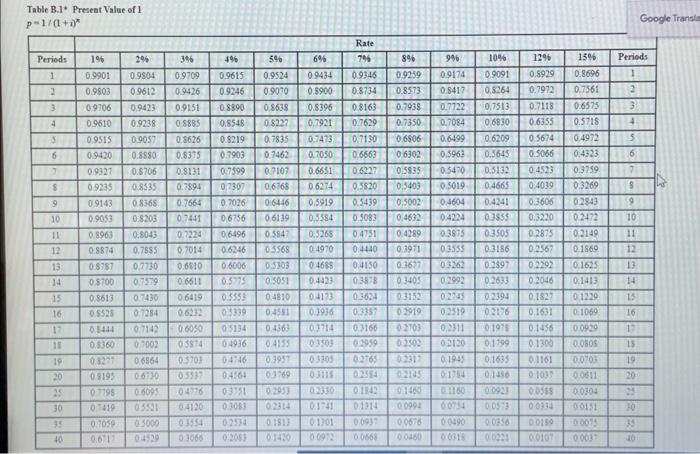

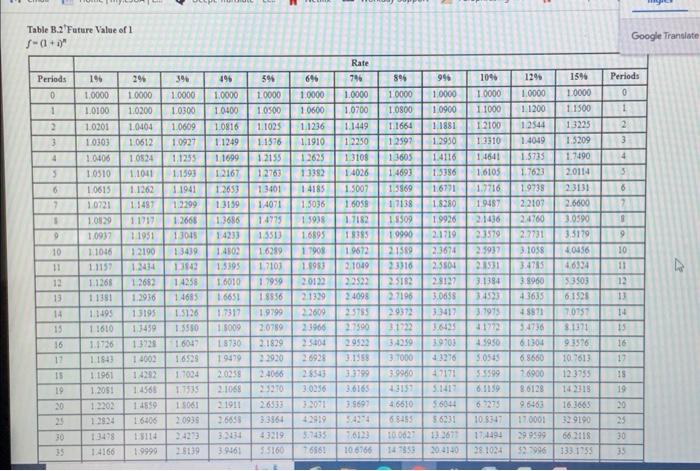

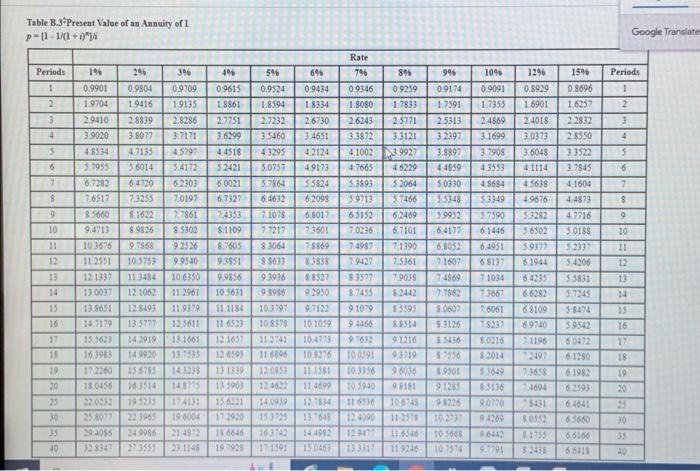

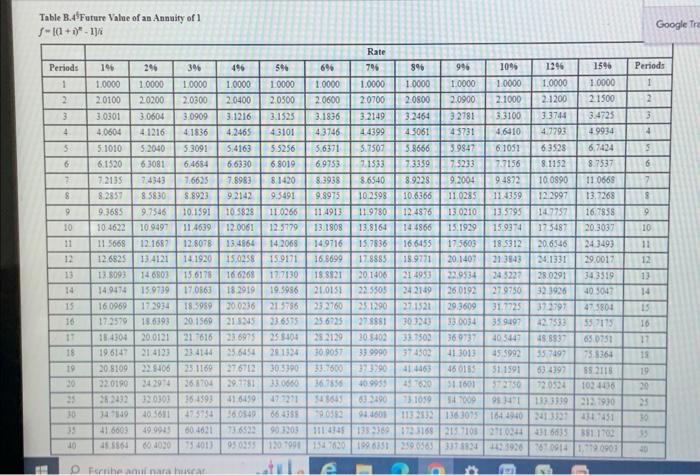

Information for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $133,700 Project 2 requires an initial investment of $100,800. Assume the company requires a 10% rate of return on its investments (PV of $1. FV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided.) Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Incone Project 1 $ 108,900 Project 2 $ 85,800 72,8ee 19,100 0,960 $ 8,040 35,840 20.160 22,400 $7,400 Compute the net present value of each potential investment. Use 7 years for Project 1 and 5 years for Project 2 (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.) Compute the net present value of each potential investment. Use 7 years for Project 1 and 5 years for Project 2. (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.) Present Value Present Value of Project 1 Net Cash Flows x of Annuity at Net Cash Flows 10% Years 1-7 $ 0 Net present value Present Value Present Value of Project 2 Net Cash Flows x ces of Annuity at 10% Net Cash Flows Years 1-5 S Net present value Table B.1 Present Value of 1 p-1/(1+1) Google Transla Rate Periods 1% 2% 3% 4% 5% 6% 796 8% 1 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 2 0.9803 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 3 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 4 0.9610 0.9238 0.8885 0.8548 0.8227 $ 0.9515 0.9057 0.8626 0.8219 0.7835 6 0.9420 0.8880 0.8375 0.7903 0.7462 2 0.9327 0.8706 0.8131 0.7599 0.7107 S 0.9235 0.8535 0.7894 07307 0,6768 0.6274 9 0.9143 0.8368 0.7664 0.7026 06446 0.5919 0.5439 101 0.9053 0.8203 0.7441 06756 0.6139 0.5584 9% 0.9259 0.9174 0.8573 0.8417 0.8163 0.7938 0.7722 0.7921 0.7629 0.7350 0.7084 0.7473 0.7130 0.6806 0.6499 0.7050 0.6663 0.6302 0.5963 0.6651 0.6227 0.5835 0.5470 0.5132 0.4523 0.3759 0.5820 0.5403 0.5019 0.4665 0.4039 0.3269 0.5002 0.4604 0.4241 0.3606 0.2843 0.5083 0.4632 04224 0.3855 0.3220 10% 12% 0.9091 0.8929 0.8264 0.7972 0.7513 0.7118 0.6575 06830 0.6355 0.5718 0.6209 0.5674 04972 0.5645 0.5066 0.4323 15% Periods 0.8696 1 0.7561 2 3 4 5 6 7 S 9 0.2472 10 11 0.8963 0.8043 0.7224 0.6496 0.5847 12 0.8874 0.7885 0.7014 0.6246 0.5568 0.5268 04970 13 0.8787 0.7730 0.6810 0.6006 0.5303 14 0.8700 0.7579 0.6611 0.5775 0.5051 0.4423 15 0.8613 07430 0.6419 0.3553 0.4810 04173 16 0.8528 0.7284 0.6232 03339 0.4581 0.3936 0.3357 17 0.5444 0.7142 0.6050 05134 0.4363 03714 16 0.8360 07002 05874 04936 0.4155 04751 0.4289 03875 03505 02875 0.4440 0.3971 03555 0.3186 0.2567 04688 0.4150 0.3677 03262 02292 0.1625 0.3878 0.3405 02992 0.3624 0.3152 02745 02919 02519 0.3166 02703 0,2311 03503 02959 02502 02120 0.2149 11 0.1869 12 0.2897 0.2633 13 0.2046 02394 0,1827 01229 02176 0.1631 0.1069 0197 0.1456 0.0929 0.1799 0.1413 14 15 16 17 0.1300 0.0805 15 19 0.8277 0.6864 0.5703 04746 0.3957 03305 02765 02317 0.1945 0.1635 0.1161 0.0703 19 20 0.5195 0.6730 05537 0.4564 0.3769 03116 0.2584 02145 01784 0.1456 01037 0.0611 20 25 07798 0.6095 04776 0.3751 0.2953 02330 01842 01460 01160 0.0923 0.0588 0.0304 25 30 07419 05521 04120 0.3083 02314 35 0.7059 0.5000 0.3554 02534 0.1813 40 0.6717 04529 0.3066 02083 01420 00972 0.1741 01314 00994 0.13011 0.0937 00676 00668 0.0460 00754 00573 00334 00490 00151 30 00318 00221 0.0356 0.0189 0.0107 00075 35 0.003 40 Table B.2 Future Value of 1 S-01+0)" Google Translate L's Rate Periods 1% 2% 3% 496 5% 6% 796 8% 996 10% 12% 15% Periods 0 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 1 1.0100 1.0200 1.0300 1.0400 1.0500 1.0600 2 1.0201 1.0404 1.0609 1.0816 1.1025 1.1236 3 1.0303 1.0612 1.0927 1.1249 1.1576 4 1.0406 1.0824 1.1255 1.1699 1.2155 3 1.0510 1.1041 1.1593 12167 12763 6 1.0615 1.1262 1.1941 1.2653 1.3401 14185 7 1.0721 1.1487 1.2299 13159 14071 1.0829 1.1717 1.2668 1.3686 1.0937 1.1951 13045 14233 10 1.1046 12190 13439 11 1.1157 1.2434 12 1.1268 1.2682 1.4258 13 1.1381 1.2936 1.4685 1.6651 1.1910) 1.2250 12597 126251 1.3108 13605 13382 1.4026 1.4691 1.5007 1.5869 1.6771 1.7716 1.9738 23131 1.5036 1.6058 17138 1.8280 1.9487 22107 14775 1.5938 1.7182 18509 1.9926 21436 24760 1.5513 1.6895 18385 19990 2.1719 23579 2.7731 1.4802 1.6289 17908 1.9672 21589 2.3674 13842 1.5395 1.7103 1.8983 2.1049 23316 2.5804 1.6010 1.7959 2.0122 2.2522 2.5182 2.8127 1.8856 21329 24098 1.0000 1.0000 1.0700 1.0800 10900 1.1449 1.1664 1.1881 1.2950 1.4116 1.0000 1.0000 1.0000 11000 1.1200 12100 12544 13225 1.3310 1.4049 1.5209 1.4641 1.5735 1.7490 1.5386 1.6105 1.7623 2.0114 1.0000 0 1.1500 2 3 4 6 2.6600 7 3.0590 3.5179 9 2.5937 3.1058 4.0456 10 2.3531 3.4785 4.6324 11 3.1384 3.8960 53503 12 2.7196 3.0658 3.4523 4.3635 6.1528 13 14 1.1495 1.3195 1.5126 1.7317 19799 22609 25785 2.9372 33417 3.7975 48871 7.0757 14 15 11610 1.3459 1.5580 15009 2.0789 23966 27590 16 1.1726 1.3728 17 1.1843 16 1.1961 19 1.2051 1.4568 20 12202 16047 14002 1.6528 142921 1.7024 1.7535 14859 15061 2.1911 25 1.2824 16406 2.0939 2.6658 18730 2.1829 19479 2.2920 26928 2.0258 2.4066 28543 21068 23270 3.0256 26533 3.2071 33864 42919 25404 5.4274 68455 30 13478 13114 24273 3:2434 43219 5.7435 7.6123 10.0627 35 1:4166 19999 2.8139 3.9461 5.5160 76561 10.6766 147853 3.1722 3.6425 2.9522 34259 19703 4.5950 3.1588 3.7000 4.3276 5.0545 6.8660 10.7613 3.3799 3.9960 47171 53599 1.6900 12.3755 3.6165 4.3157 5.1417 6.1159 8.6128 142318 3.9697 46610 5.6044 6.7275 9.6463 $ 6231 10.8347 17.0001 13.2677 174494 29.9599 20.4140 28.1024 $2.7996 41772 5.4736 8.1371 15 6.1304 93576 16 17 18 19 16.3665 20 32.9190 25 66 2118 30 133.1755 35 Table B.3 Present Value of an Annuity of 1 p-[1-1/(1+1)" Google Translate Rate Periods 1% 2% 3% 4% 596 696 796 896 946 10% 12% 15% Periods 1 0.9901 0.9804 0.9709 09615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.8929 0.8696 I 2 1.9704 1.9416 19135 1.8861 1.8594 1.8334 3 2.9410 2.8839 2.8286 2.7751 2.7232 2.6730 1.8080 1.7833 2.6243 2.5771 4 3.9020 3.8077 3.7171 3.6299 3.5460 3.4651 3.3872 1.7591 1.7355 1.6901 25313 2.4869 2.4018 3.3121 3.2397 3.1699 3.0373 2.8550 1.6257 2 2.2832 3 4 5 4.8534 4.7135 45797 4.4518 4.3295 4.2124 4.1002 3.9927 3.8897 3.7908 3.6048 3.3522 6 5.7955 5.6014 5.4172 5.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 3.7845 6 7 6.7282 6.4720 62303 6.0021 5.7864 5.5824 5.3893 5 2064 5.0330 4.8684 4.5638 4.1604 7 8 7.6517 7.3255 7.0197 6.7327 6.4632 6,2098 5.9713 3.7466 5.5348 5.3349 4.9676 4.4873 8 9 8.5660 8.1622 7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 59952 5.7590 5.3282 4.7716 9 10 9.4713 8.9826 8.5302 8.1109 7.7217 7.3601 7.0236 11 10.3676 9.7568 9.2526 8.7605 8.3064 7.8869 7.49871 12 11.2551 10.5753 9.9540 9.3851 8.9633 8.3838 7.9427 21607 6.7101 6.4177 6.1446 5.6502 71390 7.5361 5.0188 10 6.8052 6.4951 5.9377 5.2337 11 6.8137 6.1944 54206 12 13 12.1337 11.3484 10 6350 9.9856 9.39361 88527 8.3577 14 13.0037 12 1062 11:2961 15 13.8651 12.8493 11.9379 16 14.7179 13 5777 12.5611 17 15.5623 14.2919 13.1661 19 16.3983 14.9920 13.7535 19 17.2260 15.6785 14.3238 20 25 30 35 18.0456 16.3514 148775 22.0232 19.5235 174131 25.8077 22.3965 196004 29.4056 24.9986) 21.4872 40 32.8347 27.3555 23.1148 19.7928 7.9038 7.4869 10.5631 9.8986 9.2950 8.7455 8.2442 7.7862 11.1184 10.3797 9.7122 9.1079 85595 5.0607 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 12.1657 112741 10.4773 97632 91216 8.5436 12.6599 11.6896 10.9276 100591 9.3719 8.7556 13.1339 12.0853 11.1581 10.3356 9.6036 9501 53649 135903 12.4622 11.4699 10.5940 9.8181 9.1285 8.5136 7.4694 6.2593 15.6221 14.0939 12.7834 116536 10.6748 98226 9.0770 75431 6.4641 17 2920 15.3725 13.7648 12.4090 11-2578 10.2737 9.4269 8.0552 6.5660 18.6646 16.3742 144992 12.9477 11.6546 10.5668 9.6442 8.1755 6.6166 171591 15.0463 13.3317 11.9246 10.7574 9.7791 82438 6.6418 7.1034 6.4235 5.5831 7.3667 6.6282 7.6061 6.8109 5.8474 7.8237 6.9740 5.9542 8:0216 8.2014 13 5.7245 14 15 16 3.11961 6.0472 17 72497 6.1280 18 7.3658 6.1982 19 20 25 30 35 40 Table B.4 Future Value of an Annuity of 1 S-[(1+1)*-13 Google Tra Rate Periods 196 296 3% 4% 5% 6% 796 8% 9% 10% 1246 15% Periods 1 1.0000 1.0000 1.0000 1.0000 1.0000 1.0000 2 2.0100 20200 2.0300 2.0400 2.0500 3 3.0301 3.0604 3.0909 3.1216 3.1525 4 4.0604 4.1216 4:1836 4.2465 4.3101 5 5.1010 5.2040 5.3091 5.4163 5.5256 5.6371 6 6.1520 6.3081 6.4684 6.6330 6.8019 6.9753 7.1533 5.7507 5.8666 7.3359 1.0000 1.0000 1.0000 1.0000 2.0600 2.0700 2.0800 2.0900 2.1000 2.1200 3.1836 3.2149 3.2464 3.2781 3.3100 3.3744 4.3746 4.4399 4.5061 45731 4.6410 4.7793 3.9847 6.1051 6.3528 7.5233 1.0000 1.0000 I 2.1500 2 3.4725 3 4.9934 4 6,7424 3 7.2135 7.4343 7.6625 7.8983 8.1420 8.3938 8.6540 8.9228 8 8.2857 8.5830 $.8923 9.2142 9.5491 9.8975 10.2598 10.6366 9 9.3685 9.7546 10.1591 10.5828 11.0266 11.4913 11.9780 12.4876 7.7156 8.1152 9.2004 9.4872 10.0890 11.0285 11.4359 12.2997 13.0210 13.5795 14.7757 8.7537 6 11.0669 7 13.7268 16.7858 9 10 10.4622 10.9497 11.4639 12.0061 12.5779 13.1808 13.8164 14 4866 11 11.5668 12:1687 12.8078 13.4864 14.2068 14.9716 15.7836 166455 12 12.6825 13.4121 14.1920 15.0258 13 13.8093 14.6803 15.6178 16.6268 14 14.9474 15.9739 17.0863 18.2919 15 16.0969 17.2934 18.5989 20.0236 16 IT 18.4304 17.2579 18.6393 20.0121 18 19.6147 15.9171 16.8699 17.8885 17.7130 18.8821 201406 21.0151 22.5505 21.5786 23.2760 25.1290 20.1569 21.8245 23.6575 25.6725 27.8881 21.76161 23.6975 25.8404 28.2129 30.8402 21.4123 23.4144 25.6454 28.1324 30.9057 19.5986 33.9990 37 4302 19 20.8109 22.8406 25.1169 27.6712 305390 33.7600 37.3790 41.4463 18.9771 21 4953 22.9534 245227 28.0291 24.2149 26.0192 27.9750 27.1521 29.3609 31.7725 30.3243 33.0034 35.9497 33.7502 36.9737 40.5447 41.3013 45 0185 15.1929 15.9374 17.5487 20.3037 17.5603 18.5312 20.6546 24.3493 20.1407 21.38431 24.1331 29.0017 10 11 12 34.3519 13 32.3926 40 5047 14 37.2797 47.5804 15 42.7533 55.7175 16 48.8837 65.0751 17 45.5992 55.7497 75.8364 18 51.1591 63.4397 88.2118 19 20 22.0190 24.2974 26.8704 29.7781 33.0660 25 28.2432 320303 364393 41.6459 36.7856 47-7271 548645 63.2490 40.9955 43 7620 34.1601 372750 31059 547009 98.3471 72.0524 1024436 133.3339 212.1930 25 20 30 347849 40.5681 47 5754 16.0549 35 41.6603 49.9945 60.46211 73.6522 66.4388 90582 90 3203 94.4608 113 2532 136 3075 164 4940 241.3327 4347451 30 111 4345 1382369 172.3169 215 7108 2710244 431 6635 881:1702 35 40 45.5864 60 4020 75.4013 95 0255 120 7998 154 7620 199 6351 259.0565 337 8824 442 3926 767 0914 1,719 0903 40 O Fcribe anul nara buscar D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started