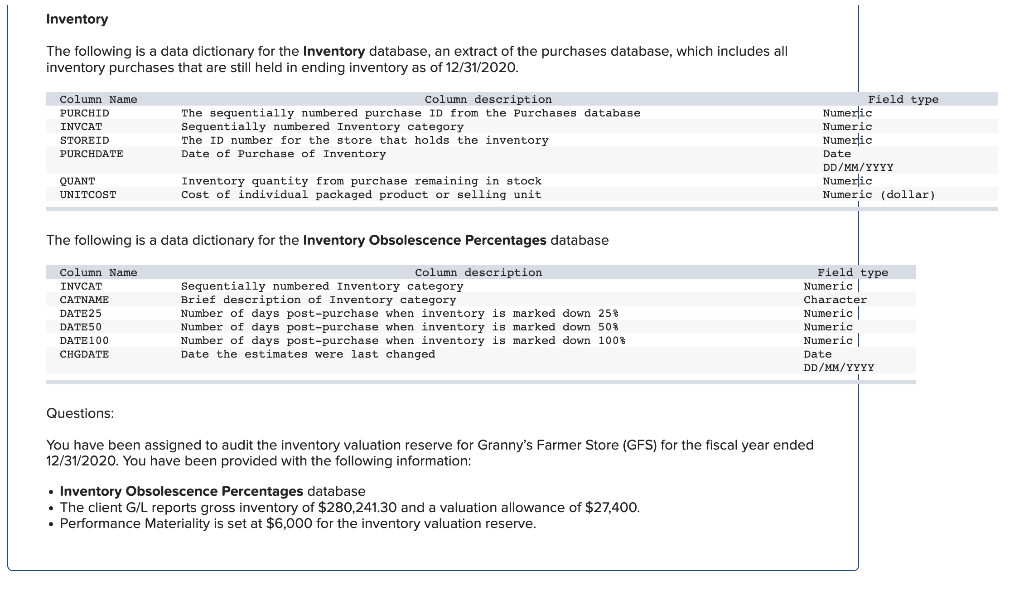

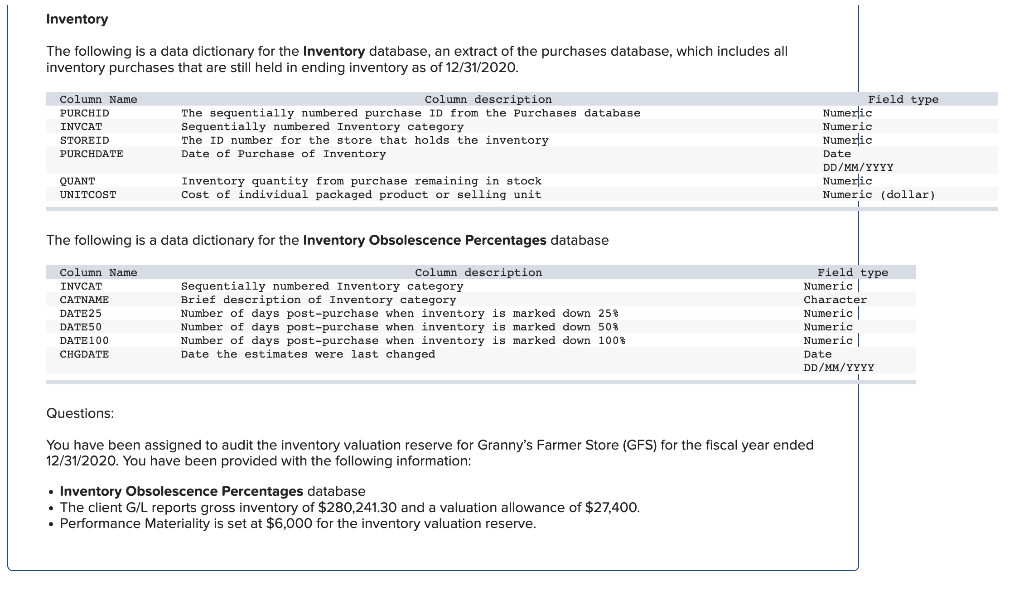

Information For Use with Granny's Farmer Store Inventory Obsolescence Granny's Farmer Store is a smaller chain of 10 sustainable farming produce stores that operates in the 3 west-coast states, but mostly in California. The company first opened in 2007 and has built up a strong customer base. The store prides itself on local sourcing and carrying organic products. However, one of the biggest issues for GFS is the obsolescence of their produce items, particularly because of their insistence on organic production and lack of preservatives. Because nearly all of the company's inventory can spoil, accurate valuation of inventory at year end is a tremendously difficult audit issue. One difficulty for GFS is that their organic groceries are, in general, only labeled with packing dates, not with expiration dates. It is the responsibility of the staff at each store to dispose of product at the point when it is unsaleable. Further, the client often marks down the inventory in the days prior to expected spoilage, adding further complexity to the issue of inventory valuation. To assist the company with preparing their inventory valuation, the company's data analysts and inventory experts analyzed company sales by class of inventory and derived average spoilage periods, as well as what percentage of inventory was saleable at different times prior to expected spoilage date. Based on this, the company created an Inventory Obsolescence Percentages database, which lists all of the types of produce sold by the store, as well three categories for inventory obsolescence: 25%,50%, and 100%. These categories provide a number of days after packaging where the inventory is written down by 25%,50%, and 100% respectively. Of course, these are averages and there can be some variation in actual. However, the estimate has performed well in the past. Whenever an auditor uses Information Prepared by the Entity, that information must be tested for completeness and accuracy. For the purposes of the following exercises, please assume that your firm has already tested the completeness and accuracy of the sales data underlying the assumptions and has determined that the dates and percentages are reasonable for purposes of an inventory valuation reserve as of the date of their testing (11/15/20). It is unlikely any of the assumptions or percentages should change. Your only responsibility is testing the end of inventory reserve. You have access to the following databases: GFS Inventory Obsolescence Data Inventory The following is a data dictionary for the Inventory database, an extract of the purchases database, which includes all The following is a data dictionary for the Inventory database, an extract of the purchases database, which includes all inventory purchases that are still held in ending inventory as of 12/31/2020. Questions: You have been assigned to audit the inventory valuation reserve for Granny's Farmer Store (GFS) for the fiscal year ended 12/31/2020. You have been provided with the following information: - Inventory Obsolescence Percentages database - The client G/L reports gross inventory of $280,241.30 and a valuation allowance of $27,400. - Performance Materiality is set at $6,000 for the inventory valuation reserve. Based on your above analysis, please write a memo for the audit file outlining any issues that you believe deserve special attention in the audit. Information For Use with Granny's Farmer Store Inventory Obsolescence Granny's Farmer Store is a smaller chain of 10 sustainable farming produce stores that operates in the 3 west-coast states, but mostly in California. The company first opened in 2007 and has built up a strong customer base. The store prides itself on local sourcing and carrying organic products. However, one of the biggest issues for GFS is the obsolescence of their produce items, particularly because of their insistence on organic production and lack of preservatives. Because nearly all of the company's inventory can spoil, accurate valuation of inventory at year end is a tremendously difficult audit issue. One difficulty for GFS is that their organic groceries are, in general, only labeled with packing dates, not with expiration dates. It is the responsibility of the staff at each store to dispose of product at the point when it is unsaleable. Further, the client often marks down the inventory in the days prior to expected spoilage, adding further complexity to the issue of inventory valuation. To assist the company with preparing their inventory valuation, the company's data analysts and inventory experts analyzed company sales by class of inventory and derived average spoilage periods, as well as what percentage of inventory was saleable at different times prior to expected spoilage date. Based on this, the company created an Inventory Obsolescence Percentages database, which lists all of the types of produce sold by the store, as well three categories for inventory obsolescence: 25%,50%, and 100%. These categories provide a number of days after packaging where the inventory is written down by 25%,50%, and 100% respectively. Of course, these are averages and there can be some variation in actual. However, the estimate has performed well in the past. Whenever an auditor uses Information Prepared by the Entity, that information must be tested for completeness and accuracy. For the purposes of the following exercises, please assume that your firm has already tested the completeness and accuracy of the sales data underlying the assumptions and has determined that the dates and percentages are reasonable for purposes of an inventory valuation reserve as of the date of their testing (11/15/20). It is unlikely any of the assumptions or percentages should change. Your only responsibility is testing the end of inventory reserve. You have access to the following databases: GFS Inventory Obsolescence Data Inventory The following is a data dictionary for the Inventory database, an extract of the purchases database, which includes all The following is a data dictionary for the Inventory database, an extract of the purchases database, which includes all inventory purchases that are still held in ending inventory as of 12/31/2020. Questions: You have been assigned to audit the inventory valuation reserve for Granny's Farmer Store (GFS) for the fiscal year ended 12/31/2020. You have been provided with the following information: - Inventory Obsolescence Percentages database - The client G/L reports gross inventory of $280,241.30 and a valuation allowance of $27,400. - Performance Materiality is set at $6,000 for the inventory valuation reserve. Based on your above analysis, please write a memo for the audit file outlining any issues that you believe deserve special attention in the audit