Answered step by step

Verified Expert Solution

Question

1 Approved Answer

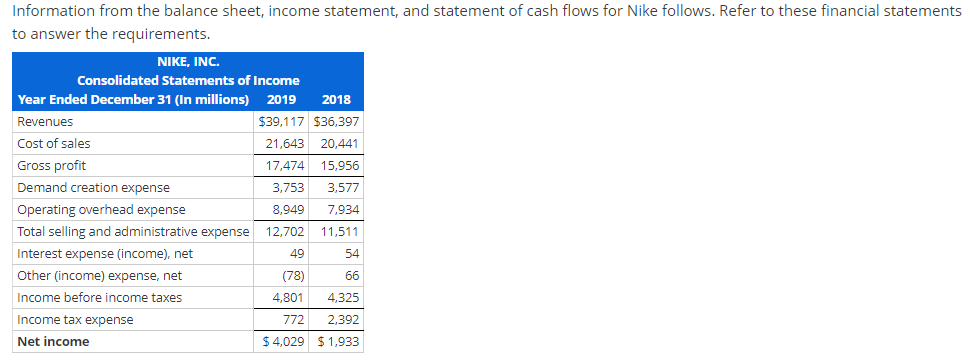

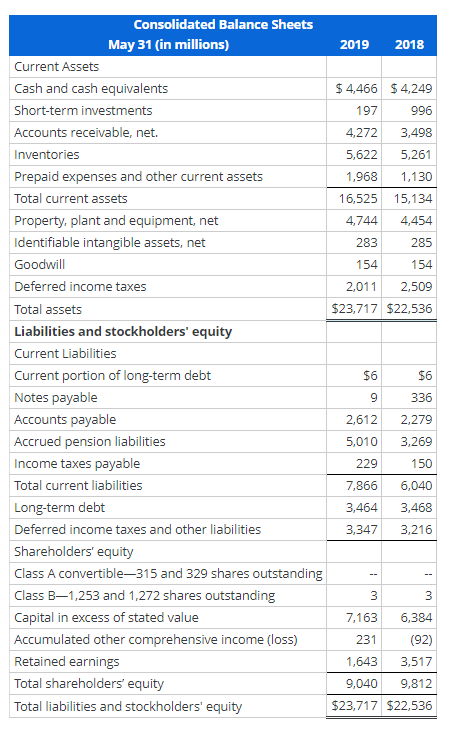

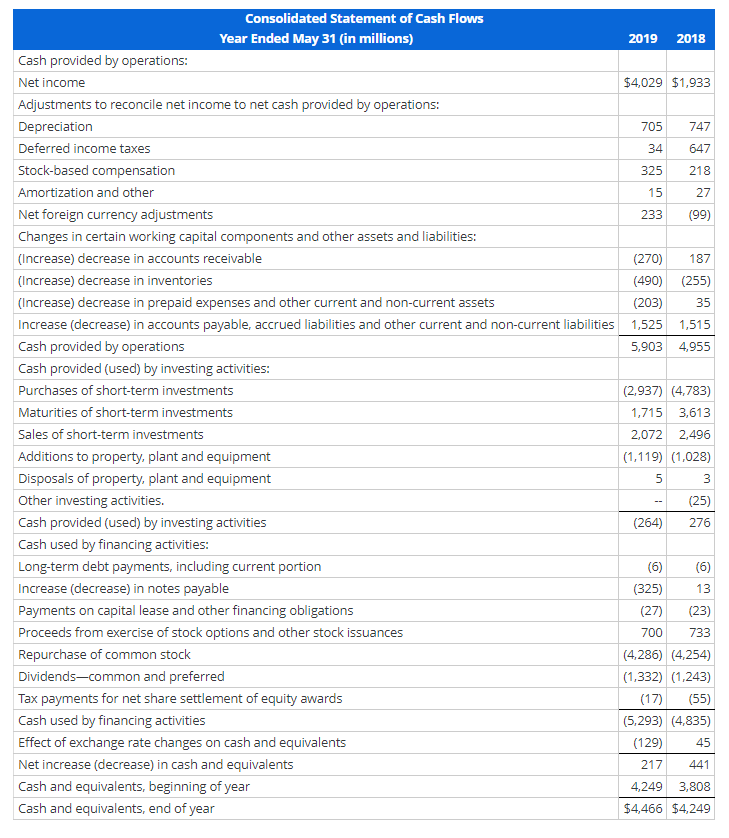

Information from the balance sheet, income statement, and statement of cash flows for Nike follows. Refer to these financial statements to answer the requirements.

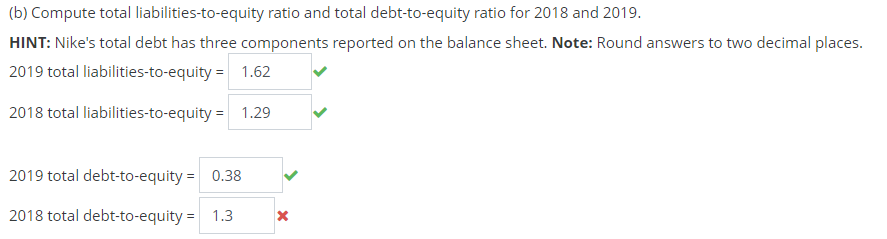

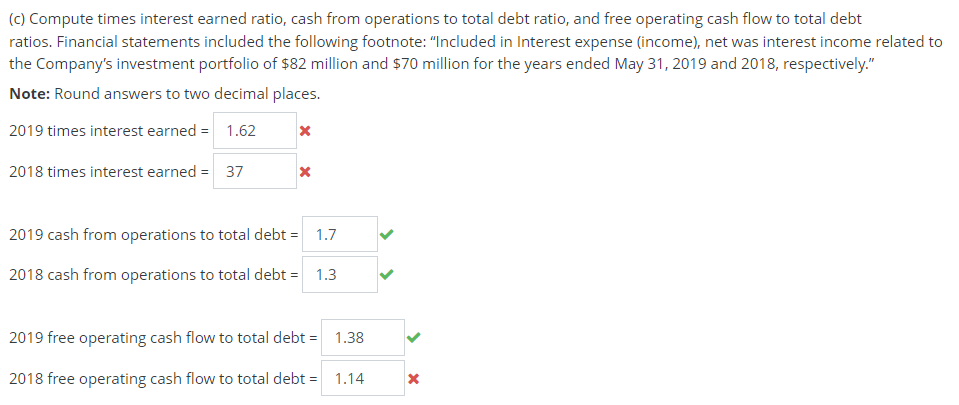

Information from the balance sheet, income statement, and statement of cash flows for Nike follows. Refer to these financial statements to answer the requirements. NIKE, INC. Consolidated Statements of Income Year Ended December 31 (In millions) 2019 2018 Revenues $39,117 $36,397 Cost of sales 21,643 20,441 Gross profit 17.474 15,956 Demand creation expense 3,753 3,577 Operating overhead expense 8,949 7,934 Total selling and administrative expense 12,702 11,511 Interest expense (income), net 49 54 Other (income) expense, net (78) 66 Income before income taxes 4,801 4,325 Income tax expense 772 2,392 Net income $ 4,029 $ 1,933 Consolidated Balance Sheets May 31 (in millions) 2019 2018 Current Assets Cash and cash equivalents $ 4,466 $ 4,249 Short-term investments 197 996 Accounts receivable, net. 4,272 3,498 Inventories 5,622 5,261 Prepaid expenses and other current assets 1,968 1,130 Total current assets 16,525 15,134 Property, plant and equipment, net 4,744 4,454 Identifiable intangible assets, net 283 285 Goodwill 154 154 Deferred income taxes 2,011 2,509 Total assets $23,717 $22,536 Liabilities and stockholders' equity Current Liabilities Current portion of long-term debt $6 $6 Notes payable 336 Accounts payable 2,612 2,279 Accrued pension liabilities 5,010 3,269 Income taxes payable 229 150 Total current liabilities 7,866 6,040 Long-term debt 3,464 3,468 Deferred income taxes and other liabilities 3,347 3,216 Shareholders' equity Class A convertible315 and 329 shares outstanding -- Class B-1,253 and 1,272 shares outstanding Capital in excess of stated value 7,163 6,384 Accumulated other comprehensive income (loss) 231 (92) Retained earnings 1,643 3,517 Total shareholders' equity 9,040 9,812 Total liabilities and stockholders' equity $23,717 $22,536 3. Consolidated Statement of Cash Flows Year Ended May 31 (in millions) 2019 2018 Cash provided by operations: Net income $4,029 $1,933 Adjustments to reconcile net income to net cash provided by operations: Depreciation 705 747 Deferred income taxes 34 647 Stock-based compensation 325 218 Amortization and other 15 27 Net foreign currency adjustments 233 (99) Changes in certain working capital components and other assets and liabilities: (Increase) decrease in accounts receivable (270) 187 (Increase) decrease in inventories (490) (255) (Increase) decrease in prepaid expenses and other current and non-current assets (203) 35 Increase (decrease) in accounts payable, accrued liabilities and other current and non-current liabilities 1,525 1,515 Cash provided by operations 5,903 4,955 Cash provided (used) by investing activities: Purchases of short-term investments (2,937) (4,783) Maturities of short-term investments 1,715 3,613 Sales of short-term investments 2,072 2,496 Additions to property, plant and equipment (1,119) (1,028) Disposals of property, plant and equipment Other investing activities. (25) Cash provided (used) by investing activities (264) 276 Cash used by financing activities: Long-term debt payments, including current portion (6) (6) Increase (decrease) in notes payable (325) 13 Payments on capital lease and other financing obligations (27) (23) Proceeds from exercise of stock options and other stock issuances 700 733 Repurchase of common stock (4,286) (4,254) Dividends-common and preferred (1,332) (1,243) Tax payments for net share settlement of equity awards (17) (55) Cash used by financing activities (5,293) (4,835) Effect of exchange rate changes on cash and equivalents (129) 45 Net increase (decrease) in cash and equivalents 217 441 Cash and equivalents, beginning of year 4,249 3,808 Cash and equivalents, end of year $4,466 $4,249 (b) Compute total liabilities-to-equity ratio and total debt-to-equity ratio for 2018 and 2019. HINT: Nike's total debt has three components reported on the balance sheet. Note: Round answers to two decimal places. 2019 total liabilities-to-equity = 1.62 2018 total liabilities-to-equity = 1.29 2019 total debt-to-equity = 0.38 2018 total debt-to-equity = 1.3 (c) Compute times interest earned ratio, cash from operations to total debt ratio, and free operating cash flow to total debt ratios. Financial statements included the following footnote: "Included in Interest expense (income), net was interest income related to the Company's investment portfolio of $82 million and $70 million for the years ended May 31, 2019 and 2018, respectively." Note: Round answers to two decimal places. 2019 times interest earned = 1.62 2018 times interest earned = 37 2019 cash from operations to total debt = 1.7 2018 cash from operations to total debt = 1.3 2019 free operating cash flow to total debt = 1.38 2018 free operating cash flow to total debt = 1.14 > Information from the balance sheet, income statement, and statement of cash flows for Nike follows. Refer to these financial statements to answer the requirements. NIKE, INC. Consolidated Statements of Income Year Ended December 31 (In millions) 2019 2018 Revenues $39,117 $36,397 Cost of sales 21,643 20,441 Gross profit 17.474 15,956 Demand creation expense 3,753 3,577 Operating overhead expense 8,949 7,934 Total selling and administrative expense 12,702 11,511 Interest expense (income), net 49 54 Other (income) expense, net (78) 66 Income before income taxes 4,801 4,325 Income tax expense 772 2,392 Net income $ 4,029 $ 1,933 Consolidated Balance Sheets May 31 (in millions) 2019 2018 Current Assets Cash and cash equivalents $ 4,466 $ 4,249 Short-term investments 197 996 Accounts receivable, net. 4,272 3,498 Inventories 5,622 5,261 Prepaid expenses and other current assets 1,968 1,130 Total current assets 16,525 15,134 Property, plant and equipment, net 4,744 4,454 Identifiable intangible assets, net 283 285 Goodwill 154 154 Deferred income taxes 2,011 2,509 Total assets $23,717 $22,536 Liabilities and stockholders' equity Current Liabilities Current portion of long-term debt $6 $6 Notes payable 336 Accounts payable 2,612 2,279 Accrued pension liabilities 5,010 3,269 Income taxes payable 229 150 Total current liabilities 7,866 6,040 Long-term debt 3,464 3,468 Deferred income taxes and other liabilities 3,347 3,216 Shareholders' equity Class A convertible315 and 329 shares outstanding -- Class B-1,253 and 1,272 shares outstanding Capital in excess of stated value 7,163 6,384 Accumulated other comprehensive income (loss) 231 (92) Retained earnings 1,643 3,517 Total shareholders' equity 9,040 9,812 Total liabilities and stockholders' equity $23,717 $22,536 3. Consolidated Statement of Cash Flows Year Ended May 31 (in millions) 2019 2018 Cash provided by operations: Net income $4,029 $1,933 Adjustments to reconcile net income to net cash provided by operations: Depreciation 705 747 Deferred income taxes 34 647 Stock-based compensation 325 218 Amortization and other 15 27 Net foreign currency adjustments 233 (99) Changes in certain working capital components and other assets and liabilities: (Increase) decrease in accounts receivable (270) 187 (Increase) decrease in inventories (490) (255) (Increase) decrease in prepaid expenses and other current and non-current assets (203) 35 Increase (decrease) in accounts payable, accrued liabilities and other current and non-current liabilities 1,525 1,515 Cash provided by operations 5,903 4,955 Cash provided (used) by investing activities: Purchases of short-term investments (2,937) (4,783) Maturities of short-term investments 1,715 3,613 Sales of short-term investments 2,072 2,496 Additions to property, plant and equipment (1,119) (1,028) Disposals of property, plant and equipment Other investing activities. (25) Cash provided (used) by investing activities (264) 276 Cash used by financing activities: Long-term debt payments, including current portion (6) (6) Increase (decrease) in notes payable (325) 13 Payments on capital lease and other financing obligations (27) (23) Proceeds from exercise of stock options and other stock issuances 700 733 Repurchase of common stock (4,286) (4,254) Dividends-common and preferred (1,332) (1,243) Tax payments for net share settlement of equity awards (17) (55) Cash used by financing activities (5,293) (4,835) Effect of exchange rate changes on cash and equivalents (129) 45 Net increase (decrease) in cash and equivalents 217 441 Cash and equivalents, beginning of year 4,249 3,808 Cash and equivalents, end of year $4,466 $4,249 (b) Compute total liabilities-to-equity ratio and total debt-to-equity ratio for 2018 and 2019. HINT: Nike's total debt has three components reported on the balance sheet. Note: Round answers to two decimal places. 2019 total liabilities-to-equity = 1.62 2018 total liabilities-to-equity = 1.29 2019 total debt-to-equity = 0.38 2018 total debt-to-equity = 1.3 (c) Compute times interest earned ratio, cash from operations to total debt ratio, and free operating cash flow to total debt ratios. Financial statements included the following footnote: "Included in Interest expense (income), net was interest income related to the Company's investment portfolio of $82 million and $70 million for the years ended May 31, 2019 and 2018, respectively." Note: Round answers to two decimal places. 2019 times interest earned = 1.62 2018 times interest earned = 37 2019 cash from operations to total debt = 1.7 2018 cash from operations to total debt = 1.3 2019 free operating cash flow to total debt = 1.38 2018 free operating cash flow to total debt = 1.14 > Information from the balance sheet, income statement, and statement of cash flows for Nike follows. Refer to these financial statements to answer the requirements. NIKE, INC. Consolidated Statements of Income Year Ended December 31 (In millions) 2019 2018 Revenues $39,117 $36,397 Cost of sales 21,643 20,441 Gross profit 17.474 15,956 Demand creation expense 3,753 3,577 Operating overhead expense 8,949 7,934 Total selling and administrative expense 12,702 11,511 Interest expense (income), net 49 54 Other (income) expense, net (78) 66 Income before income taxes 4,801 4,325 Income tax expense 772 2,392 Net income $ 4,029 $ 1,933 Consolidated Balance Sheets May 31 (in millions) 2019 2018 Current Assets Cash and cash equivalents $ 4,466 $ 4,249 Short-term investments 197 996 Accounts receivable, net. 4,272 3,498 Inventories 5,622 5,261 Prepaid expenses and other current assets 1,968 1,130 Total current assets 16,525 15,134 Property, plant and equipment, net 4,744 4,454 Identifiable intangible assets, net 283 285 Goodwill 154 154 Deferred income taxes 2,011 2,509 Total assets $23,717 $22,536 Liabilities and stockholders' equity Current Liabilities Current portion of long-term debt $6 $6 Notes payable 336 Accounts payable 2,612 2,279 Accrued pension liabilities 5,010 3,269 Income taxes payable 229 150 Total current liabilities 7,866 6,040 Long-term debt 3,464 3,468 Deferred income taxes and other liabilities 3,347 3,216 Shareholders' equity Class A convertible315 and 329 shares outstanding -- Class B-1,253 and 1,272 shares outstanding Capital in excess of stated value 7,163 6,384 Accumulated other comprehensive income (loss) 231 (92) Retained earnings 1,643 3,517 Total shareholders' equity 9,040 9,812 Total liabilities and stockholders' equity $23,717 $22,536 3. Consolidated Statement of Cash Flows Year Ended May 31 (in millions) 2019 2018 Cash provided by operations: Net income $4,029 $1,933 Adjustments to reconcile net income to net cash provided by operations: Depreciation 705 747 Deferred income taxes 34 647 Stock-based compensation 325 218 Amortization and other 15 27 Net foreign currency adjustments 233 (99) Changes in certain working capital components and other assets and liabilities: (Increase) decrease in accounts receivable (270) 187 (Increase) decrease in inventories (490) (255) (Increase) decrease in prepaid expenses and other current and non-current assets (203) 35 Increase (decrease) in accounts payable, accrued liabilities and other current and non-current liabilities 1,525 1,515 Cash provided by operations 5,903 4,955 Cash provided (used) by investing activities: Purchases of short-term investments (2,937) (4,783) Maturities of short-term investments 1,715 3,613 Sales of short-term investments 2,072 2,496 Additions to property, plant and equipment (1,119) (1,028) Disposals of property, plant and equipment Other investing activities. (25) Cash provided (used) by investing activities (264) 276 Cash used by financing activities: Long-term debt payments, including current portion (6) (6) Increase (decrease) in notes payable (325) 13 Payments on capital lease and other financing obligations (27) (23) Proceeds from exercise of stock options and other stock issuances 700 733 Repurchase of common stock (4,286) (4,254) Dividends-common and preferred (1,332) (1,243) Tax payments for net share settlement of equity awards (17) (55) Cash used by financing activities (5,293) (4,835) Effect of exchange rate changes on cash and equivalents (129) 45 Net increase (decrease) in cash and equivalents 217 441 Cash and equivalents, beginning of year 4,249 3,808 Cash and equivalents, end of year $4,466 $4,249 (b) Compute total liabilities-to-equity ratio and total debt-to-equity ratio for 2018 and 2019. HINT: Nike's total debt has three components reported on the balance sheet. Note: Round answers to two decimal places. 2019 total liabilities-to-equity = 1.62 2018 total liabilities-to-equity = 1.29 2019 total debt-to-equity = 0.38 2018 total debt-to-equity = 1.3 (c) Compute times interest earned ratio, cash from operations to total debt ratio, and free operating cash flow to total debt ratios. Financial statements included the following footnote: "Included in Interest expense (income), net was interest income related to the Company's investment portfolio of $82 million and $70 million for the years ended May 31, 2019 and 2018, respectively." Note: Round answers to two decimal places. 2019 times interest earned = 1.62 2018 times interest earned = 37 2019 cash from operations to total debt = 1.7 2018 cash from operations to total debt = 1.3 2019 free operating cash flow to total debt = 1.38 2018 free operating cash flow to total debt = 1.14 > Information from the balance sheet, income statement, and statement of cash flows for Nike follows. Refer to these financial statements to answer the requirements. NIKE, INC. Consolidated Statements of Income Year Ended December 31 (In millions) 2019 2018 Revenues $39,117 $36,397 Cost of sales 21,643 20,441 Gross profit 17.474 15,956 Demand creation expense 3,753 3,577 Operating overhead expense 8,949 7,934 Total selling and administrative expense 12,702 11,511 Interest expense (income), net 49 54 Other (income) expense, net (78) 66 Income before income taxes 4,801 4,325 Income tax expense 772 2,392 Net income $ 4,029 $ 1,933 Consolidated Balance Sheets May 31 (in millions) 2019 2018 Current Assets Cash and cash equivalents $ 4,466 $ 4,249 Short-term investments 197 996 Accounts receivable, net. 4,272 3,498 Inventories 5,622 5,261 Prepaid expenses and other current assets 1,968 1,130 Total current assets 16,525 15,134 Property, plant and equipment, net 4,744 4,454 Identifiable intangible assets, net 283 285 Goodwill 154 154 Deferred income taxes 2,011 2,509 Total assets $23,717 $22,536 Liabilities and stockholders' equity Current Liabilities Current portion of long-term debt $6 $6 Notes payable 336 Accounts payable 2,612 2,279 Accrued pension liabilities 5,010 3,269 Income taxes payable 229 150 Total current liabilities 7,866 6,040 Long-term debt 3,464 3,468 Deferred income taxes and other liabilities 3,347 3,216 Shareholders' equity Class A convertible315 and 329 shares outstanding -- Class B-1,253 and 1,272 shares outstanding Capital in excess of stated value 7,163 6,384 Accumulated other comprehensive income (loss) 231 (92) Retained earnings 1,643 3,517 Total shareholders' equity 9,040 9,812 Total liabilities and stockholders' equity $23,717 $22,536 3. Consolidated Statement of Cash Flows Year Ended May 31 (in millions) 2019 2018 Cash provided by operations: Net income $4,029 $1,933 Adjustments to reconcile net income to net cash provided by operations: Depreciation 705 747 Deferred income taxes 34 647 Stock-based compensation 325 218 Amortization and other 15 27 Net foreign currency adjustments 233 (99) Changes in certain working capital components and other assets and liabilities: (Increase) decrease in accounts receivable (270) 187 (Increase) decrease in inventories (490) (255) (Increase) decrease in prepaid expenses and other current and non-current assets (203) 35 Increase (decrease) in accounts payable, accrued liabilities and other current and non-current liabilities 1,525 1,515 Cash provided by operations 5,903 4,955 Cash provided (used) by investing activities: Purchases of short-term investments (2,937) (4,783) Maturities of short-term investments 1,715 3,613 Sales of short-term investments 2,072 2,496 Additions to property, plant and equipment (1,119) (1,028) Disposals of property, plant and equipment Other investing activities. (25) Cash provided (used) by investing activities (264) 276 Cash used by financing activities: Long-term debt payments, including current portion (6) (6) Increase (decrease) in notes payable (325) 13 Payments on capital lease and other financing obligations (27) (23) Proceeds from exercise of stock options and other stock issuances 700 733 Repurchase of common stock (4,286) (4,254) Dividends-common and preferred (1,332) (1,243) Tax payments for net share settlement of equity awards (17) (55) Cash used by financing activities (5,293) (4,835) Effect of exchange rate changes on cash and equivalents (129) 45 Net increase (decrease) in cash and equivalents 217 441 Cash and equivalents, beginning of year 4,249 3,808 Cash and equivalents, end of year $4,466 $4,249 (b) Compute total liabilities-to-equity ratio and total debt-to-equity ratio for 2018 and 2019. HINT: Nike's total debt has three components reported on the balance sheet. Note: Round answers to two decimal places. 2019 total liabilities-to-equity = 1.62 2018 total liabilities-to-equity = 1.29 2019 total debt-to-equity = 0.38 2018 total debt-to-equity = 1.3 (c) Compute times interest earned ratio, cash from operations to total debt ratio, and free operating cash flow to total debt ratios. Financial statements included the following footnote: "Included in Interest expense (income), net was interest income related to the Company's investment portfolio of $82 million and $70 million for the years ended May 31, 2019 and 2018, respectively." Note: Round answers to two decimal places. 2019 times interest earned = 1.62 2018 times interest earned = 37 2019 cash from operations to total debt = 1.7 2018 cash from operations to total debt = 1.3 2019 free operating cash flow to total debt = 1.38 2018 free operating cash flow to total debt = 1.14 >

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

b Compute total liabilitiestoequity ratio and total debttoequity ratio for 2018 and 2019 Total Liabi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started