Answered step by step

Verified Expert Solution

Question

1 Approved Answer

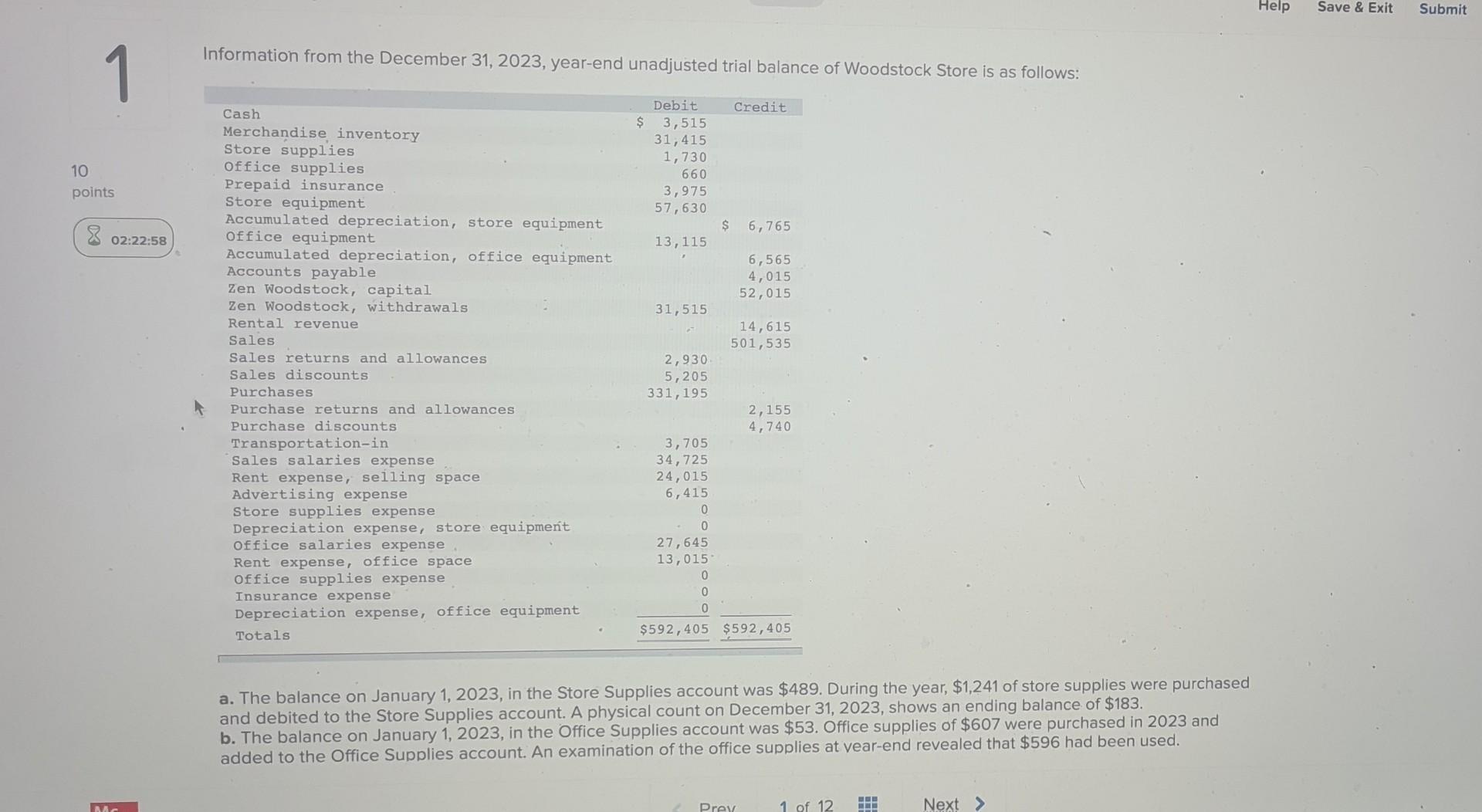

Information from the December 31,2023 , year-end unadjusted trial balance of Woodstock Store is as follows: a. The balance on January 1,2023 , in the

Information from the December 31,2023 , year-end unadjusted trial balance of Woodstock Store is as follows: a. The balance on January 1,2023 , in the Store Supplies account was $489. During the year, $1,241 of store supplies were purchased and debited to the Store Supplies account. A physical count on December 31,2023 , shows an ending balance of $183. b. The balance on January 1,2023 , in the Office Supplies account was $53. Office supplies of $607 were purchased in 2023 and added to the Office Supplies account. An examination of the office supplies at vear-end revealed that $596 had been used. a. The balance on January 1,2023 , in the Store Supplies account was $489. During the year, $1,241 of store supplies were purchased and debited to the Store Supplies account. A physical count on December 31, 2023, shows an ending balance of $183. b. The balance on January 1, 2023, in the Office Supplies account was $53. Office supplies of $607 were purchased in 2023 and added to the Office Supplies account. An examination of the office supplies at year-end revealed that $596 had been used. c. The balance in the Prepaid Insurance account represents a policy purchased on September 1, 2023; it was valid for 12 months from that date. d. The store equipment was originally estimated to have a useful life of 12 years and a residual value of $3,270. e. When the office equipment was purchased, it was estimated that it would last 5 years and have no residual value. f. Ending metrchandise inventory, 29,300 . Required: Prepare a classified multiple-step income statement. (Input all amounts as positive value. Do not round intermediate answer. Round your final answers to nearest whole dollar.) Information from the December 31,2023 , year-end unadjusted trial balance of Woodstock Store is as follows: a. The balance on January 1,2023 , in the Store Supplies account was $489. During the year, $1,241 of store supplies were purchased and debited to the Store Supplies account. A physical count on December 31,2023 , shows an ending balance of $183. b. The balance on January 1,2023 , in the Office Supplies account was $53. Office supplies of $607 were purchased in 2023 and added to the Office Supplies account. An examination of the office supplies at vear-end revealed that $596 had been used. a. The balance on January 1,2023 , in the Store Supplies account was $489. During the year, $1,241 of store supplies were purchased and debited to the Store Supplies account. A physical count on December 31, 2023, shows an ending balance of $183. b. The balance on January 1, 2023, in the Office Supplies account was $53. Office supplies of $607 were purchased in 2023 and added to the Office Supplies account. An examination of the office supplies at year-end revealed that $596 had been used. c. The balance in the Prepaid Insurance account represents a policy purchased on September 1, 2023; it was valid for 12 months from that date. d. The store equipment was originally estimated to have a useful life of 12 years and a residual value of $3,270. e. When the office equipment was purchased, it was estimated that it would last 5 years and have no residual value. f. Ending metrchandise inventory, 29,300 . Required: Prepare a classified multiple-step income statement. (Input all amounts as positive value. Do not round intermediate answer. Round your final answers to nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started