Question

Information from the statement of financial position and statement of income is given below for Martinez Road Inc., a company following IFRS, for the year

Information from the statement of financial position and statement of income is given below for Martinez Road Inc., a company following IFRS, for the year ended December 31. Martinez Road has adopted the policy of classifying interest paid as operating activities and dividends paid as financing activities.

| Comparative Statement of Financial Position, at December 31 | |||||||

|---|---|---|---|---|---|---|---|

| 2020 | 2019 | ||||||

| Cash | $94,900 | $47,550 | |||||

| Accounts receivable | 91,900 | 37,100 | |||||

| Inventory | 124,500 | 104,650 | |||||

| Investments in land | 92,400 | 115,000 | |||||

| Property, plant, and equipment | 292,000 | 215,000 | |||||

| Accumulated depreciation | (48,800 | ) | (40,000 | ) | |||

| $646,900 | $479,300 | ||||||

| Accounts payable | $53,500 | $48,380 | |||||

| Accrued liabilities | 12,300 | 19,130 | |||||

| Notes payable | 134,000 | 72,000 | |||||

| Common shares | 260,000 | 208,000 | |||||

| Retained earnings | 187,100 | 131,790 | |||||

| $646,900 | $479,300 | ||||||

| Statement of Income, year ended December 31, 2020 | |||||||

| Revenues | |||||||

| Sales revenue | $289,410 | ||||||

| Gain on disposal of investment in land | 5,000 | ||||||

| Gain on disposal of equipment | 8,950 | ||||||

| 303,360 | |||||||

| Expenses | |||||||

| Cost of goods sold | $98,360 | ||||||

| Depreciation expense | 56,900 | ||||||

| Operating expenses | 14,700 | ||||||

| Income tax expense | 38,300 | ||||||

| Interest expense | 2,720 | 210,980 | |||||

| Net income | $92,380 | ||||||

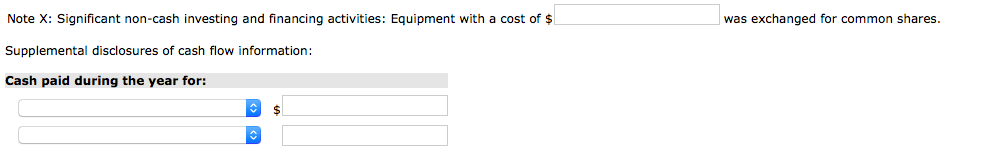

Additional information:

| 1. | Investments in land were sold at a gain during 2020. | |

| 2. | Equipment costing $58,000 was sold for $18,850, resulting in a gain. | |

| 3. | Common shares were issued in exchange for some equipment during the year. No other shares were issued. | |

| 4. | The remaining purchases of equipment were paid for in cash. |

Prepare a statement of cash flows for the year ended December 31, 2020, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started