Answered step by step

Verified Expert Solution

Question

1 Approved Answer

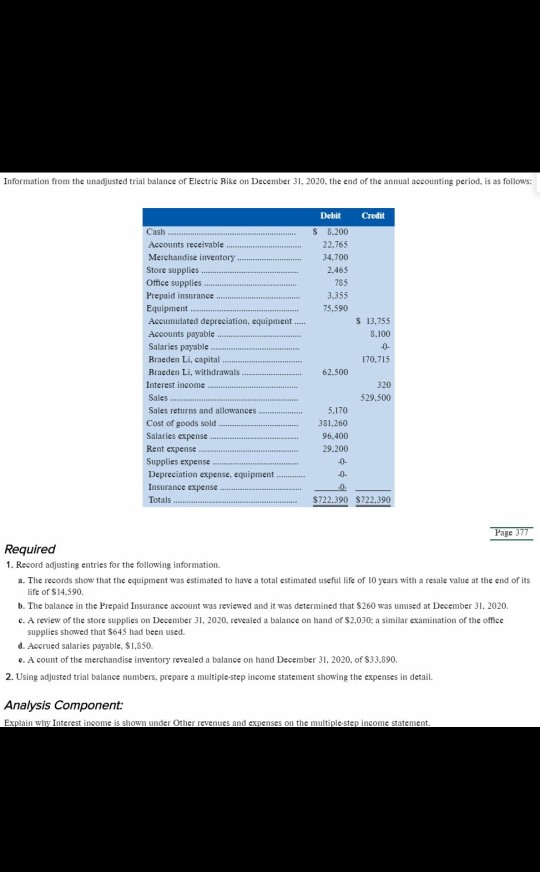

Information from the unadjusted trial balance of Electric Bike on December 31, 2020, the end of the annual accounting period, is as follows: Cash Accounts

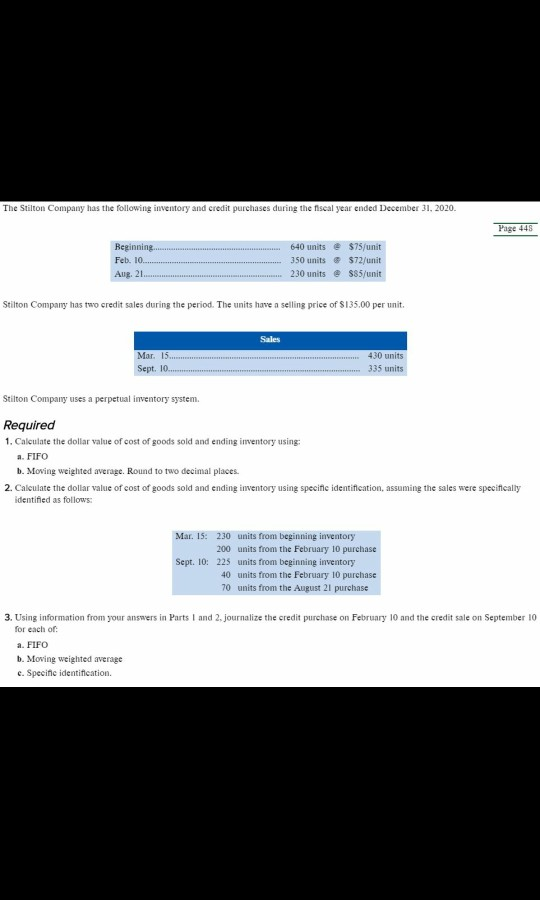

Information from the unadjusted trial balance of Electric Bike on December 31, 2020, the end of the annual accounting period, is as follows: Cash Accounts receivable Merchandise inventory Store supplies Office supplies Prepaid insurance Equipment Accumulated depreciation equipment...... Accounts payable Salaries payable Braeden Li, capital Braeden Li, withdrawals Interest income Sales Sales returns and allowances Cost of goods sold Salaries expense Rent expense Supplies expense Depreciation expense, equipment Insurance expense Debit Credit $ 8.200 22.765 34,700 2.465 785 3.355 75.590 $ 13.755 8.100 -0. 170,715 62.500 320 529,500 5.170 351,260 96.400 29.200 -0- -0- 20 $722.390 $722,390 Totals... Page 377 Required 1. Record adjusting entries for the following information a. The records show that the equipment was estimated to have a total estimated useful life of 10 years with a resale value at the end of its life of S14,590. b. The balance in the Prepaid Insurance account was reviewed and it was determined that $260 was unused at December 31, 2020. C. A review of the store supplies on December 31, 2020, revealed a balance on hand of 52,030, a similar examination of the office supplies showed that $645 had been used d. Accrued salaries payable, $1.850. e. A count of the merchandise inventory revealed a balance on hand December 31, 2020, of $33,890. 2. Using adjusted trial balance numbers, prepare a multiple-step income statement showing the expenses in detail. Analysis Component: Explain why Interest income is shown under Other revenues and expenses on the multiple step income statement The Stilton Company has the following inventory and credit purchases during the fiscal year ended December 31, 2020 Page 445 Beginning Feb. 10 Aug. 21 640 units $75/unit 350 units @ $72/unit 230 units @ $85/unit Stilton Company has two credit sales during the period. The units have a selling price of $135.00 per unit. Sales Mar. 15... Sept. 10 ... 430 units 335 units Stilton Company uses a perpetual inventory system. Required 1. Calculate the dollar value of cost of goods sold and ending inventory using: a. FIFO b. Moving weighted average. Round to two decimal places. 2. Calculate the dollar value of cost of goods sold and ending inventory using specific identification, assuming the sales were specifically identified as follows: Mar. 15: 230 units from beginning inventory 200 units from the February 10 purchase Sept. 10: 225 units from beginning inventory 40 units from the February 10 purchase 70 units from the August 21 purchase 3. Using information from your answers in Parts 1 and 2. journalize the credit purchase on February 10 and the credit sale on September 10 for each of a FIFO b. Moving weighted average c. Specific identification

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started