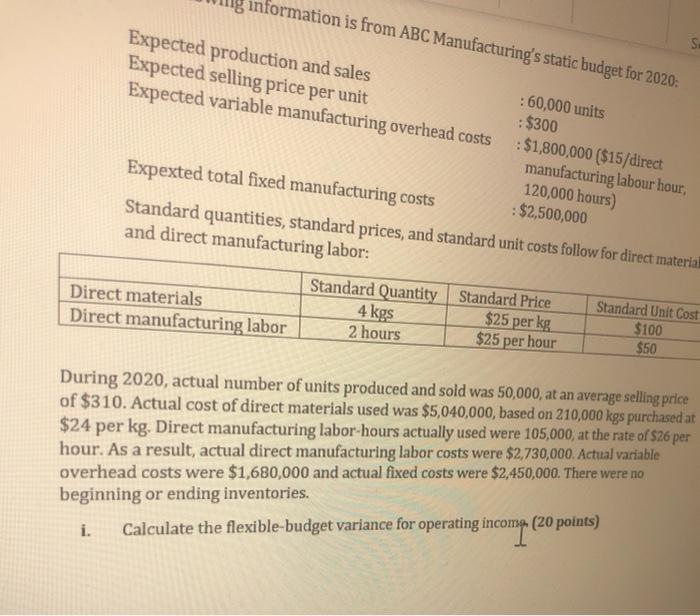

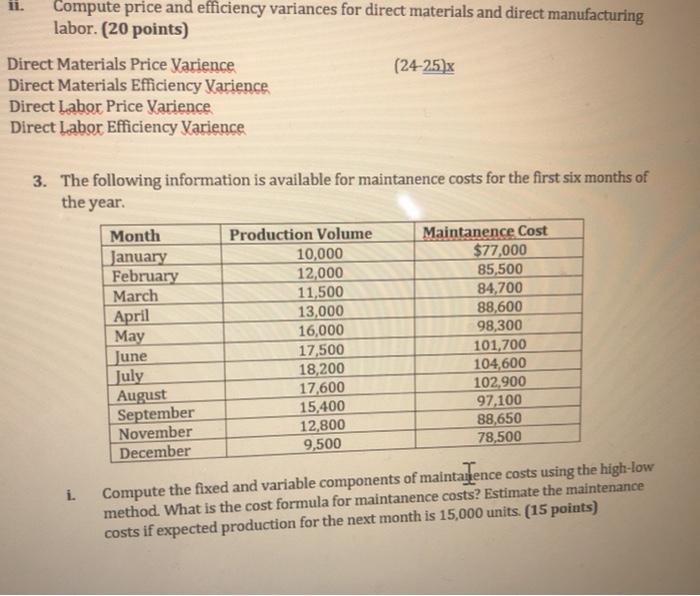

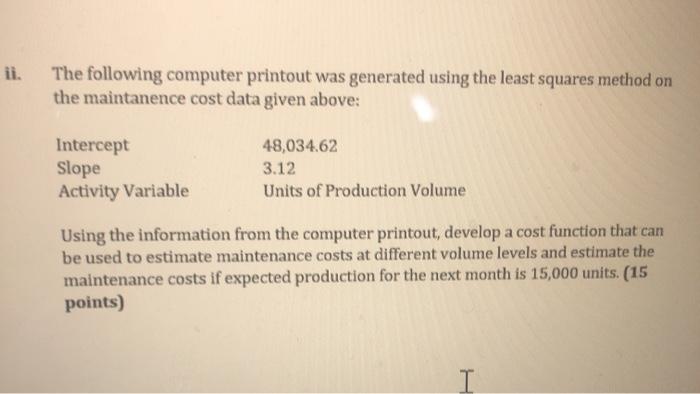

information is from ABC Manufacturing's static budget for 2020: Expected production and sales Expected selling price per unit Expected variable manufacturing overhead costs : 60,000 units : $300 : $1,800,000 ($15/direct manufacturing labour hour, 120,000 hours) : $2,500,000 Expexted total fixed manufacturing costs Standard quantities, standard prices, and standard unit costs follow for direct material and direct manufacturing labor: Standard Quantity Standard Price Standard Unit Cost Direct materials 4 kgs $25 per kg $100 Direct manufacturing labor 2 hours $25 per hour $50 During 2020, actual number of units produced and sold was 50,000, at an average selling price of $310. Actual cost of direct materials used was $5,040,000, based on 210,000 kgs purchased at $24 per kg. Direct manufacturing labor-hours actually used were 105,000, at the rate of $26 per hour. As a result, actual direct manufacturing labor costs were $2,730,000. Actual variable overhead costs were $1,680,000 and actual fixed costs were $2,450,000. There were no beginning or ending inventories. i. Calculate the flexible-budget variance for operating income (20 points) 11. Compute price and efficiency variances for direct materials and direct manufacturing labor. (20 points) Direct Materials Price Varience (24-25 x Direct Materials Efficiency Varience Direct Labor Price Varience Direct Labor Efficiency Varience 3. The following information is available for maintanence costs for the first six months of the year. Month Production Volume Maintanence Cost January 10,000 $77,000 February 12,000 85,500 March 11,500 84,700 April 13,000 88,600 May 16,000 98,300 June 17,500 101,700 July 18,200 104,600 August 17,600 102,900 September 15,400 97,100 November 12,800 88,650 December 9,500 78,500 i. Compute the fixed and variable components of maintanence costs using the high-low method. What is the cost formula for maintanence costs? Estimate the maintenance costs if expected production for the next month is 15,000 units (15 points) ii. The following computer printout was generated using the least squares method on the maintanence cost data given above: Intercept Slope Activity Variable 48,034.62 3.12 Units of Production Volume Using the information from the computer printout, develop a cost function that can be used to estimate maintenance costs at different volume levels and estimate the maintenance costs if expected production for the next month is 15,000 units (15 points)