information

questions

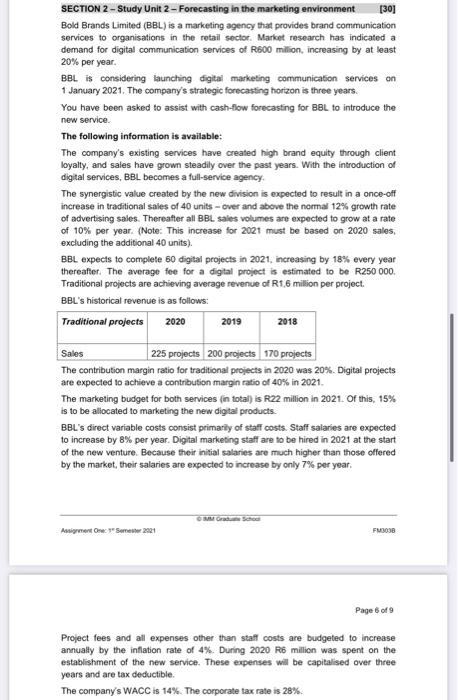

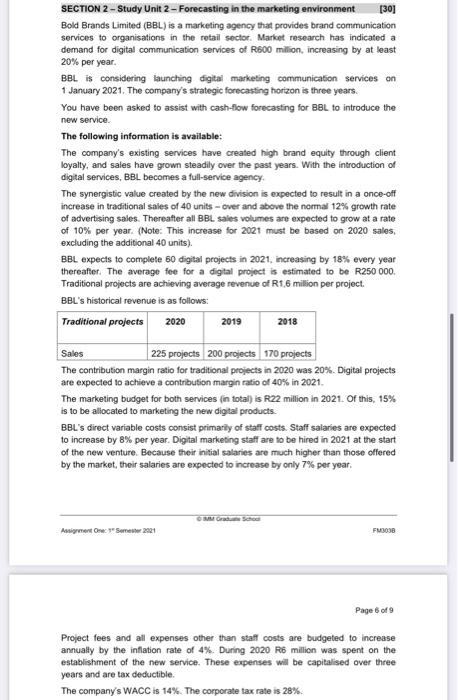

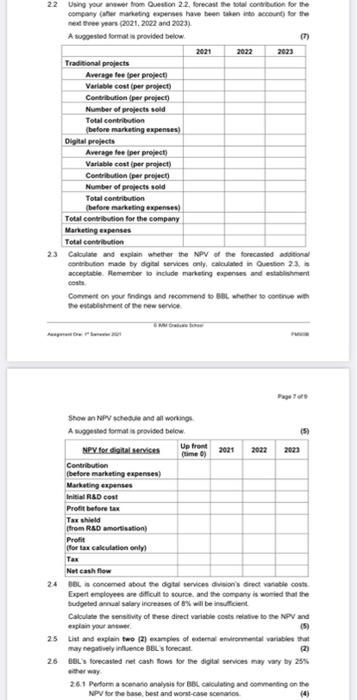

SECTION 2 - Study Unit 2 - Forecasting in the marketing environment [30] Bold Brands Limited (BBL) is a marketing agency that provides brand communication services to organisations in the retail sector. Market research has indicated a demand for digital communication services of R500 million, increasing by at least 20% per year. BBL is considering launching digital marketing communication Services on 1 January 2021. The company's strategic forecasting horizon is three years. You have been asked to assist with cash-flow forecasting for BBL to introduce the new service The following information is available: The company's existing services have created high brand equity through client loyalty, and sales have grown steadily over the past years. With the introduction of digital services, BBL becomes a full-service agency The synergistic value created by the new division is expected to result in a once-off increase in traditional sales of 40 units - over and above the normal 12% growth rate of advertising sales. Thereafter all BBL sales volumes are expected to grow at a rate of 10% per year. (Note: This increase for 2021 must be based on 2020 sales, excluding the additional 40 units). BBL expects to complete 60 digital projects in 2021, increasing by 18% every year thereafter. The average fee for a digital project is estimated to be R250 000 Traditional projects are achieving average revenue of R1,6 million per project. BBL's historical revenue is as follows: Traditional projects 2019 2018 2020 Sales 225 projects 200 projects 170 projects The contribution margin ratio for traditional projects in 2020 was 20%. Digital projects are expected to achieve a contribution margin ratio of 40% in 2021. The marketing budget for both services (in total) is R22 million in 2021. Of this, 15% is to be allocated to marketing the new digital products BBL's direct variable costs consist primarily of staff costs. Staff salaries are expected to increase by 8% per year. Digital marketing staff are to be hired in 2021 at the start of the new venture. Because their initial salaries are much higher than those offered by the market, their salaries are expected to increase by only 7% per year. Assignment One: T Semester 2021 F3030 Page 6 of 9 Project fees and all expenses other than staff costs are budgeted to increase annually by the inflation rate of 4%. During 2020 R6 million was spent on the establishment of the new service. These expenses will be capitalised over three years and are tax deductible The company's WACC is 14%. The corporate tax rate is 28% 22 Using your awer from Question 22. forecast the total contribution for the company er marketing es have been taken into account for the extree years (2021, 2022 and 2023) A suggested format in provided below. 2021 2022 2023 Traditional projects Average fee per project Variable cost per project Contribution per project) Number of projects sold Total contribution (before marketing expenses) Digital projects Average for per project Variable cost per project) Contribution (per project Number of projects sold Total contribution before marketing expenses) Total contribution for the company Marketing expenses Total contribution 23 Calculate and explain whether the NPV of the forecasted addition contribution made by digital services only, calculated in Question 23. acceptable. Remember to include marketing expenses and establishment Comment on your findings and recommend t> BBL wwer to continue with the establishment of the new service (5) Show an NPV Rhese and all wortings Aged format is provided below Up front NPV ferti 2021 2022 2023 (time) Contribution before marketing expenses) Marketing expenses Initial R&D cost Profit before tax Taxshield from R&D amortisation Profit for tax calculation only Tax Net cash flow 24 BBL concemed about the digital services divisions direct variable co Expert employees are difficult to tout, and the company is world that the Budgeted annual salary increases of 8% will be insuficient Calculate the sensitivity of these direct variable costs relative to the NPV and (5) 25 list and explain two (2) examples of external environmental variables that may negatively ince B forecast (2 26 BBL's forecasted net cash flows for the digital services may vary by 25% 261 Performa scenario analysis for BBL looting and commenting on the NPV for the base best and worst cases (4) SECTION 2 - Study Unit 2 - Forecasting in the marketing environment [30] Bold Brands Limited (BBL) is a marketing agency that provides brand communication services to organisations in the retail sector. Market research has indicated a demand for digital communication services of R500 million, increasing by at least 20% per year. BBL is considering launching digital marketing communication Services on 1 January 2021. The company's strategic forecasting horizon is three years. You have been asked to assist with cash-flow forecasting for BBL to introduce the new service The following information is available: The company's existing services have created high brand equity through client loyalty, and sales have grown steadily over the past years. With the introduction of digital services, BBL becomes a full-service agency The synergistic value created by the new division is expected to result in a once-off increase in traditional sales of 40 units - over and above the normal 12% growth rate of advertising sales. Thereafter all BBL sales volumes are expected to grow at a rate of 10% per year. (Note: This increase for 2021 must be based on 2020 sales, excluding the additional 40 units). BBL expects to complete 60 digital projects in 2021, increasing by 18% every year thereafter. The average fee for a digital project is estimated to be R250 000 Traditional projects are achieving average revenue of R1,6 million per project. BBL's historical revenue is as follows: Traditional projects 2019 2018 2020 Sales 225 projects 200 projects 170 projects The contribution margin ratio for traditional projects in 2020 was 20%. Digital projects are expected to achieve a contribution margin ratio of 40% in 2021. The marketing budget for both services (in total) is R22 million in 2021. Of this, 15% is to be allocated to marketing the new digital products BBL's direct variable costs consist primarily of staff costs. Staff salaries are expected to increase by 8% per year. Digital marketing staff are to be hired in 2021 at the start of the new venture. Because their initial salaries are much higher than those offered by the market, their salaries are expected to increase by only 7% per year. Assignment One: T Semester 2021 F3030 Page 6 of 9 Project fees and all expenses other than staff costs are budgeted to increase annually by the inflation rate of 4%. During 2020 R6 million was spent on the establishment of the new service. These expenses will be capitalised over three years and are tax deductible The company's WACC is 14%. The corporate tax rate is 28% 22 Using your awer from Question 22. forecast the total contribution for the company er marketing es have been taken into account for the extree years (2021, 2022 and 2023) A suggested format in provided below. 2021 2022 2023 Traditional projects Average fee per project Variable cost per project Contribution per project) Number of projects sold Total contribution (before marketing expenses) Digital projects Average for per project Variable cost per project) Contribution (per project Number of projects sold Total contribution before marketing expenses) Total contribution for the company Marketing expenses Total contribution 23 Calculate and explain whether the NPV of the forecasted addition contribution made by digital services only, calculated in Question 23. acceptable. Remember to include marketing expenses and establishment Comment on your findings and recommend t> BBL wwer to continue with the establishment of the new service (5) Show an NPV Rhese and all wortings Aged format is provided below Up front NPV ferti 2021 2022 2023 (time) Contribution before marketing expenses) Marketing expenses Initial R&D cost Profit before tax Taxshield from R&D amortisation Profit for tax calculation only Tax Net cash flow 24 BBL concemed about the digital services divisions direct variable co Expert employees are difficult to tout, and the company is world that the Budgeted annual salary increases of 8% will be insuficient Calculate the sensitivity of these direct variable costs relative to the NPV and (5) 25 list and explain two (2) examples of external environmental variables that may negatively ince B forecast (2 26 BBL's forecasted net cash flows for the digital services may vary by 25% 261 Performa scenario analysis for BBL looting and commenting on the NPV for the base best and worst cases (4)