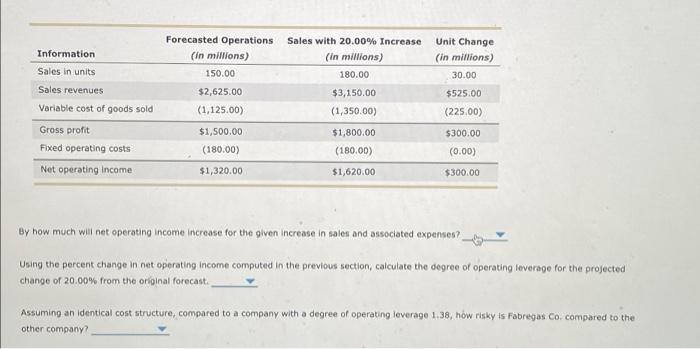

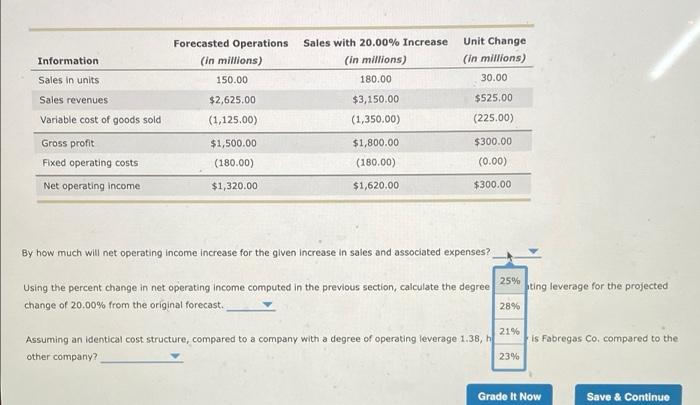

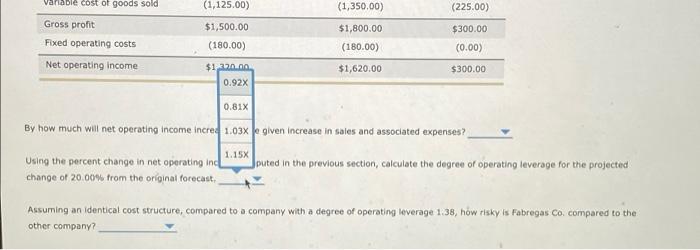

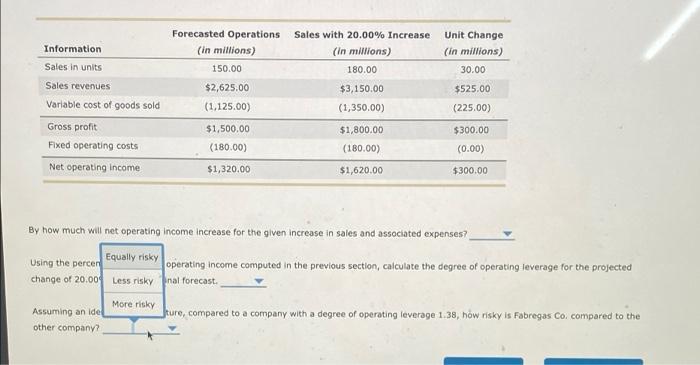

Information Sales in units Forecasted Operations (in millions) 150.00 $2,625.00 (1,125.00) Sales with 20.00% Increase (in millions) 180.00 $3,150.00 Unit Change (in millions) 30.00 $525.00 (225.00) (1,350.00) Sales revenues Variable cost of goods sold Gross profit Fixed operating costs Net operating Income $1,500.00 $1,800.00 (180.00) $1,620.00 $300.00 (0.00) (180.00) $1,320.00 $300.00 By how much will net operating income increase for the given increase in sales and associated expenses? Using the percent change in net operating income computed in the previous section, calculate the degree of operating leverage for the projected change of 20.00% from the original forecast Assuming an identical cost structure, compared to a company with a degree of operating leverage 1.38, how risky is Fabregas Co. compared to the other company? Information Sales with 20.00% Increase (in millions) 180.00 Unit Change (in millions) 30.00 Forecasted Operations (in millions) 150.00 $2,625.00 (1,125.00) $1,500.00 (180.00) $3,150.00 $525.00 (1,350.00) Sales in units Sales revenues Variable cost of goods sold Gross profit Fixed operating costs Net operating income (225.00) $1,800.00 $300.00 (180.00) (0.00) $1,320.00 $1,620.00 $300.00 By how much will net operating income increase for the given increase in sales and associated expenses? 25% Using the percent change in net operating Income computed in the previous section, calculate the degree change of 20.00% from the original forecast. ting leverage for the projected 28% 21% Assuming an identical cost structure, compared to a company with a degree of operating leverage 1.38, other company? is Fabregas Co, compared to the 23% Grade It Now Save & Continue Variable cost of goods sold (1,125.00) (1,350.00) (225.00) Gross profit $1,500.00 (180.00) $1,800.00 (180.00) $300.00 (0.00) Fixed operating costs Net operating income $120.00 0.92X $1,620.00 $300.00 0.81% By how much will net operating income incred 1.03xle given increase in sales and associated expenses? 1.15X Using the percent change in net operating in change of 20.00% from the original forecast, puted in the previous section, calculate the degree of operating leverage for the projected Assuming an identical cost structure, compared to a company with a degree of operating leverage 1.38, how risky Is Fabregas Co. compared to the other company? Information Forecasted Operations (in millions) 150.00 Sales with 20.00% Increase (in millions) 180.00 Unit Change (in millions) 30.00 Sales in units $525.00 Sales revenues Variable cost of goods sold Gross profit $2,625.00 (1.125.00) $3,150.00 (1,350.00) (225.00) $300.00 $1,500.00 (180.00) Fixed operating costs $1,800.00 (180.00) (0.00) Net operating income $1,320.00 $1,620.00 $300.00 By how much will net operating income increase for the given increase in sales and associated expenses? Equally risky Using the percen operating Income computed in the previous section, calculate the degree of operating leverage for the projected change of 20.00% Less risky nal forecast More risky ture, compared to a company with a degree of operating leverage 1.38, how risky is Fabregas Co. compared to the Assuming an ide other company