Information

Terrys auditors have approached the management team with their concern that Terry has not been properly recording deferred taxes. In particular, they are concerned that Terry is simply recognizing 25% as the companys income tax expense. They have asked the company to make a thorough review of the companys tax liability utilizing the services of professional tax accountants

The review revealed three book/tax differences in Terrys financial information:

- Terrys management opened a new life insurance policy this year on the CEO. The premium for this new policy is $917/month. The policy cannot be prepaid

- Terrys cash receipts from the sale of the machines (in our Chapter 18 Terry), and not the revenue recognized, must be recognized for tax purposes.

- Up through Year 2, Terry had no book/tax differences for amortization and depreciation. This happens when companies use the MACRS tables for determining their depreciation and amortization expenses for both GAAP and tax purposes, a common practice among small companies (like Terry). However, in Year 3, Terry decided to switch to the straight-line depreciation method for GAAP purposes. Since this is a change in estimate, it did not require any special changes to Terrys GAAP accounting, but it does create a difference for tax purposes. A summary of the book/tax differences will be provided by the instructor after we have completed Terry #7.

In addition, the experts feel that Terrys tax rate will change to 254% in Year 5 and to 253% in Years 6 & 7 due to new tax laws passed and signed into law during Year 3.

Questions 1-4

- Make the appropriate journal entry to correctly record income tax expense for Year 3. (Please see the hints section for help with making these entries!)

- Make any necessary changes to the financial statements.

- What do you think investors reaction will be to the adjustment for deferred taxes (if any)? In other words, based on your changes to the financial statements and the change in the ratios, do you think investors will be happy with these changes? Why or why not?

- Who might be affected by Terrys decision not to recognize deferred taxes appropriately in past years? How could this decision affect each individual or group?

HINTS:

The sale of the machines was recorded in an earlier Terry assignment. Youll find all of the numbers you need for the tax adjustment in that earlier problem. Make sure that you have corrected any necessary mistakes to your work on that problem before you start doing these calculations

Your ending cash balance will not change, since you haven't paid the government anything yet. However, you will need to add one (1) new line item to your Statement of Cash Flows to adjust from Net Income to Cash Flows from Operating Activities.

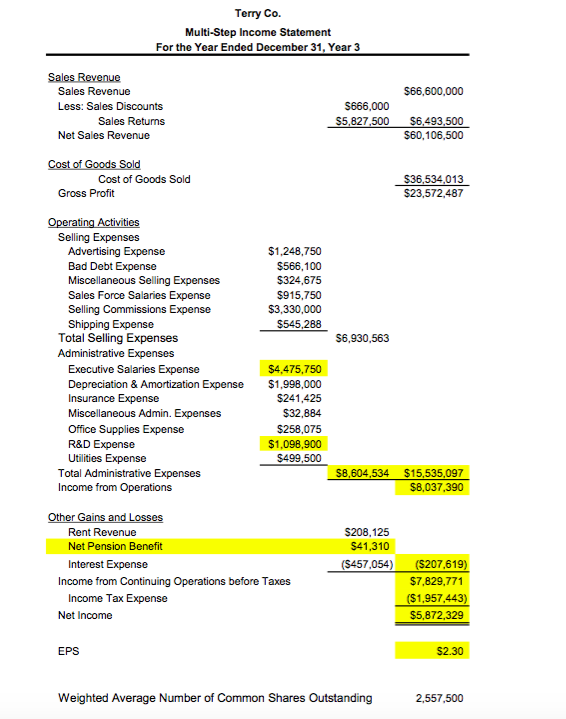

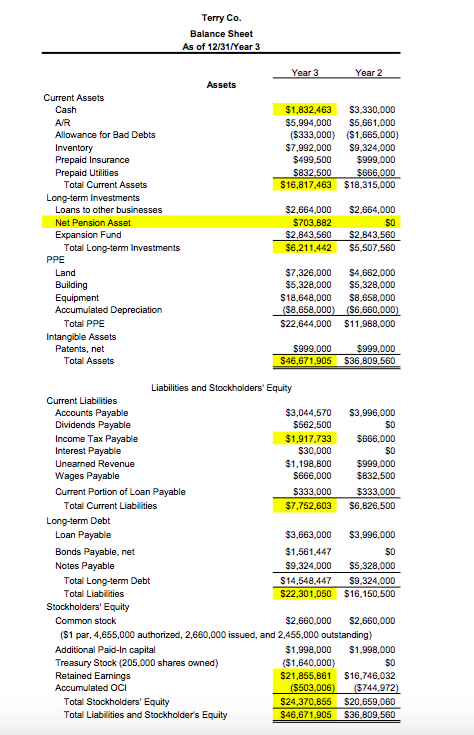

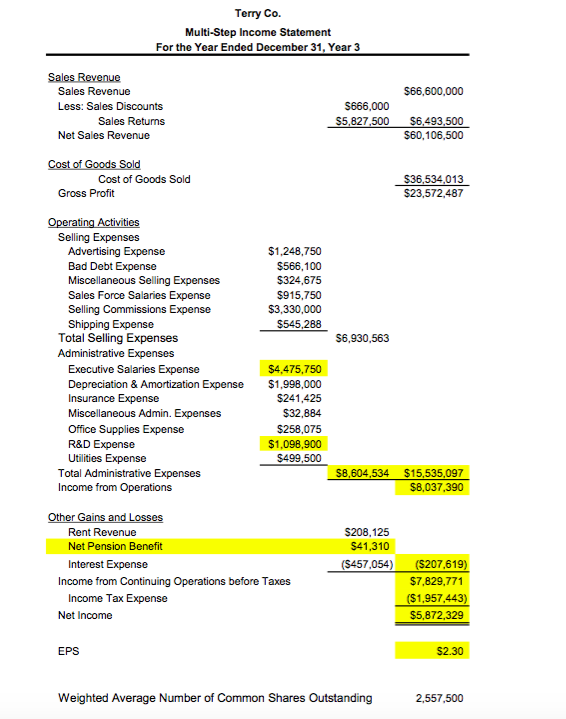

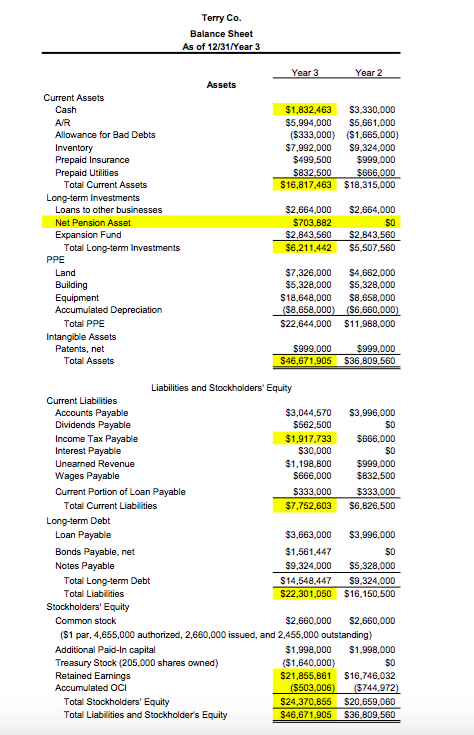

Terry Co. Multi-Step Income Statement For the Year Ended December 31, Year3 Sales Revenue Less: Sales Discounts $66,600,000 S666,000 S5,827,500 Sales Returns 493,500 $60,106,500 Net Sales Revenue Cost of Goods Sold $36,534013 $23,572.487 Gross Profit Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense $1,248,750 $566,100 $324,675 $915,750 $3,330,000 Total Selling Expenses 56,930,563 Executive Salaries Expense Depreciation & Amortization Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense R&D Expense Utilities Expense $4,475,750 $1,998,000 $241,425 $32,884 $258,075 $1,098,900 S499,500 Total Administrative Expenses Income from Operations 604,534 $15,535,097 $8,037,390 Rent Revenue Net Pension Benefit Interest Expense $208,125 S41,310 (S457,054) (207,619) $7,829,771 $1,957.443) $5,872,329 Income from Continuing Operations before Taxes Income Tax Expense Net Income EPS S2.30 Weighted Average Number of Common Shares Outstanding 2,557,500 Terry Co. Balance Sheet As of 12/31/Year 3 Year Year 2 Assets Current Assets Cash AR Allowance for Bad Debts $1,832.463 $3,330,000 $5,994,000 S5,661,000 (S333,000) (S1,665,000) $7,992,000 S9,324,000 5999,000 Prepaid Insurance Prepaid Utilities S499,500 Total Current Assets S16,817,463 $18,315,000 Loans to other businesses Net Pension Asset Expansion Fund $2,664,000 S2,664.000 S703,882 $2,843,560 S2.B43,560 $6,211,442 S5,507,560 Total Long-term Investments PPE Land $7,326,000 S4,662,000 $5,328,000 S5,328,000 S18,648,000 S8,658,000 660,000 658,000 Total PPE $22,644,000 11,988,00 Intangible Assets Patents, net 5999.000$999,000 S46,671,905 S36,809,560 Total Assets Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Dividends Payable Income Tax Payable Interest Payable Unearned Revenue Wages Payable Current Portion of Loan Payable S3,044,570 S3,996,000 S0 $1,917,733 $66,000 S0 $1,198,800 $999,000 S30,000 $333.000$333.000 $7,752,603$6.826,500 Total Current Liabilities Long-term Debt Loan Payable Bonds Payable, net Notes Payable S3,663,000 S3,996,000 S0 $9,324,000 S5,328,000 S14,548.447 S9,324,000 $22,301,050 $16,150,500 $1,561.447 Total Long-term Deblt Total Liabilities Stockholders' Equity Common stock $2,660,000 S2,660,000 ($1 par, 4,655,000 authorized, 2,660,000 issued, and 2,455,000 outstanding) Additional Paid-In capital Treasury Stock (205,000 shares owned) Retained Earnings Accumulated OCI $1,998,000 S1,998,000 S0 S21,855,861 $16,746.032 744,972 $24,370,855 $20,659,060 $46,671,905 $36,809,560 $1,640,000) $503,006 Total Stockholders' Equity Total Liabilities and Stockholder's Equity Terry Co. Statement of Cash Flows For Year Ended 12/31/Year 3 Cash Flow from Operations Net Income $5,872,329 Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation & Amortization Amortization of Bond Discount ($1,665,000) S1,332,000 $499,500 ($166,500) $1,998,000 $2,479 ($461,916) ($951,430) Change in Income Tax Payable 1,251,733 $30,000 $199,800 Change in A/P Change in Interest Payable Change in Unearned Revenue Change in Wages Payable (166.500) S1,902.165 S7,774,494 Net Cash Flow from Operations Cash Flow from Investments Purchase of Land (S2,664,000) 990,000 Purchase of Equipment Net Cash Flow from Investments (S12,654,000) Cash Flow from Financing Repayment of Loans Purchase of Treasury Stock Issuance of Bonds Payable Issuance of Notes Payable Payments of Dividends ($333,000) (S1,640,000) $1,558,969 S3,996,000 $200,000 Net Cash Flow from Financing S3,381,969 Net Increase (Decrease) in Cash Cash, January 1, Year 2 Cash, December 31, Year 2 (S1,497,537) S3,330,000 $1,832,463 Terry Co. Multi-Step Income Statement For the Year Ended December 31, Year3 Sales Revenue Less: Sales Discounts $66,600,000 S666,000 S5,827,500 Sales Returns 493,500 $60,106,500 Net Sales Revenue Cost of Goods Sold $36,534013 $23,572.487 Gross Profit Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense $1,248,750 $566,100 $324,675 $915,750 $3,330,000 Total Selling Expenses 56,930,563 Executive Salaries Expense Depreciation & Amortization Expense Insurance Expense Miscellaneous Admin. Expenses Office Supplies Expense R&D Expense Utilities Expense $4,475,750 $1,998,000 $241,425 $32,884 $258,075 $1,098,900 S499,500 Total Administrative Expenses Income from Operations 604,534 $15,535,097 $8,037,390 Rent Revenue Net Pension Benefit Interest Expense $208,125 S41,310 (S457,054) (207,619) $7,829,771 $1,957.443) $5,872,329 Income from Continuing Operations before Taxes Income Tax Expense Net Income EPS S2.30 Weighted Average Number of Common Shares Outstanding 2,557,500 Terry Co. Balance Sheet As of 12/31/Year 3 Year Year 2 Assets Current Assets Cash AR Allowance for Bad Debts $1,832.463 $3,330,000 $5,994,000 S5,661,000 (S333,000) (S1,665,000) $7,992,000 S9,324,000 5999,000 Prepaid Insurance Prepaid Utilities S499,500 Total Current Assets S16,817,463 $18,315,000 Loans to other businesses Net Pension Asset Expansion Fund $2,664,000 S2,664.000 S703,882 $2,843,560 S2.B43,560 $6,211,442 S5,507,560 Total Long-term Investments PPE Land $7,326,000 S4,662,000 $5,328,000 S5,328,000 S18,648,000 S8,658,000 660,000 658,000 Total PPE $22,644,000 11,988,00 Intangible Assets Patents, net 5999.000$999,000 S46,671,905 S36,809,560 Total Assets Liabilities and Stockholders' Equity Current Liabilities Accounts Payable Dividends Payable Income Tax Payable Interest Payable Unearned Revenue Wages Payable Current Portion of Loan Payable S3,044,570 S3,996,000 S0 $1,917,733 $66,000 S0 $1,198,800 $999,000 S30,000 $333.000$333.000 $7,752,603$6.826,500 Total Current Liabilities Long-term Debt Loan Payable Bonds Payable, net Notes Payable S3,663,000 S3,996,000 S0 $9,324,000 S5,328,000 S14,548.447 S9,324,000 $22,301,050 $16,150,500 $1,561.447 Total Long-term Deblt Total Liabilities Stockholders' Equity Common stock $2,660,000 S2,660,000 ($1 par, 4,655,000 authorized, 2,660,000 issued, and 2,455,000 outstanding) Additional Paid-In capital Treasury Stock (205,000 shares owned) Retained Earnings Accumulated OCI $1,998,000 S1,998,000 S0 S21,855,861 $16,746.032 744,972 $24,370,855 $20,659,060 $46,671,905 $36,809,560 $1,640,000) $503,006 Total Stockholders' Equity Total Liabilities and Stockholder's Equity Terry Co. Statement of Cash Flows For Year Ended 12/31/Year 3 Cash Flow from Operations Net Income $5,872,329 Change in A/R Change in Inventory Change in Prepaid Insurance Change in Prepaid Utilities Depreciation & Amortization Amortization of Bond Discount ($1,665,000) S1,332,000 $499,500 ($166,500) $1,998,000 $2,479 ($461,916) ($951,430) Change in Income Tax Payable 1,251,733 $30,000 $199,800 Change in A/P Change in Interest Payable Change in Unearned Revenue Change in Wages Payable (166.500) S1,902.165 S7,774,494 Net Cash Flow from Operations Cash Flow from Investments Purchase of Land (S2,664,000) 990,000 Purchase of Equipment Net Cash Flow from Investments (S12,654,000) Cash Flow from Financing Repayment of Loans Purchase of Treasury Stock Issuance of Bonds Payable Issuance of Notes Payable Payments of Dividends ($333,000) (S1,640,000) $1,558,969 S3,996,000 $200,000 Net Cash Flow from Financing S3,381,969 Net Increase (Decrease) in Cash Cash, January 1, Year 2 Cash, December 31, Year 2 (S1,497,537) S3,330,000 $1,832,463