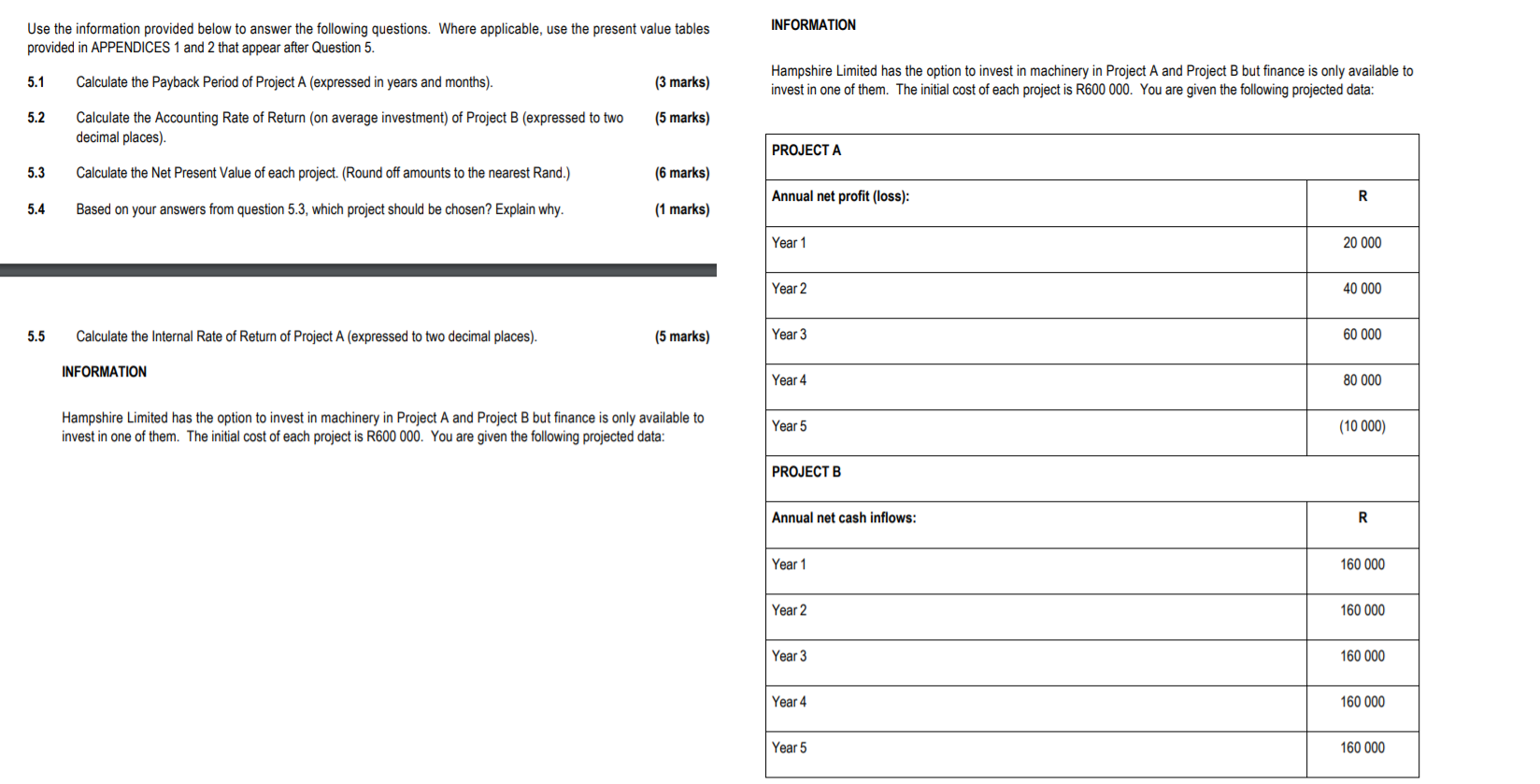

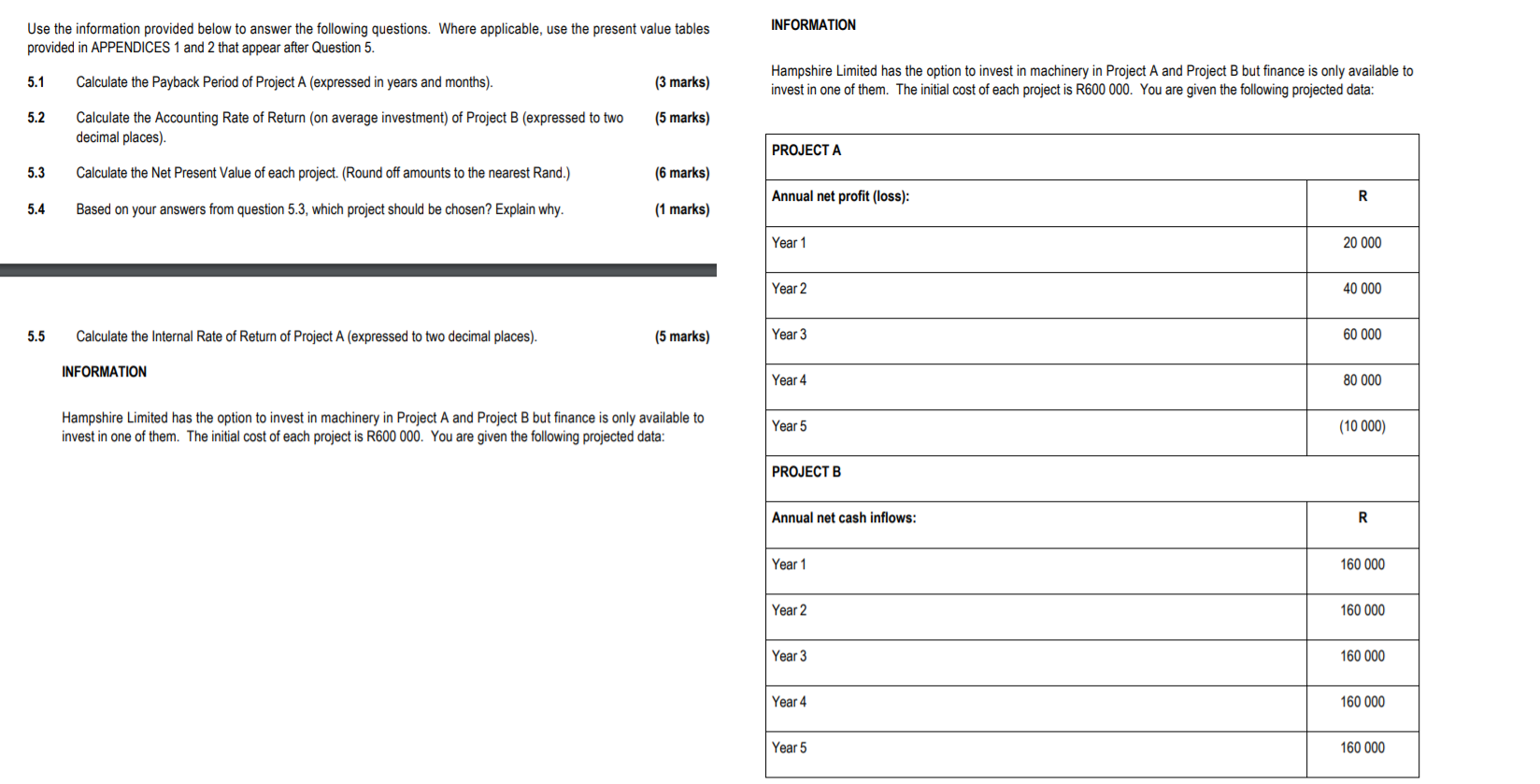

INFORMATION Use the information provided below to answer the following questions. Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after Question 5. 5.1 Calculate the Payback period of Project A (expressed in years and months). (3 marks) Hampshire Limited has the option to invest in machinery in Project A and Project B but finance is only available to invest in one of them. The initial cost of each project is R600 000. You are given the following projected data: 5.2 Calculate the Accounting Rate of Return on average investment) of Project B (expressed to two decimal places) (5 marks) PROJECT A 5.3 Calculate the Net Present Value of each project. (Round off amounts to the nearest Rand.) (6 marks) Annual net profit (loss): R 5.4 Based on your answers from question 5.3, which project should be chosen? Explain why. (1 marks) Year 1 20 000 Year 2 40 000 5.5 Calculate the Internal Rate of Return of Project A (expressed to two decimal places). (5 marks) Year 3 60 000 INFORMATION Year 4 80 000 Hampshire Limited has the option to invest in machinery in Project A and Project B but finance is only available to invest in one of them. The initial cost of each project is R600 000. You are given the following projected data: Year 5 (10 000) PROJECT B Annual net cash inflows: R Year 1 160 000 Year 2 160 000 Year 3 160 000 Year 4 160 000 Year 5 160 000 INFORMATION Use the information provided below to answer the following questions. Where applicable, use the present value tables provided in APPENDICES 1 and 2 that appear after Question 5. 5.1 Calculate the Payback period of Project A (expressed in years and months). (3 marks) Hampshire Limited has the option to invest in machinery in Project A and Project B but finance is only available to invest in one of them. The initial cost of each project is R600 000. You are given the following projected data: 5.2 Calculate the Accounting Rate of Return on average investment) of Project B (expressed to two decimal places) (5 marks) PROJECT A 5.3 Calculate the Net Present Value of each project. (Round off amounts to the nearest Rand.) (6 marks) Annual net profit (loss): R 5.4 Based on your answers from question 5.3, which project should be chosen? Explain why. (1 marks) Year 1 20 000 Year 2 40 000 5.5 Calculate the Internal Rate of Return of Project A (expressed to two decimal places). (5 marks) Year 3 60 000 INFORMATION Year 4 80 000 Hampshire Limited has the option to invest in machinery in Project A and Project B but finance is only available to invest in one of them. The initial cost of each project is R600 000. You are given the following projected data: Year 5 (10 000) PROJECT B Annual net cash inflows: R Year 1 160 000 Year 2 160 000 Year 3 160 000 Year 4 160 000 Year 5 160 000