Question

Information/Instructions: 1. Case Summary Katy EH Manufacturing Company The owners of Katy EH Manufacturing, a small manufacturer of gas grills, have prepared a preliminary budget

Information/Instructions:

1. Case Summary Katy EH Manufacturing Company

The owners of Katy EH Manufacturing, a small manufacturer of gas grills, have prepared a preliminary budget for the upcoming year and would like to assess the financial impact of several alternative scenarios, including dropping a product; changing the price on a product, with a resulting increase in volume; and shifting advertising focus, with a resulting shift in volume from one product to another. A new budget must be prepared. At year-end, the actual results are better than had been planned, but not necessarily better than what should have been, given actual sales volumes.

2. Hint

Consider using the topic of contribution analysis as an easy way to analyze profit-planning issues such as adding or dropping a product or service; changing a price; adding or decreasing expected volumes; or preparing a profit budget. In this particular situation, there are three products, each with different proportions of variable and fixed costs. Make sure you can identify variable and fix costs. Pay attention to the relation of profit and contribution margin. In addition, you also need to consider non-financial factors prior to make your decision.

3. Required

a) Should Katy EH drop Grill A? The owners wanted to know the impact of dropping Grill A from their line of products. Sharp was told to assume that the volumes and selling prices of the other two products would be the same whether or not the Grill A product line was dropped (15 points).

b) Should Katy EH lower the price of Grill C? The owners wanted to know the impact if they lowered the price of Grill C to $75 and if doing so led to a 20,000-unit increase in sales of Grill C (15 points).

c) Should Katy EH change its advertising focus? The owners wanted to know the impact of a 10,000-unit increase in Grill C volume and a related 10,000-unit decrease in Grill A volume because of a shift in advertising emphasis(15 points).

d) Should Katy EH lower the price of Grill C and change its advertising focus? The owners wanted to know the impact of lowering the price of Grill C to $75 and shifting the advertising focus more to Grill C, thereby decreasing Grill A volume by 10,000 units and increasing Grill C volume by 30,000 units (15 points).

e) Prepare a revised 2016 profit budget assuming the owners chose Option 2 lowering the price of Grill C to $75 and expecting sales volume of that grill to increase to 220,000 units (15 points).

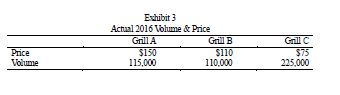

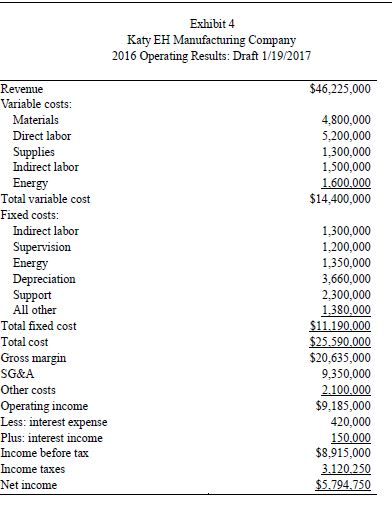

f) The actual results for 2016 are shown in Exhibits3-4. Was 2016 net income more or less than what should have been expected given these actual volumes and prices? If the results were different, why (25 points).

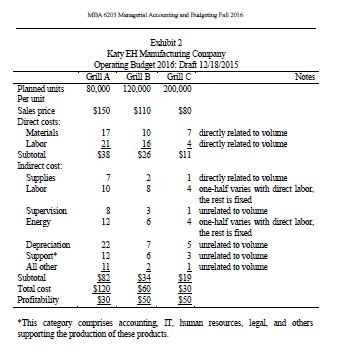

1. Standard costs for the three products are explained in Exhibit 2. Selling, general, and administrative (SG&A), other costs, interest income, and interest expense were likely to remain the same no matter which product-line combinations the company produced.

Before calling it a day, the two owners asked their assistant, Jane Sharp, to determine the impact of several options on income before tax. They agreed to meet the following day, the Sharp hurried off to look at what these latest ideas would mean. She had six questions to address (see page 1) and was asked to consider each option independent of all other options.

Sharp and the owners met the following morning to review her work. Having finished her duties, she left for an early weekend getaway. She didnt give the budget another thought. Early in January 2017, Sharp prepared a rough draft of the actual 2016 volume, selling price, and financial results (Exhibit 3 & 4). (This case is adopted and modified from Cases in Managerial and Cost Accounting, Cambridge Business Publishers).

Exhibit 1

| Katy EH Manufacturing Company Operating Budget 2016: Draft 12/18/2015 Sales | $41,200,000 |

| Less: costs of products sold | 22,800,000 |

| Gross margin | $18,400,000 |

| SG&A | 9,350,000 |

| Other costs | 2,100,000 |

| Operating income | $6,950,000 |

| Less: Interest expense | 420,000 |

| Plus: Interest income | 150,000 |

| Income before tax | $6,680,000 |

| Income taxes | 2,338,000 |

| Net income | $4,342,000 |

Exhibit 2

Katy EH Manufacturing Company Operating Budget 2016: Draft 12/18/2015

Exhibit 3

Exhibit 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started