Answered step by step

Verified Expert Solution

Question

1 Approved Answer

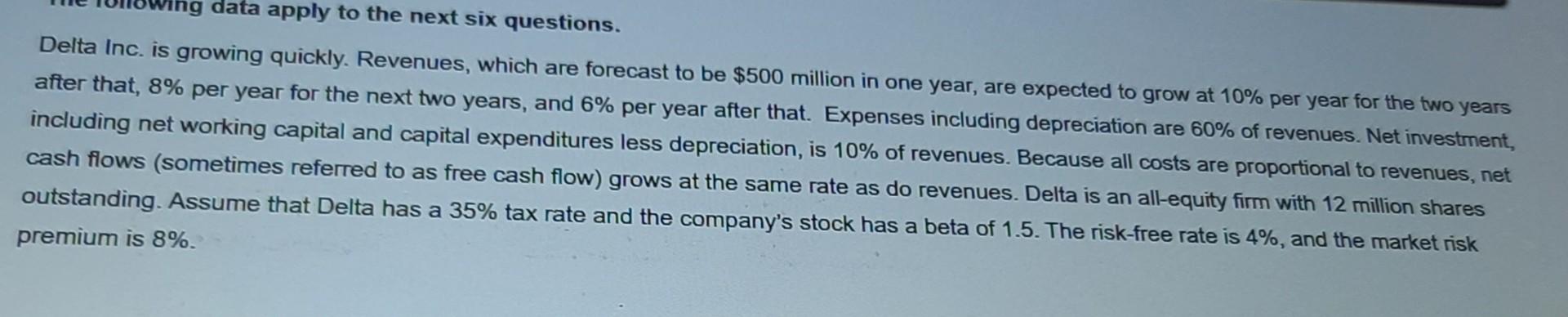

Ing data apply to the next six questions. Delta Inc. is growing quickly. Revenues, which are forecast to be $500 million in one year, are

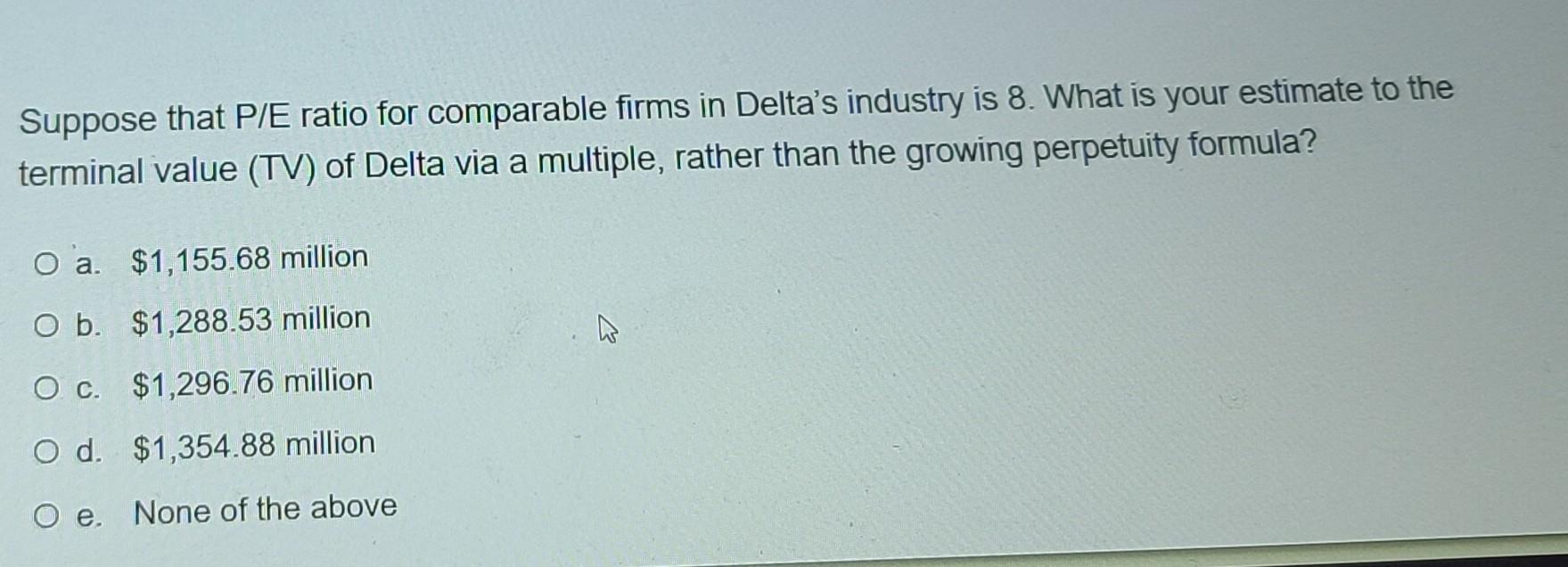

Ing data apply to the next six questions. Delta Inc. is growing quickly. Revenues, which are forecast to be $500 million in one year, are expected to grow at 10% per year for the two years after that, 8% per year for the next two years, and 6% per year after that. Expenses including depreciation are 60% of revenues. Net investment, including net working capital and capital expenditures less depreciation, is 10% of revenues. Because all costs are proportional to revenues, net cash flows (sometimes referred to as free cash flow) grows at the same rate as do revenues. Delta is an all-equity firm with 12 million shares outstanding. Assume that Delta has a 35% tax rate and the company's stock has a beta of 1.5. The risk-free rate is 4%, and the market risk premium is 8%. Suppose that P/E ratio for comparable firms in Delta's industry is 8. What is your estimate to the terminal value (TV) of Delta via a multiple, rather than the growing perpetuity formula? O a $1,155.68 million O b. $1,288.53 million O c. $1,296.76 million O d. $1,354.88 million Oe. None of the above Ing data apply to the next six questions. Delta Inc. is growing quickly. Revenues, which are forecast to be $500 million in one year, are expected to grow at 10% per year for the two years after that, 8% per year for the next two years, and 6% per year after that. Expenses including depreciation are 60% of revenues. Net investment, including net working capital and capital expenditures less depreciation, is 10% of revenues. Because all costs are proportional to revenues, net cash flows (sometimes referred to as free cash flow) grows at the same rate as do revenues. Delta is an all-equity firm with 12 million shares outstanding. Assume that Delta has a 35% tax rate and the company's stock has a beta of 1.5. The risk-free rate is 4%, and the market risk premium is 8%. Suppose that P/E ratio for comparable firms in Delta's industry is 8. What is your estimate to the terminal value (TV) of Delta via a multiple, rather than the growing perpetuity formula? O a $1,155.68 million O b. $1,288.53 million O c. $1,296.76 million O d. $1,354.88 million Oe. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started