Answered step by step

Verified Expert Solution

Question

1 Approved Answer

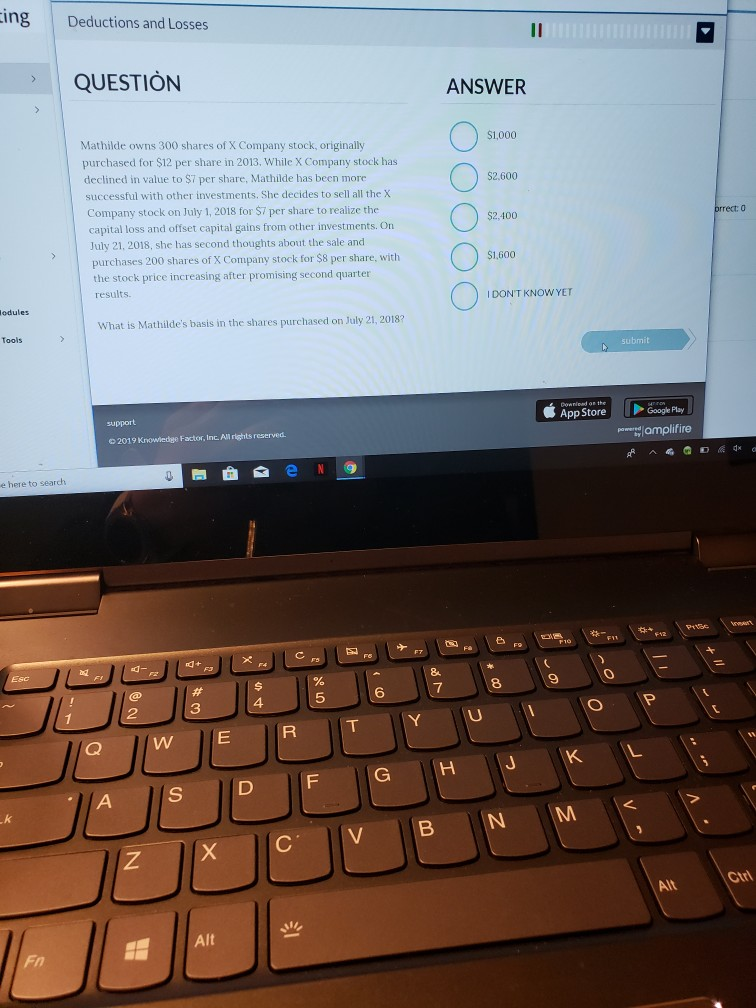

ing Deductions and Losses QUESTION ANSWER $1,000 Mathilde owns 300 shares of X Company stock, originally purchased for S12 per share in 2013. While X

ing Deductions and Losses QUESTION ANSWER $1,000 Mathilde owns 300 shares of X Company stock, originally purchased for S12 per share in 2013. While X Company stock has declined in value to $7 per share, Mathilde has been more successful with other investments. She decides to sell all the X Company stock on July 1, 2018 for $7 per share to realize the capital loss and offset capital gains from other investments. On July 21, 2018, she has second thoughts about the sale and purchases 200 shares of X Company stock for $8 per share, with the stock price increasing after promising second quarter S2,600 0% $2,400 $1,600 results IDONT KNOWYET What is Mathilde's basis in the shares purchased on July 21, 2018? AppStoreGoo Play e amplifire 2019 Knowledge Factor, Inc. Al rights reserved. e e here to search 6 OP N M Ctrl

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started