Answered step by step

Verified Expert Solution

Question

1 Approved Answer

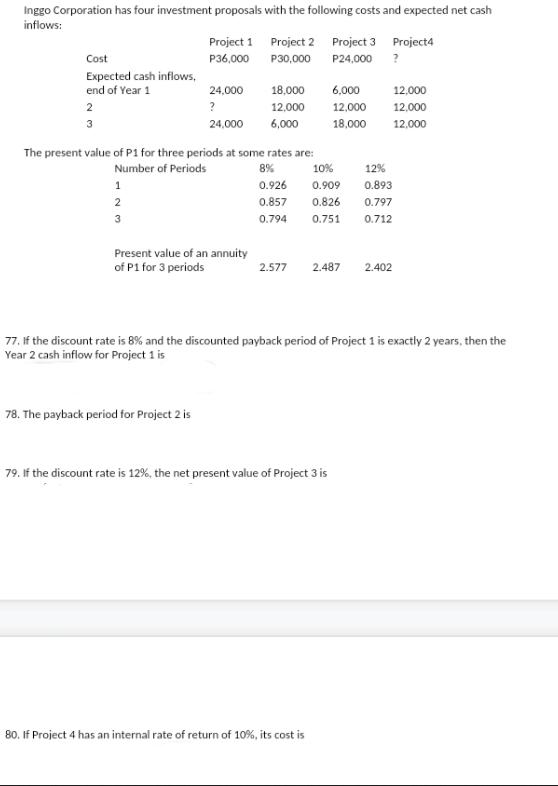

Inggo Corporation has four investment proposals with the following costs and expected net cash inflows: Cost Expected cash inflows, end of Year 1 2

Inggo Corporation has four investment proposals with the following costs and expected net cash inflows: Cost Expected cash inflows, end of Year 1 2 3 1 2 3 Project 1 P36,000 The present value of P1 for three periods at some rates are: Number of Periods 24,000 ? 24,000 Present value of an annuity of P1 for 3 periods 78. The payback period for Project 2 is Project 2 P30,000 18,000 12,000 6,000 8% 0.926 0.857 0.794 Project 3 P24,000 6,000 12,000 18,000 10% 0.909 0.826 0.751 79. If the discount rate is 12%, the net present value of Project 3 is 80. If Project 4 has an internal rate of return of 10%, its cost is Project4 ? 12,000 12,000 12,000 2.577 2.487 2.402 77. If the discount rate is 8% and the discounted payback period of Project 1 is exactly 2 years, then the Year 2 cash inflow for Project 1 is 12% 0.893 0.797 0.712

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations 77 If the discounted payback period of Project 1 is exactly 2 y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started