Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ingrid Corporation (Ingrid) purchased 100% of the outstanding voting shares of Josephine Limited (Josephine) for $2.7 million on December 31, 2019. Ingrid uses the cost

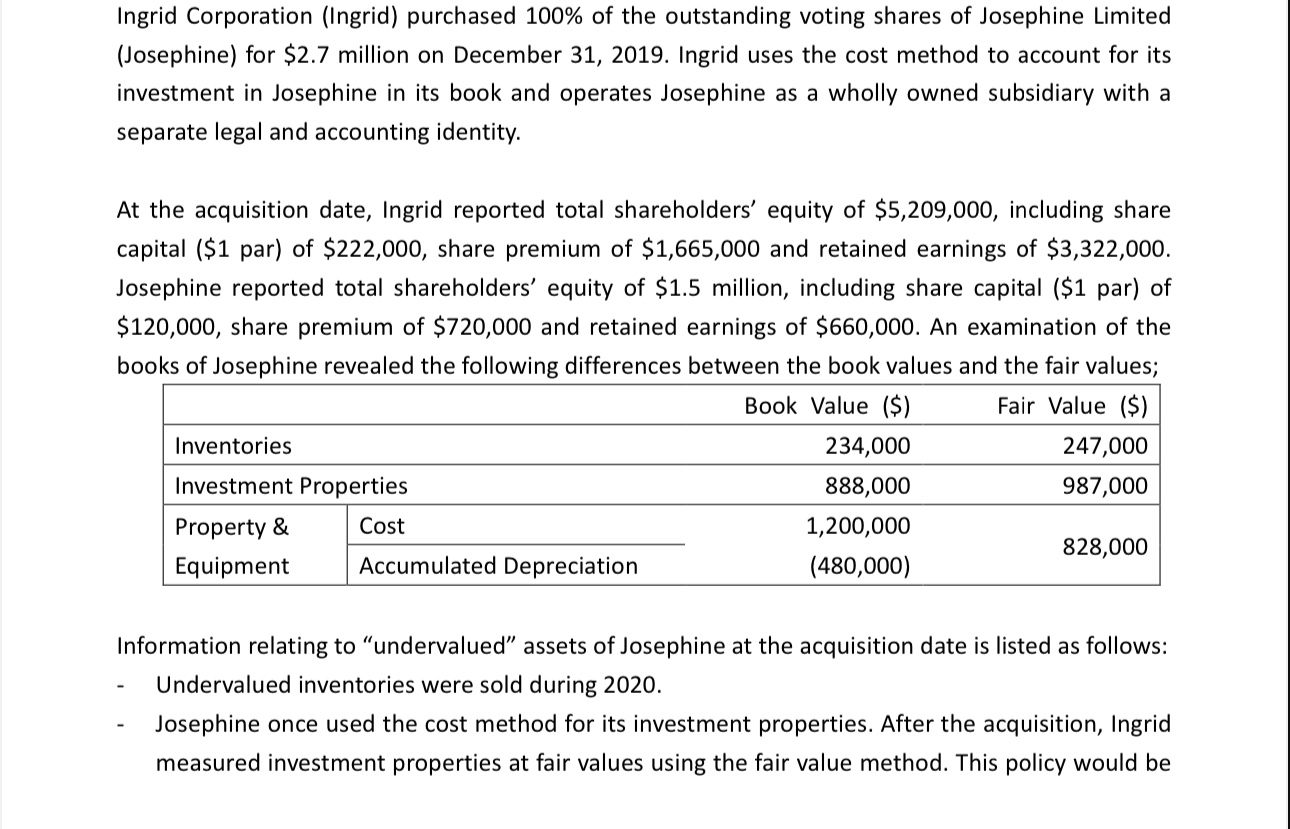

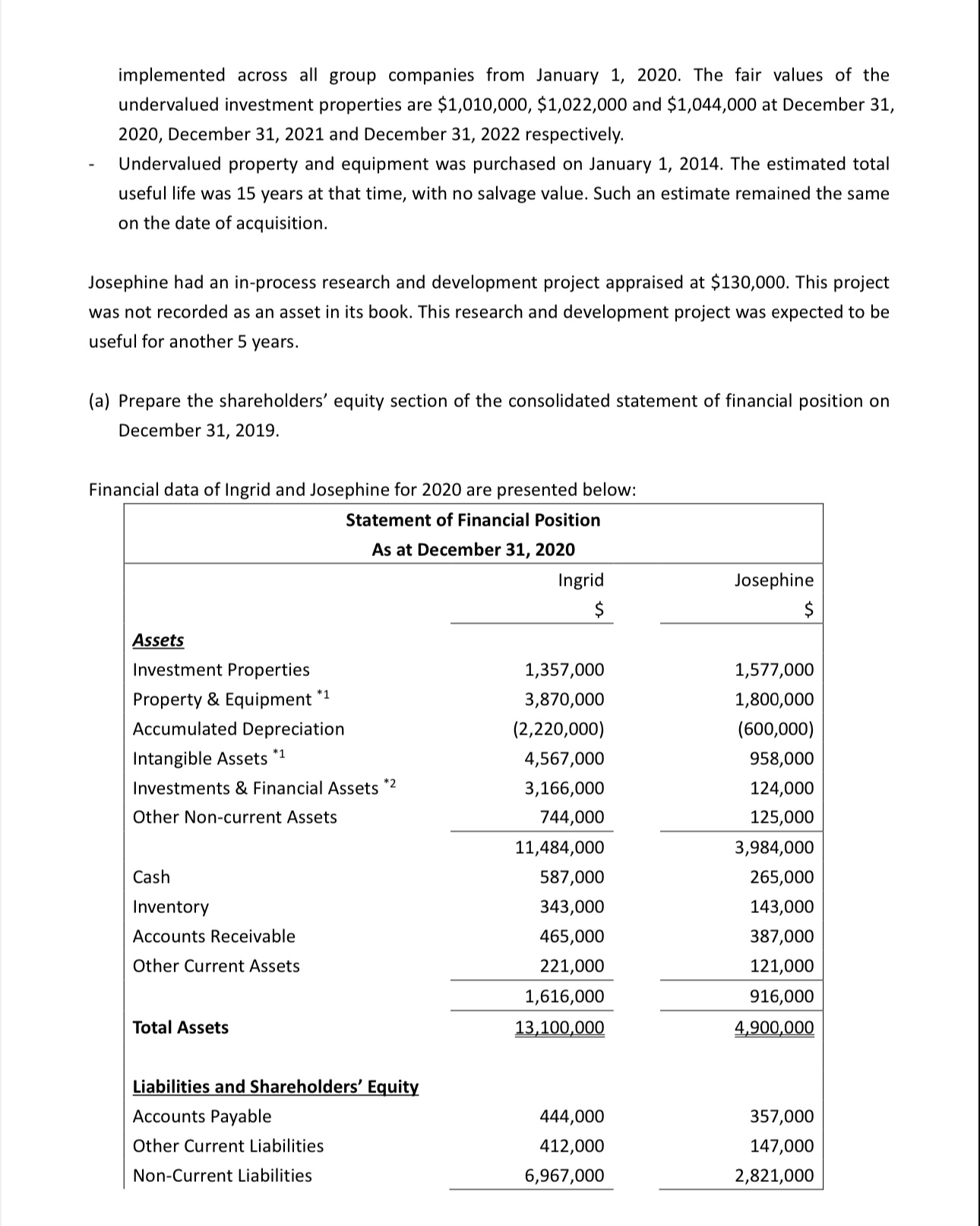

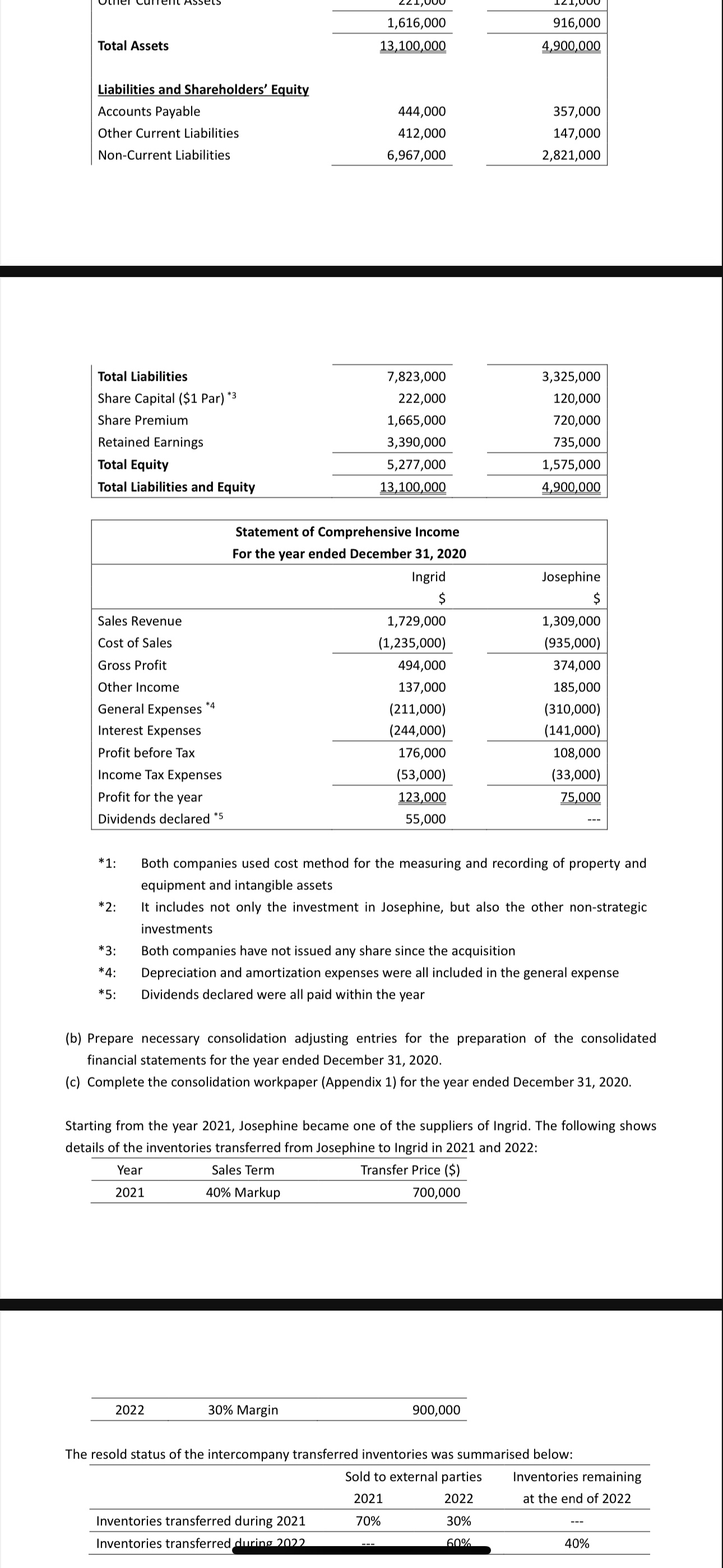

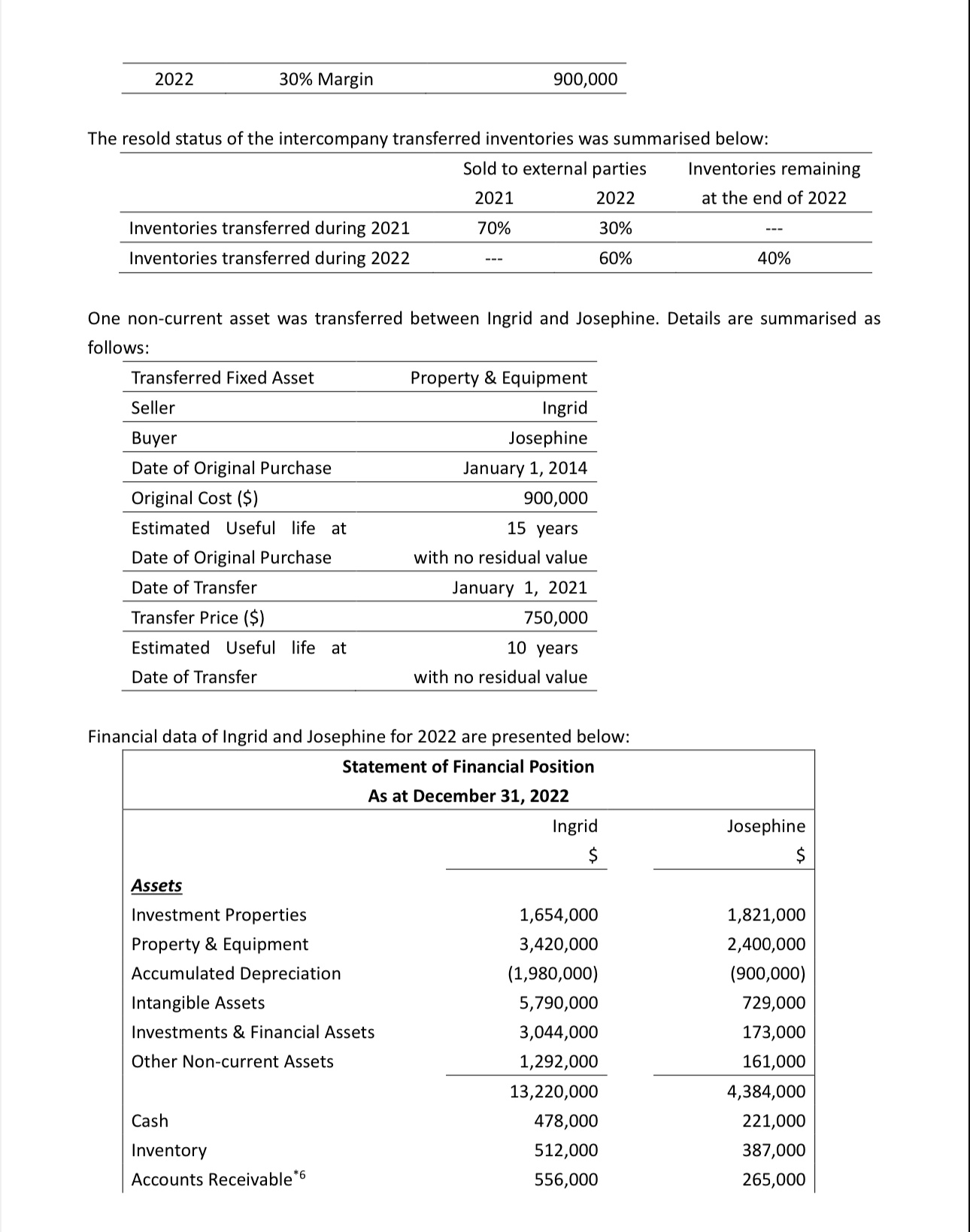

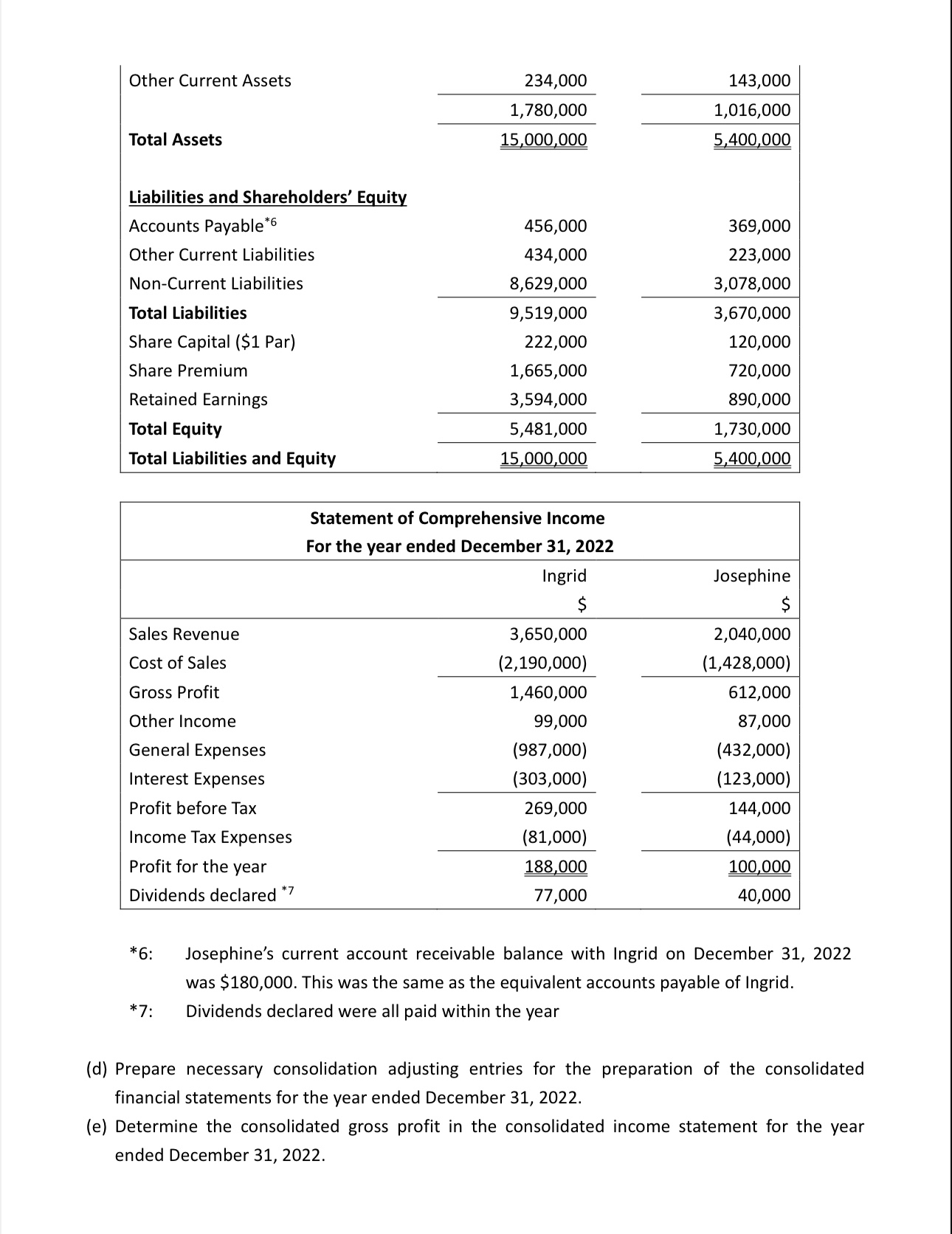

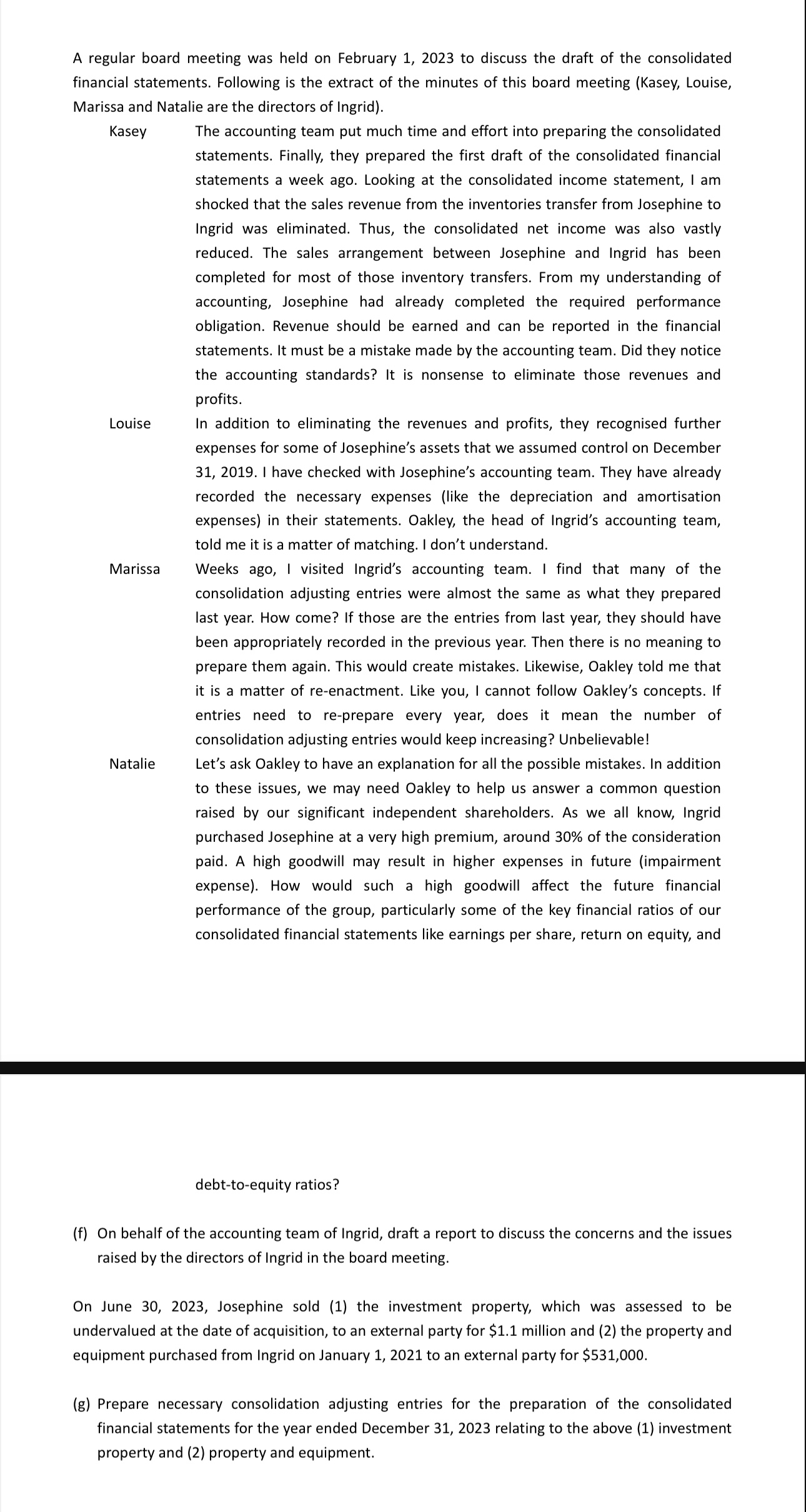

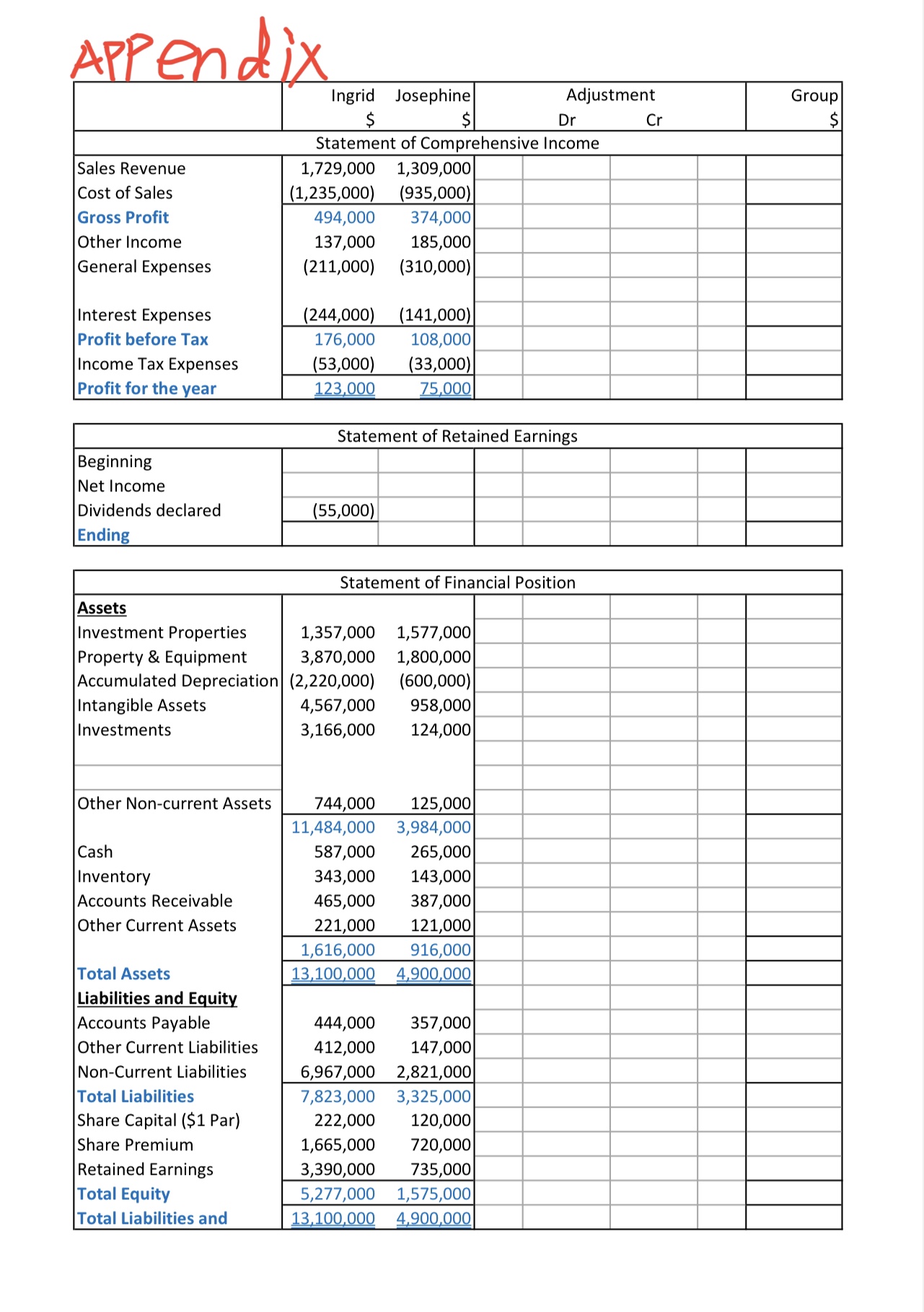

Ingrid Corporation (Ingrid) purchased 100% of the outstanding voting shares of Josephine Limited (Josephine) for \$2.7 million on December 31, 2019. Ingrid uses the cost method to account for its investment in Josephine in its book and operates Josephine as a wholly owned subsidiary with a separate legal and accounting identity. At the acquisition date, Ingrid reported total shareholders' equity of $5,209,000, including share capital ( $1 par) of $222,000, share premium of $1,665,000 and retained earnings of $3,322,000. Josephine reported total shareholders' equity of $1.5 million, including share capital ( $1 par) of $120,000, share premium of $720,000 and retained earnings of $660,000. An examination of the books of Josephine revealed the following differences between the book values and the fair values; Information relating to "undervalued" assets of Josephine at the acquisition date is listed as follows: - Undervalued inventories were sold during 2020. - Josephine once used the cost method for its investment properties. After the acquisition, Ingrid measured investment properties at fair values using the fair value method. This policy would be implemented across all group companies from January 1, 2020. The fair values of the undervalued investment properties are $1,010,000,$1,022,000 and $1,044,000 at December 31, 2020, December 31, 2021 and December 31, 2022 respectively. - Undervalued property and equipment was purchased on January 1, 2014. The estimated total useful life was 15 years at that time, with no salvage value. Such an estimate remained the same on the date of acquisition. Josephine had an in-process research and development project appraised at $130,000. This project was not recorded as an asset in its book. This research and development project was expected to be useful for another 5 years. (a) Prepare the shareholders' equity section of the consolidated statement of financial position on December 31, 2019. *1: Both companies used cost method for the measuring and recording of property and equipment and intangible assets *2: It includes not only the investment in Josephine, but also the other non-strategic investments *3: Both companies have not issued any share since the acquisition *4: Depreciation and amortization expenses were all included in the general expense *5: Dividends declared were all paid within the year (b) Prepare necessary consolidation adjusting entries for the preparation of the consolidated financial statements for the year ended December 31, 2020. (c) Complete the consolidation workpaper (Appendix 1) for the year ended December 31, 2020. Starting from the year 2021, Josephine became one of the suppliers of Ingrid. The following shows details of the inventories transferred from Josephine to Ingrid in 2021 and 2022: \begin{tabular}{lll} \hline 2022 & 30% Margin & 900,000 \\ \hline \end{tabular} The resold status of the intercompany transferred inventories was summarised below: The resold status of the intercompany transferred inventories was summarised below: One non-current asset was transferred between Ingrid and Josephine. Details are summarised as follows: Financial data of Ingrid and Josephine for 2022 are presented below: *6: Josephine's current account receivable balance with Ingrid on December 31, 2022 was $180,000. This was the same as the equivalent accounts payable of Ingrid. *7: Dividends declared were all paid within the year (d) Prepare necessary consolidation adjusting entries for the preparation of the consolidated financial statements for the year ended December 31, 2022. (e) Determine the consolidated gross profit in the consolidated income statement for the year ended December 31, 2022. A regular board meeting was held on February 1, 2023 to discuss the draft of the consolidated financial statements. Following is the extract of the minutes of this board meeting (Kasey, Louise, Marissa and Natalie are the directors of Ingrid). Kasey The accounting team put much time and effort into preparing the consolidated statements. Finally, they prepared the first draft of the consolidated financial statements a week ago. Looking at the consolidated income statement, I am shocked that the sales revenue from the inventories transfer from Josephine to Ingrid was eliminated. Thus, the consolidated net income was also vastly reduced. The sales arrangement between Josephine and Ingrid has been completed for most of those inventory transfers. From my understanding of accounting, Josephine had already completed the required performance obligation. Revenue should be earned and can be reported in the financial statements. It must be a mistake made by the accounting team. Did they notice the accounting standards? It is nonsense to eliminate those revenues and profits. Louise In addition to eliminating the revenues and profits, they recognised further expenses for some of Josephine's assets that we assumed control on December 31, 2019. I have checked with Josephine's accounting team. They have already recorded the necessary expenses (like the depreciation and amortisation expenses) in their statements. Oakley, the head of Ingrid's accounting team, told me it is a matter of matching. I don't understand. Marissa Weeks ago, I visited Ingrid's accounting team. I find that many of the consolidation adjusting entries were almost the same as what they prepared last year. How come? If those are the entries from last year, they should have been appropriately recorded in the previous year. Then there is no meaning to prepare them again. This would create mistakes. Likewise, Oakley told me that it is a matter of re-enactment. Like you, I cannot follow Oakley's concepts. If entries need to re-prepare every year, does it mean the number of consolidation adjusting entries would keep increasing? Unbelievable! Natalie Let's ask Oakley to have an explanation for all the possible mistakes. In addition to these issues, we may need Oakley to help us answer a common question raised by our significant independent shareholders. As we all know, Ingrid purchased Josephine at a very high premium, around 30% of the consideration paid. A high goodwill may result in higher expenses in future (impairment expense). How would such a high goodwill affect the future financial performance of the group, particularly some of the key financial ratios of our consolidated financial statements like earnings per share, return on equity, and debt-to-equity ratios? (f) On behalf of the accounting team of Ingrid, draft a report to discuss the concerns and the issues raised by the directors of Ingrid in the board meeting. On June 30, 2023, Josephine sold (1) the investment property, which was assessed to be undervalued at the date of acquisition, to an external party for $1.1 million and (2) the property and equipment purchased from Ingrid on January 1, 2021 to an external party for $531,000. (g) Prepare necessary consolidation adjusting entries for the preparation of the consolidated financial statements for the year ended December 31, 2023 relating to the above (1) investment property and (2) property and equipment. PPPOn dix

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started