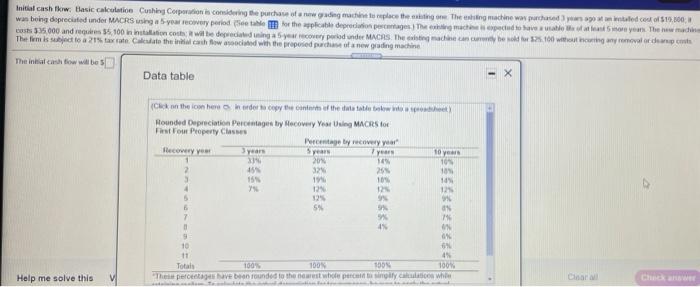

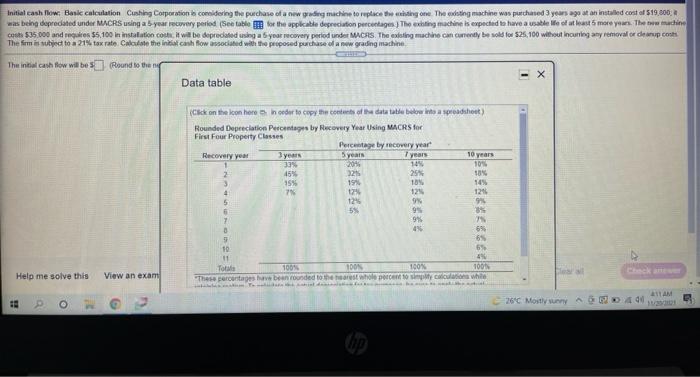

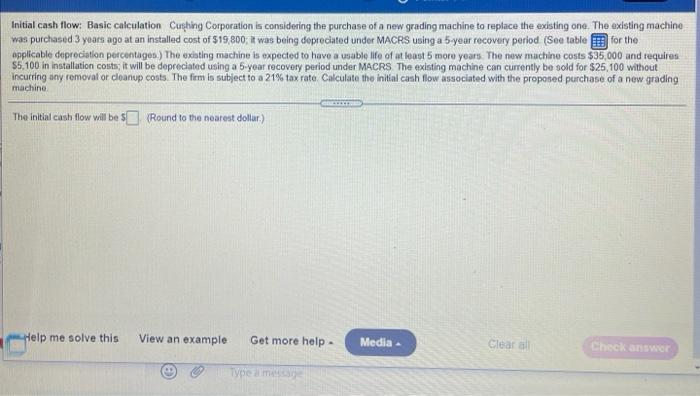

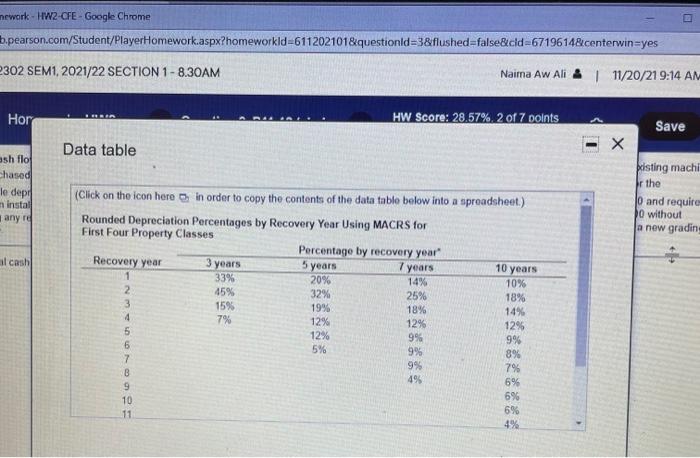

Initial cash ikw Basic calculation Cushing Corporation is considering the purchase of new gading machine to replace the linge The wing machine was purchased apted cost of $19.000 wan bong deprecated under MACRS in your recovery period (See table for the applicable depreciation percentages each expected to have the more you the new medias 3.000 and reques. 100 in to come will be directedninger pred under MACRS Tech machen cabell 3.106 counting any renovator cheap che The fomis suject to a 215 taxate. Caleate the chanced with the proposed purchase of a new grading machine The initial cash flow will be Data table (Click on the icon her in der of the table Rounded Depreciation Percentages by flecowy You Using MACRS for First Four Property Class Percentage by every year Recovery yet 3 years years 7 years 10 ye 20 YEN 101 15 32 20 18 15 19 1 109 12 1 125 59 9 2 946 4 9 10 11 49 100% 100% 100 100% "Then founded to the first when i Help me solve this Initial cash flow Basic calculation Cushing Corporation comidering the purchase of a new grading machine to replace the casting one. The dating machine was purchased 3 years ago at an installed cost of 519,800 was being deprecated under MACRS using a 5 year recovery period (See table for the applicable depreciation percentages. The exting machine is expected to have a usable We of at least 5 more years. The machine co $35.000 and requires 55.100 in installation cost it will be deprecated using a year recovery period under CRS. The existing machine can comenybe sold for $25.100 without incuring any removal orderup.com The firm in subject to a 21% tax rate Calculate the initial cash flow associated with the proposed purchase ofwgrading machine The initial cash flow will be $ Round to them Data table Click on the con horen oder to copy the contents of the datatable beboer into a spreadshot) Rounded Depreciation Percentage by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery yeart Recovery year 3 years years 7 years 10 years 33 20% 10 109 2 15% 32 25% 10% 3 155 197 10 145 4 7 12 12 124 5 99% 99 5% 95 89 7 9 0 45 69 5 65 10 6% 11 Tots 100% IDON 100% 1001 These percentages en founded to the rest whole process while Help me solve this View an exam ALAM G 26C Mostly suny 44 Initial cash flow: Basic calculation Cushing Corporation is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased 3 years ago at an installed cost of $19,800, it was being dopreciated under MACRS using a 5-year recovery period (See table for the applicable depreciation percentages.) The existing machine is expected to have a usable life of at least 5 more years. The new machine costs $35,000 and requires $5,100 in installation costs; it will be depreciated using a 5-year recovery period under MACRS The existing machine can currently be sold for $25,100 without incurring any removal or cleanup costs. The firm is subject to a 21% tax rata Calculate the initial cash flow associated with the proposed purchase of a new grading machine The initial cash flow will be $ (Round to the nearest dollar) Help me solve this View an example Get more help Media Cleara Check answer Typeme nework - HW2-CFE- Google Chrome b.pearson.com/Student/PlayerHomework.aspx?homeworkld-6112021018 questionid=3&flushed=false&cd=6719614&.centerwin=yes 2302 SEM1,2021/22 SECTION 1 - 8.30AM Naira Aw Ali 1 11/20/219:14 AM Hor HW Score: 28,57% 2 of 7 points Save Data table ash flo chased le dep pristing machi Ir the Jo and require O without a new gradin Install any al cash 5 years (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 1295 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 49 6% 9 6% 10 6% 11 4%