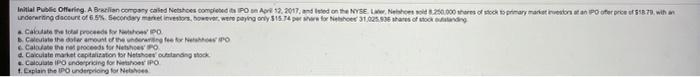

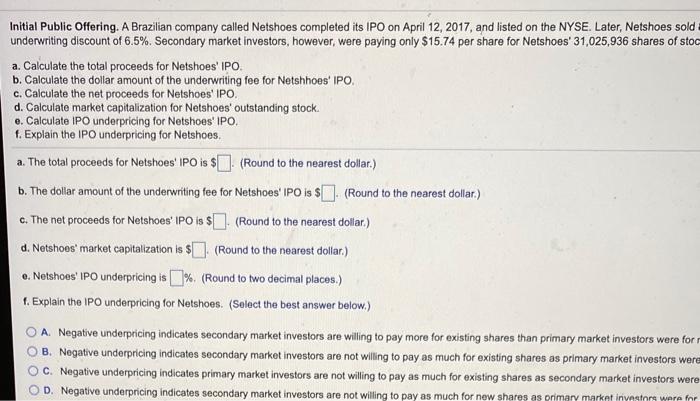

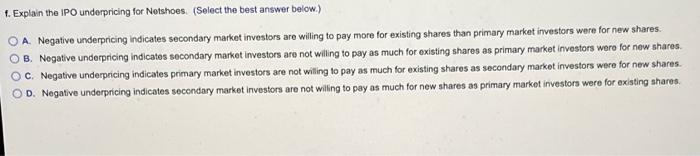

Initial Offering ABruction company called Netshoes comoined a po 12. 2017. and ved on the NYSELM20.000 hores of toch 13 primary made treba poofer price of $1870, with urortina decourt of 6. Seconday maneno, bowever were paying only $16.4 perwer 1.025.0 shares of took a cabo el proceso Colete the front of the info Nero Cate the proceeds for Netshoes d. Calculate market capitalization for Netshoes outstanding stock Calcul IPO nderpricing for IPO 1. Explain the undergoing for Initial Public Offering. A Brazilian company called Netshoes completed its IPO on April 12, 2017, and listed on the NYSE. Later, Netshoes sold underwriting discount of 6.5%. Secondary market investors, however, were paying only $15.74 per share for Netshoes' 31,025,936 shares of stoc a. Calculate the total proceeds for Netshoes' IPO b. Calculate the dollar amount of the underwriting fee for Netshhoes' IPO c. Calculate the net proceeds for Netshoes' IPO. d. Calculate market capitalization for Netshoes' outstanding stock. e. Calculate IPO underpricing for Netshoes' IPO. f. Explain the IPO underpricing for Netshoes, a. The total proceeds for Netshoes' IPO is $. (Round to the nearest dollar.) b. The dollar amount of the underwriting fee for Netshoes' IPO is $ - (Round to the nearest dollar.) c. The net proceeds for Netshoes' IPO is $ . (Round to the nearest dollar) d. Netshoes' market capitalization is $(Round to the nearest dollar) . Netshoes' IPO underpricing is % (Round to two decimal places.) f. Explain the IPO underpricing for Netshoes. (Select the best answer below.) O A Negative underpricing indicates secondary market investors are willing to pay more for existing shares than primary market investors were for B. Negative underpricing indicates secondary market investors are not willing to pay as much for existing shares as primary market investors were C. Negative underpricing indicates primary market investors are not willing to pay as much for existing shares as secondary market investors were D. Negative underpricing indicates secondary market investors are not willing to pay as much for new shares as primary market in stone ware for 1. Explain the IPO underpricing for Netshoes (Select the best answer below.) A. Negative underpricing indicates secondary market investors are wiling to pay more for existing shares than primary market investors were for new shares. B. Negative underpricing indicatos secondary market investors are not willing to pay as much for existing shares as primary market investors were for new shares C. Negative underpricing indicates primary market investors are not willing to pay as much for existing shares as secondary market investors were for new shares. OD. Negative underpricing indicates secondary market investors are not willing to pay as much for new shares as primary market investors were for existing shares