Question

Initial position: l The management of Austrian PIERER MOBILITY AG (ex KTM INDUSTRIES) intends to acquire 100% of Dutch ACCELL Group retroactively as of January

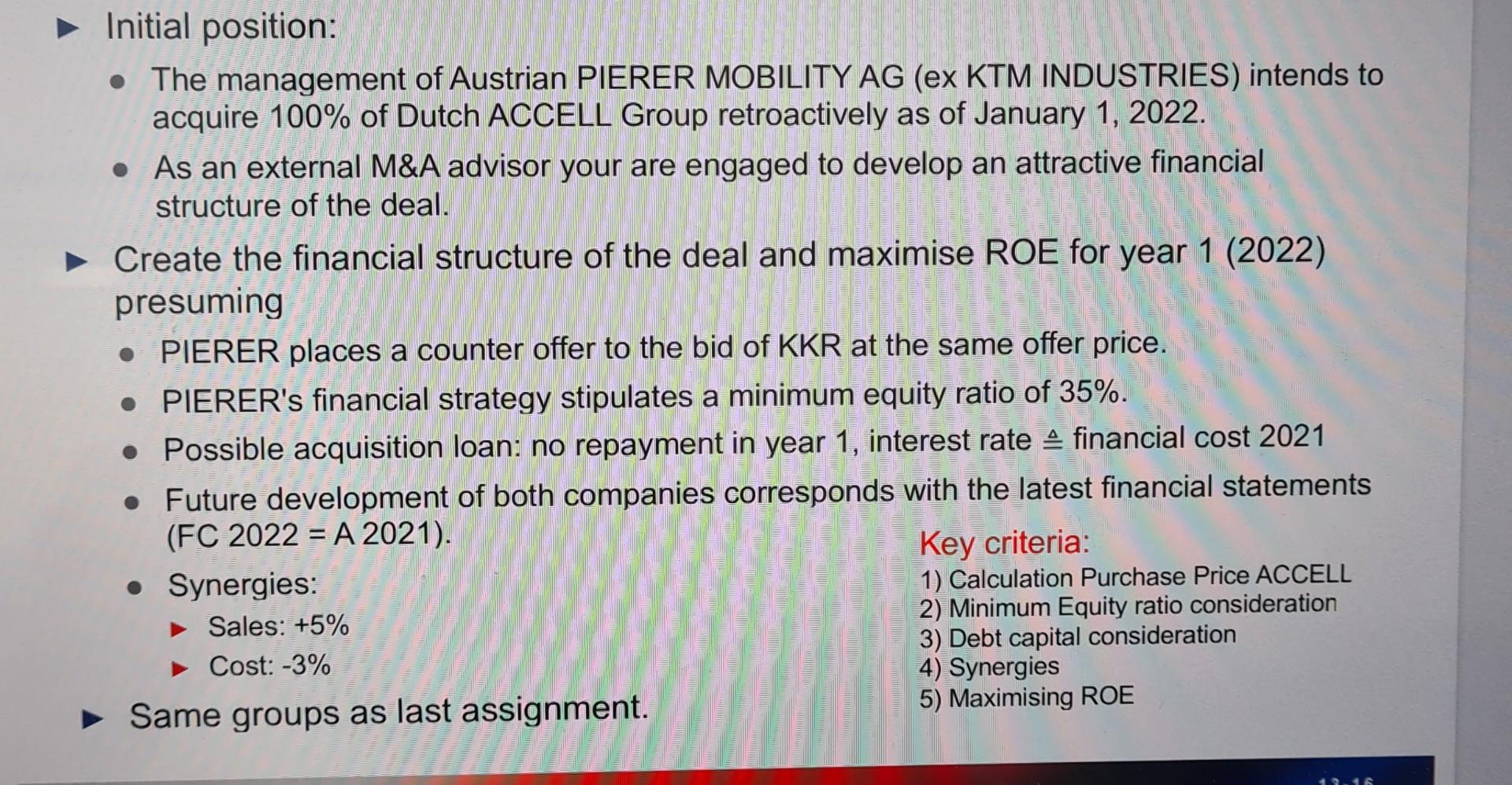

Initial position: l The management of Austrian PIERER MOBILITY AG (ex KTM INDUSTRIES) intends to acquire 100% of Dutch ACCELL Group retroactively as of January 1, 2022. l As an external M&A advisor your are engaged to develop an attractive financial structure of the deal. Create the financial structure of the deal and maximise ROE for year 1 (2022) presuming l PIERER places a counter offer to the bid of KKR at the same offer price. l PIERER's financial strategy stipulates a minimum equity ratio of 35%. l Possible acquisition loan: no repayment in year 1, interest rate financial cost 2021 l Future development of both companies corresponds with the latest financial statements (FC 2022 = A 2021). l Synergies: Sales: +5% Cost: -3% Same groups as last assignment. Mergers & Acquisitions 1 3 - 1 6 Key criteria: 1) Calculation Purchase Price ACCELL 2) Minimum Equity ratio consideration 3) Debt capital consideration 4) Synergies 5) Maximising ROE

Initial position: The management of Austrian PIERER MOBILITY AG (ex KTM INDUSTRIES) intends to acquire 100% of Dutch ACCELL Group retroactively as of January 1, 2022. As an external M&A advisor your are engaged to develop an attractive financial structure of the deal. Create the financial structure of the deal and maximise ROE for year 1 (2022) presuming PIERER places a counter offer to the bid of KKR at the same offer price. PIERER's financial strategy stipulates a minimum equity ratio of 35%. Possible acquisition loan: no repayment in year 1, interest rate financial cost 2021 Future development of both companies corresponds with the latest financial statements (FC 2022 = A 2021). Key criteria: Synergies: 1) Calculation Purchase Price ACCELL Sales: +5% 2) Minimum Equity ratio consideration 3) Debt capital consideration Cost: -3% 4) Synergies Same groups as last assignment. 5) Maximising ROE 42_ Initial position: The management of Austrian PIERER MOBILITY AG (ex KTM INDUSTRIES) intends to acquire 100% of Dutch ACCELL Group retroactively as of January 1, 2022. As an external M&A advisor your are engaged to develop an attractive financial structure of the deal. Create the financial structure of the deal and maximise ROE for year 1 (2022) presuming PIERER places a counter offer to the bid of KKR at the same offer price. PIERER's financial strategy stipulates a minimum equity ratio of 35%. Possible acquisition loan: no repayment in year 1, interest rate financial cost 2021 Future development of both companies corresponds with the latest financial statements (FC 2022 = A 2021). Key criteria: Synergies: 1) Calculation Purchase Price ACCELL Sales: +5% 2) Minimum Equity ratio consideration 3) Debt capital consideration Cost: -3% 4) Synergies Same groups as last assignment. 5) Maximising ROE 42_

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started