Answered step by step

Verified Expert Solution

Question

1 Approved Answer

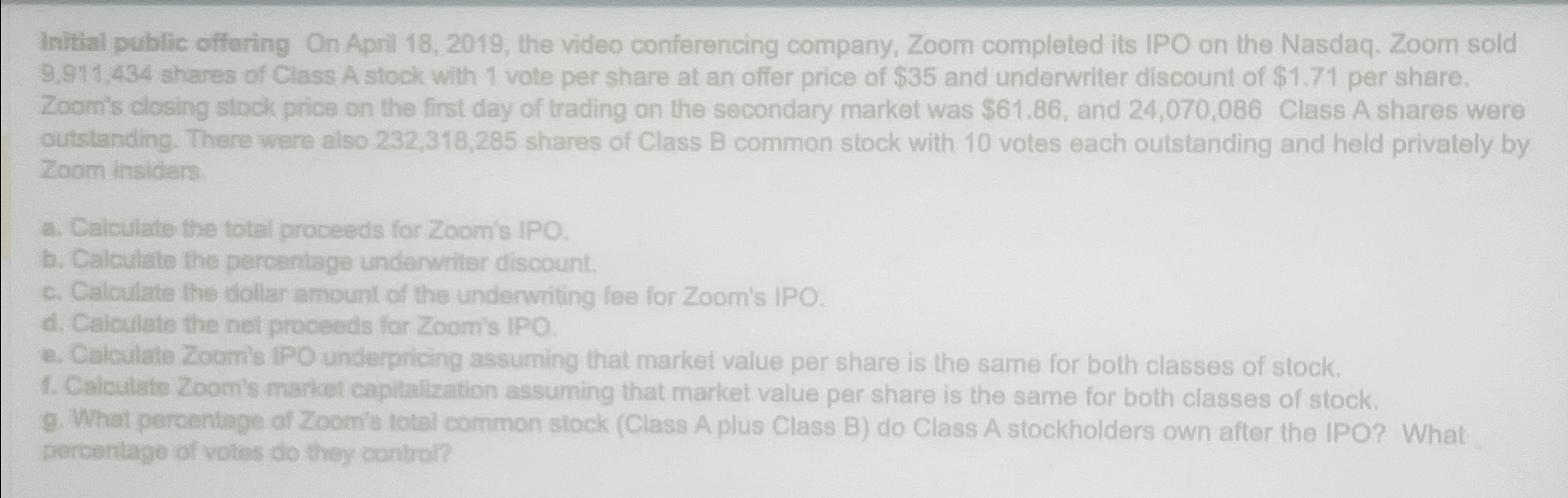

Initial public offering On April 1 8 , 2 0 1 9 , the video conferencing company, Zoom completed its IPO on the Nasdaq. Zoom

Initial public offering On April the video conferencing company, Zoom completed its IPO on the Nasdaq. Zoom sold shares of Class A stock with vote per share at an offer price of $ and underwriter discount of $ per share. Zoom's closing stock price on the first day of trading on the secondary market was $ and Class A shares were outstanding. There were also shares of Class B common stock with votes each outstanding and held privately by Zoom insiders.

a Caiculate the tolel proceeds for Zoom's IPO.

b Calculate the percentage undenwiter discount.

c Calculate the dollar amount of the underwriting fee for Zoom's IPO.

d Calculate the nel proceeds for Zoom's IPO.

Calculate Zoomb iPO underpricing assuming that market value per share is the same for both classes of stock.

Calculate Zoomls market caphalization assuming that market value per share is the same for both classes of stock.

What percentige of Zoom's total common stock Class A plus Class B do Class A stockholders own after the IPO? What percentage of voles do they contror?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started