Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Initial situation At the beginning of year 20_1, MAG had acquired all TAG shares for 750. At the time of acquisition, TAG's hidden reserves

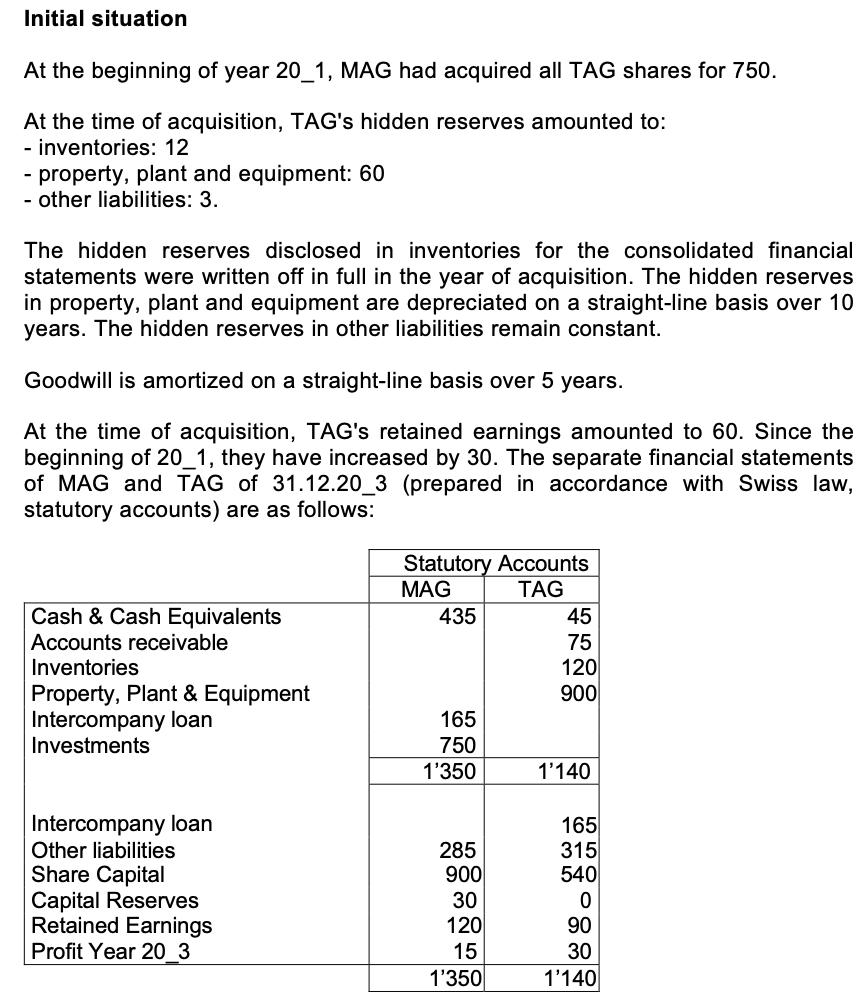

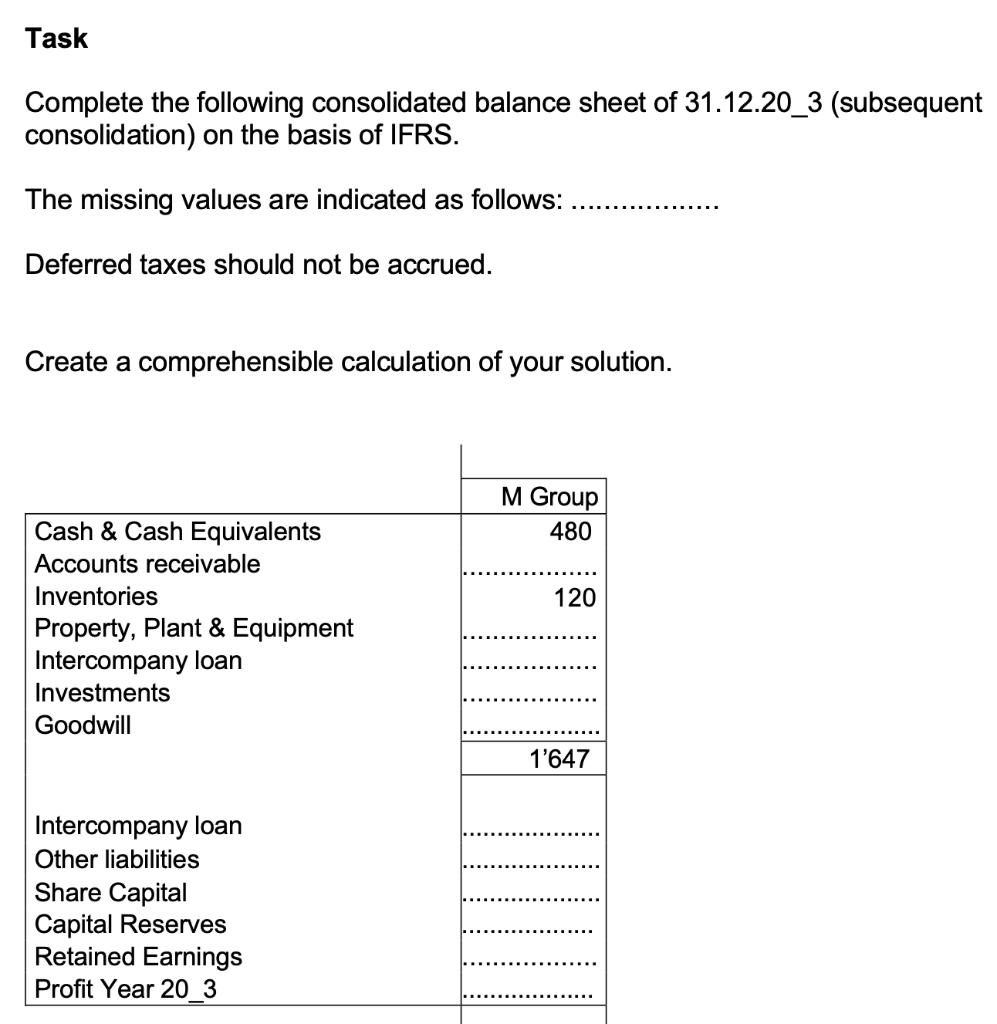

Initial situation At the beginning of year 20_1, MAG had acquired all TAG shares for 750. At the time of acquisition, TAG's hidden reserves amounted to: - inventories: 12 - property, plant and equipment: 60 - other liabilities: 3. The hidden reserves disclosed in inventories for the consolidated financial statements were written off in full in the year of acquisition. The hidden reserves in property, plant and equipment are depreciated on a straight-line basis over 10 years. The hidden reserves in other liabilities remain constant. Goodwill is amortized on a straight-line basis over 5 years. At the time of acquisition, TAG's retained earnings amounted to 60. Since the beginning of 20_1, they have increased by 30. The separate financial statements of MAG and TAG of 31.12.20_3 (prepared in accordance with Swiss law, statutory accounts) are as follows: Cash & Cash Equivalents Accounts receivable Inventories Property, Plant & Equipment Intercompany loan Investments Intercompany loan Other liabilities Share Capital Capital Reserves Retained Earnings Profit Year 20_3 Statutory Accounts MAG TAG 435 165 750 1'350 285 900 30 120 15 1'350 45 75 120 200 1'140 165 315 540 0 90 30 1'140 Task Complete the following consolidated balance sheet of 31.12.20_3 (subsequent consolidation) on the basis of IFRS. The missing values are indicated as follows: Deferred taxes should not be accrued. Create a comprehensible calculation of your solution. Cash & Cash Equivalents Accounts receivable Inventories Property, Plant & Equipment Intercompany loan Investments Goodwill Intercompany loan Other liabilities Share Capital Capital Reserves Retained Earnings Profit Year 20 3 M Group 480 120 1'647

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started