Answered step by step

Verified Expert Solution

Question

1 Approved Answer

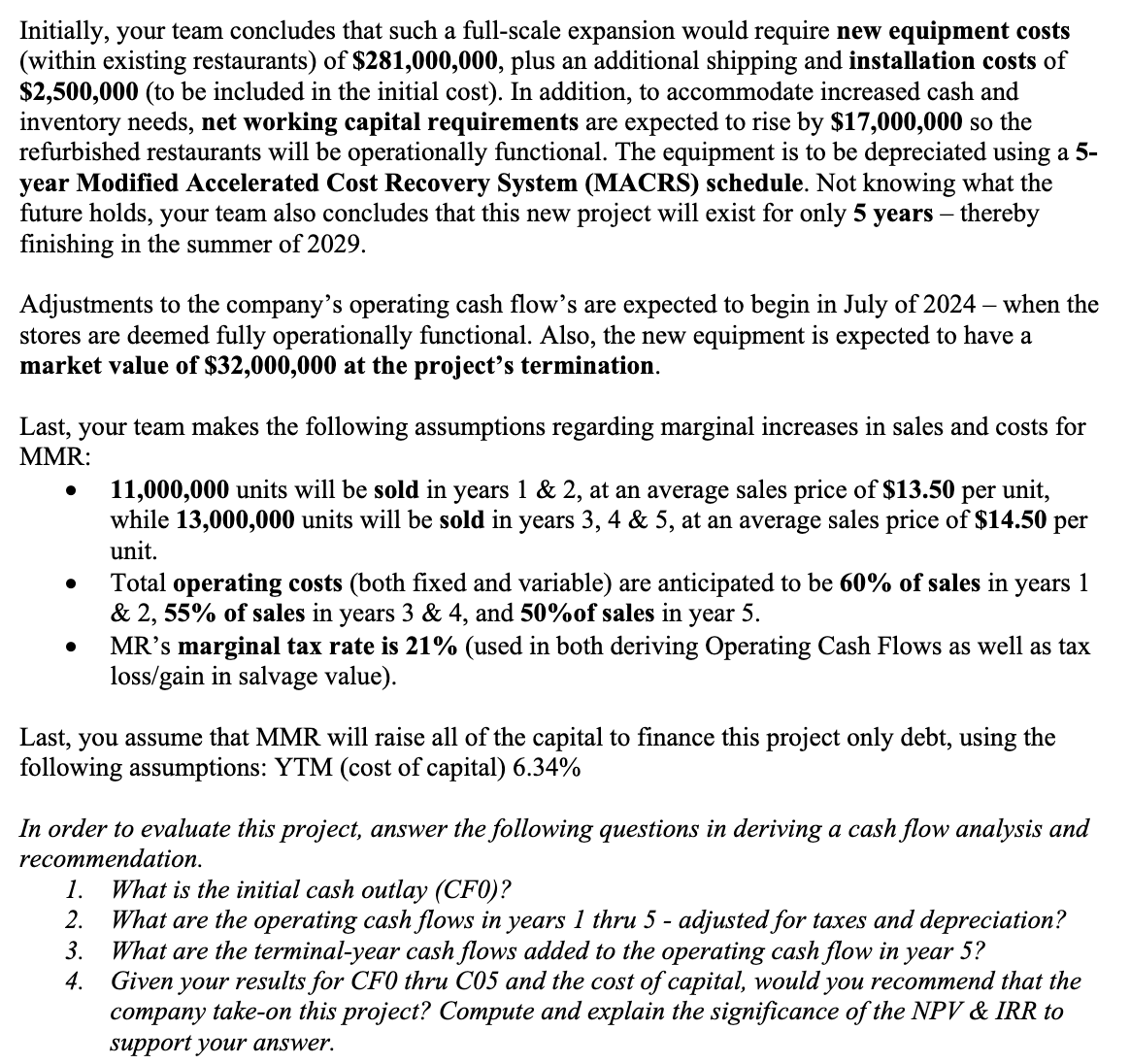

Initially, your team concludes that such a full - scale expansion would require new equipment costs ( within existing restaurants ) of $ 2 8

Initially, your team concludes that such a fullscale expansion would require new equipment costs

within existing restaurants of $ plus an additional shipping and installation costs of

$to be included in the initial cost In addition, to accommodate increased cash and

inventory needs, net working capital requirements are expected to rise by $ so the

refurbished restaurants will be operationally functional. The equipment is to be depreciated using a

year Modified Accelerated Cost Recovery System MACRS schedule. Not knowing what the

future holds, your team also concludes that this new project will exist for only years thereby

finishing in the summer of

Adjustments to the company's operating cash flow's are expected to begin in July of when the

stores are deemed fully operationally functional. Also, the new equipment is expected to have a

market value of $ at the project's termination.

Last, your team makes the following assumptions regarding marginal increases in sales and costs for

MMR:

units will be sold in years & at an average sales price of $ per unit,

while units will be sold in years & at an average sales price of $ per

unit.

Total operating costs both fixed and variable are anticipated to be of sales in years

& of sales in years & and of sales in year

MRs marginal tax rate is used in both deriving Operating Cash Flows as well as tax

lossgain in salvage value

Last, you assume that MMR will raise all of the capital to finance this project only debt, using the

following assumptions: YTM cost of capital

In order to evaluate this project, answer the following questions in deriving a cash flow analysis and

recommendation.

What is the initial cash outlay CFO

What are the operating cash flows in years thru adjusted for taxes and depreciation?

What are the terminalyear cash flows added to the operating cash flow in year

Given your results for CF thru C and the cost of capital, would you recommend that the

company takeon this project? Compute and explain the significance of the NPV & IRR to

support your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started