Question

Innis Investments manages funds for a number of companies and wealthy clients. For a new client, Innis has been authorized to invest up to $1.2

- Innis Investments manages funds for a number of companies and wealthy clients. For a new client, Innis has been authorized to invest up to $1.2 million in two investment funds: a stock and a money market. Each unit of the stock fund costs $50 and provides an annual rate of return of 10%; each unit of the money market fund costs $100 and provides an annual rate of return of 4%.

The client wants to minimize risk subject to the requirement that the annual income from the investment be at least $60,000 and at least $300,000 be invested in the money market fund. According to Innis=s risk measurement system, each stock fund unit has a risk index of 8, and each money market fund unit has a risk index of 3 (higher the number the more risk).

a) What is the optimal solution if the annual return is maximized?

b) What is the optimal solution if risk is minimized? What is the value of the objective function?

c) What is the range of optimality for the objective function?

d) What is the dual price for the funds available constraint? For the second constraint?

e) Suppose the risk index for the stock fund (CS) increases from 8 to 12. How does the optimal solution change?

f) Suppose the risk index for the money market (CM) fund increases from 3 to 3.5. How does the optimal solution change?

g) Suppose CS increases to 12 and CM increases to 3.3 (risk indexes). How does the optimal solution change?

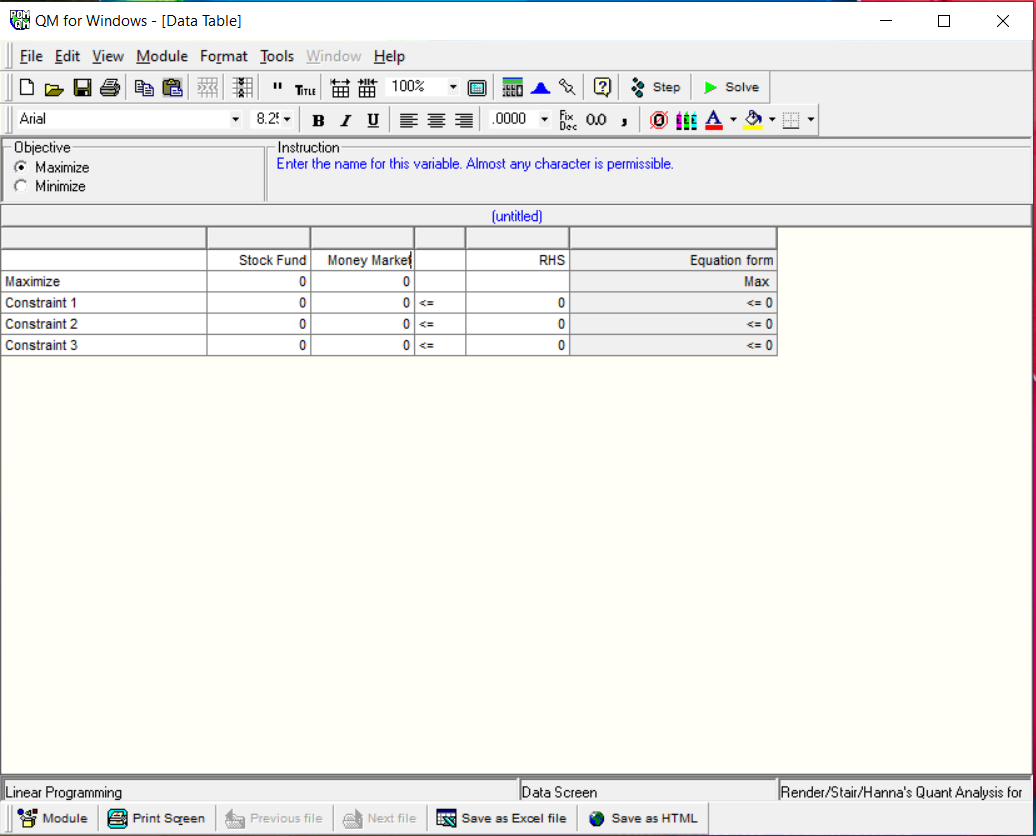

How do I fill out the form below to solve problem

QM for Windows - [Data Table] File Edit View Module Format Tools Window Help Arial - 8.25 B IU lixFec0.0 , (0) Instruction - Objective - Maximize C Minimize (untitled) \begin{tabular}{l|l|l|} \hline Stock Fund Money Marke\} & RHS \\ \hline \end{tabular} Equation form Linear Programming Data Screen Render/Stair/Hanna's Quant Analysis for Module Print Sqeen Previous file Save as Excel file Save as HTML

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started