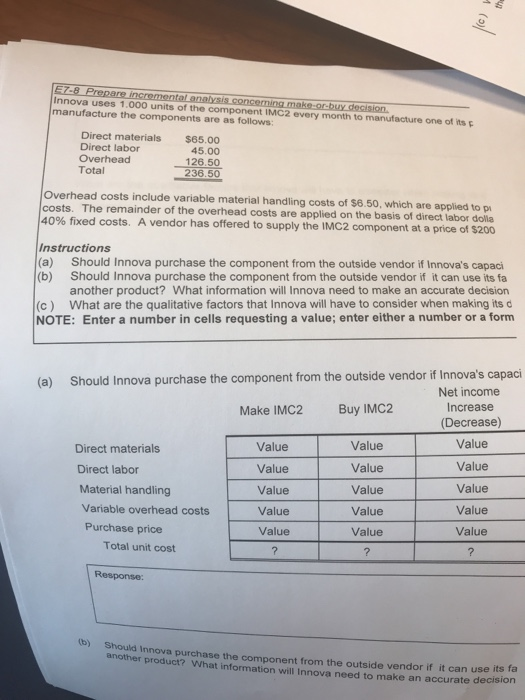

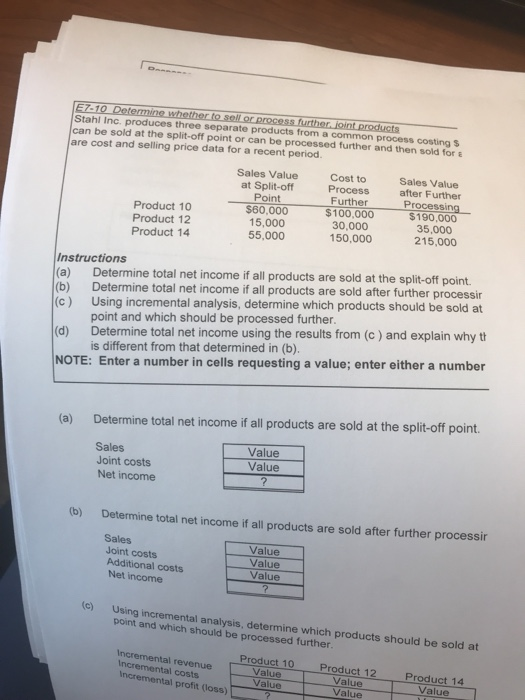

Innova uses 1.000 units of the component IMC2 every month to manufacture one of its p manufacture the components are as follows Direct materials Direct labor Overhead Total $65.00 45.00 126.50 Overhead costs include variable material handling costs of $6.50, which are applied to p The remainder of the overhead costs are applied on the basis of direct labor dola 40% fixed costs. A vendor has offered to supply the IMC2 component at a price os200 Instructions (a) Should Innova purchase the component from the outside vendor if Innova's capaci (b) Should Innova purchase the component from the outside vendor if it can use its fa another product? What information will Innova need to make an accurate decision (c) What are the qualitative factors that Innova will have to consider when making its d NOTE: Enter a number in cells requesting a value; enter either a number or a form (a) Should Innova purchase the component from the outside vendor if Innova's capaci Net income Increase Decrease) Value Make IMC2 Buy IMC2 Value Value Value Value Value Value Value Value Value Value Direct materials Value Value Value Value Direct labor Material handling Variable overhead costs Purchase price Total unit cost (b) Should Innova purchase the component from the outside vendor if it can use its fa hat information will Innova need to make an accurate decision Stahl Inc. produces three separate products from a common process costing S can be sold at the split-off point or can be processed further and then sold for are cost and selling price data for a recent period. Sales Value at Split-off Point $60,000 15,000 55,000 Cost to Process Further $100,000 30,000 150,000 Sales Value after Further Processing $190,000 35,000 215,000 Product 10 Product 12 Product 14 Instructions (a) Determine total net income if all products are sold at the split-off point. (b) (c) Using incremental analysis, determine which products should be sold at Determine total net income if all products are sold after further processir point and which should be processed further is different from that determined in (b). (d) Determine total net income using the results from (c ) and explain why t NOTE: Enter a number in cells requesting a value; enter either a number (a) Determine total net income if all products are sold at the split-off point Sales Joint costs Net income Value Value (b) Determine total net incom if all products are sold after further processir Sales Joint costs Additional costs Net income Value Value Value (c) Using incremental analysis, determine which products should be sold at point and which should be processed further Product 10 Value Value Product 12 Value Value Product 14 Incremental costs Incremental profit (loss) Value Innova uses 1.000 units of the component IMC2 every month to manufacture one of its p manufacture the components are as follows Direct materials Direct labor Overhead Total $65.00 45.00 126.50 Overhead costs include variable material handling costs of $6.50, which are applied to p The remainder of the overhead costs are applied on the basis of direct labor dola 40% fixed costs. A vendor has offered to supply the IMC2 component at a price os200 Instructions (a) Should Innova purchase the component from the outside vendor if Innova's capaci (b) Should Innova purchase the component from the outside vendor if it can use its fa another product? What information will Innova need to make an accurate decision (c) What are the qualitative factors that Innova will have to consider when making its d NOTE: Enter a number in cells requesting a value; enter either a number or a form (a) Should Innova purchase the component from the outside vendor if Innova's capaci Net income Increase Decrease) Value Make IMC2 Buy IMC2 Value Value Value Value Value Value Value Value Value Value Direct materials Value Value Value Value Direct labor Material handling Variable overhead costs Purchase price Total unit cost (b) Should Innova purchase the component from the outside vendor if it can use its fa hat information will Innova need to make an accurate decision Stahl Inc. produces three separate products from a common process costing S can be sold at the split-off point or can be processed further and then sold for are cost and selling price data for a recent period. Sales Value at Split-off Point $60,000 15,000 55,000 Cost to Process Further $100,000 30,000 150,000 Sales Value after Further Processing $190,000 35,000 215,000 Product 10 Product 12 Product 14 Instructions (a) Determine total net income if all products are sold at the split-off point. (b) (c) Using incremental analysis, determine which products should be sold at Determine total net income if all products are sold after further processir point and which should be processed further is different from that determined in (b). (d) Determine total net income using the results from (c ) and explain why t NOTE: Enter a number in cells requesting a value; enter either a number (a) Determine total net income if all products are sold at the split-off point Sales Joint costs Net income Value Value (b) Determine total net incom if all products are sold after further processir Sales Joint costs Additional costs Net income Value Value Value (c) Using incremental analysis, determine which products should be sold at point and which should be processed further Product 10 Value Value Product 12 Value Value Product 14 Incremental costs Incremental profit (loss) Value