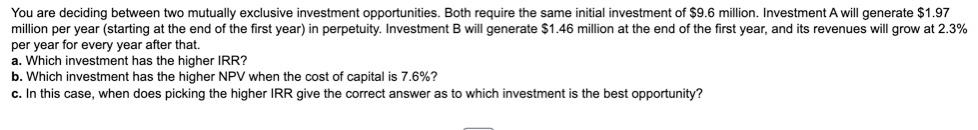

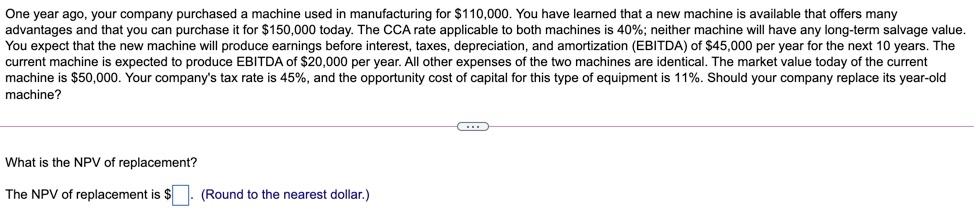

Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.98 million. The product is expected to generate profits of $1.12 million per year for 10 years. The company will have to provide product support expected to cost $92,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 6.2%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.3% and 15.7%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment? You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $9.6 million. Investment A will generate $1.97 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.46 million at the end of the first year, and its revenues will grow at 2.3% per year for every year after that. a. Which investment has the higher IRR? b. Which investment has the higher NPV when the cost of capital is 7.6%? c. In this case, when does picking the higher IRR give the correct answer as to which investment is the best opportunity? One year ago, your company purchased a machine used in manufacturing for $110,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $150,000 today. The CCA rate applicable to both machines is 40%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $45,000 per year for the next 10 years. The current machine is expected to produce EBITDA of $20,000 per year. All other expenses of the two machines are identical. The market value today of current machine is $50,000. Your company's tax rate is 45%, and the opportunity cost of capital for this type of equipment is 11%. Should your company replace its year-old machine? What is the NPV of replacement? The NPV of replacement is $ (Round to the nearest dollar.)