Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Innovations Corp (IC) uses the percentage of credit sales method to estimate bad debts each month and then uses the aging method at year-end. During

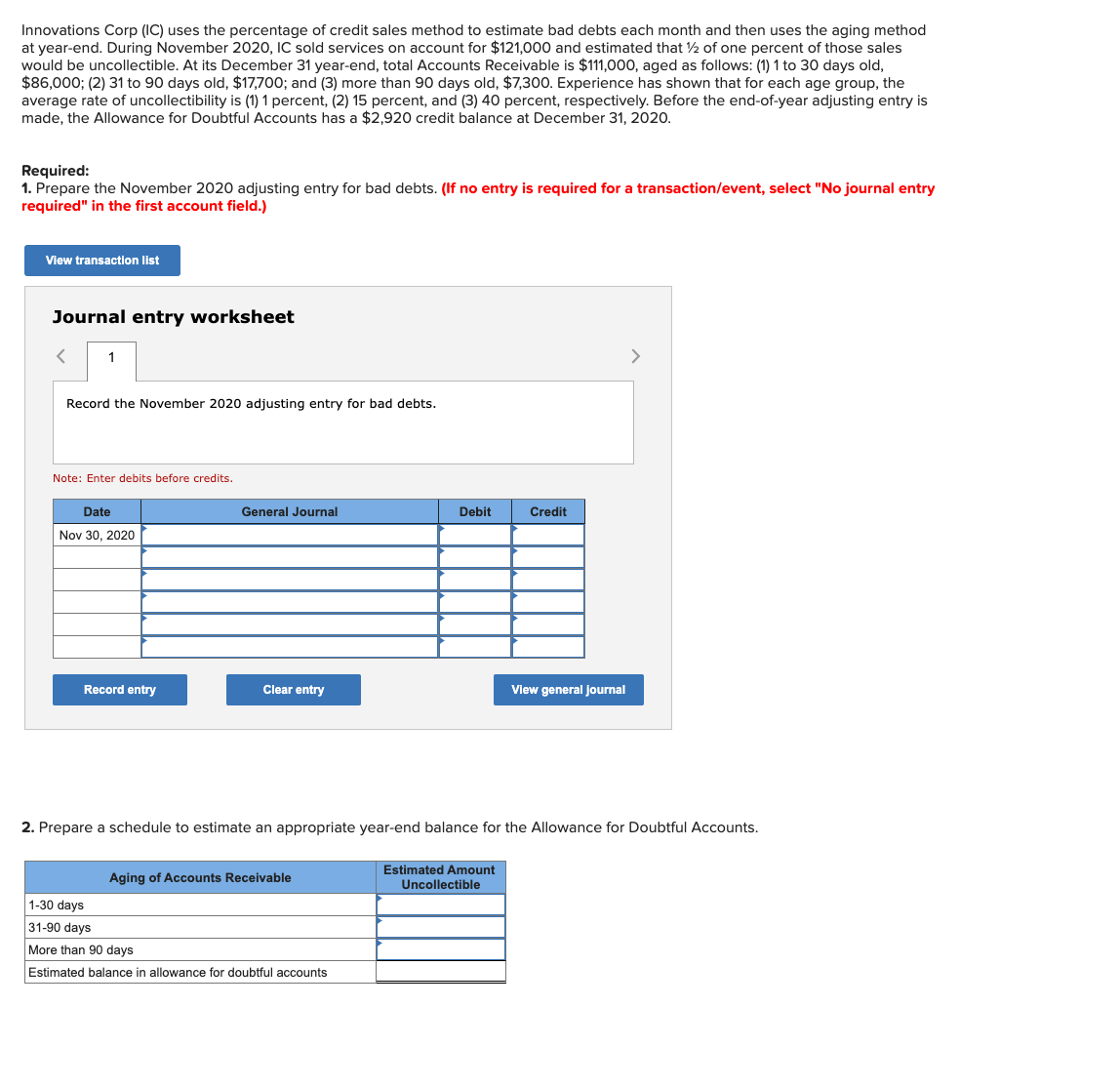

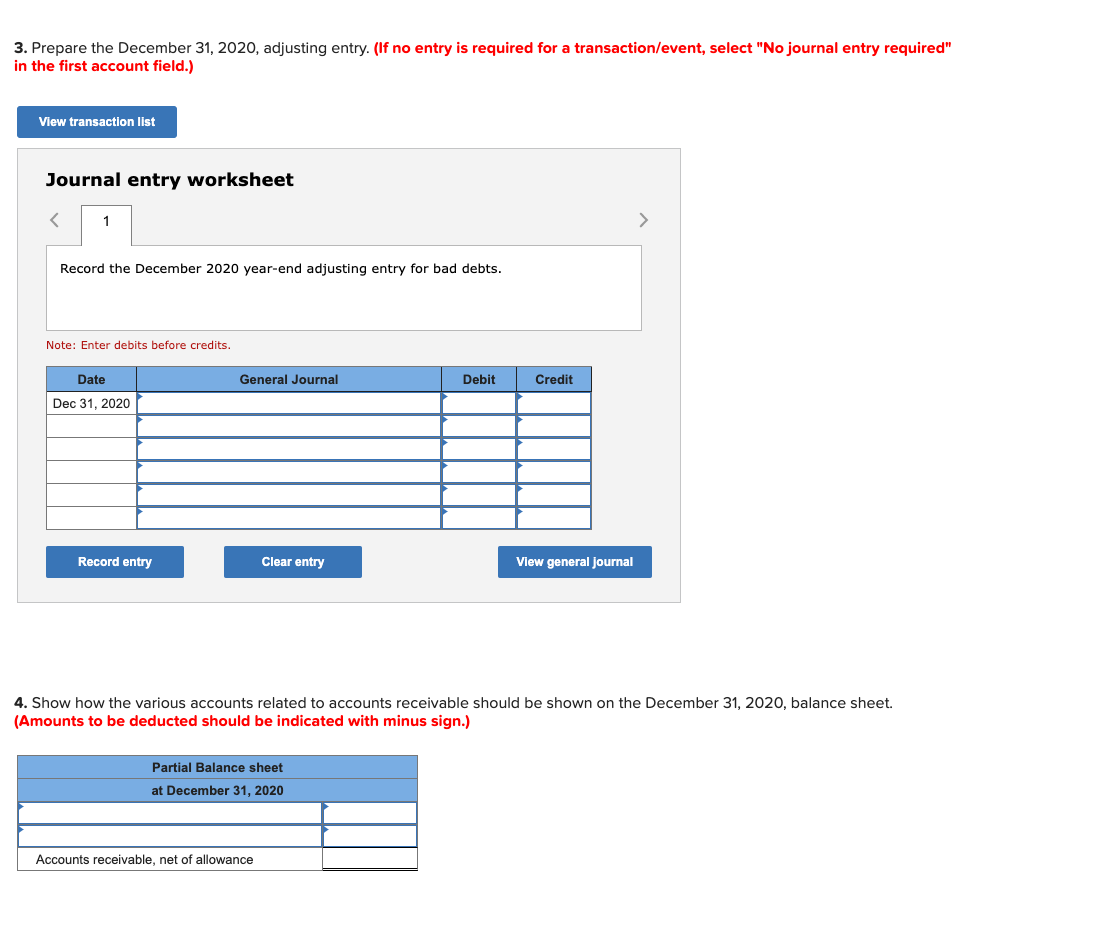

Innovations Corp (IC) uses the percentage of credit sales method to estimate bad debts each month and then uses the aging method at year-end. During November 2020 , IC sold services on account for $121,000 and estimated that 1/2 of one percent of those sales would be uncollectible. At its December 31 year-end, total Accounts Receivable is $111,000, aged as follows: (1) 1 to 30 days old, $86,000; (2) 31 to 90 days old, $17,700; and (3) more than 90 days old, $7,300. Experience has shown that for each age group, the average rate of uncollectibility is (1) 1 percent, (2) 15 percent, and (3) 40 percent, respectively. Before the end-of-year adjusting entry is made, the Allowance for Doubtful Accounts has a $2,920 credit balance at December 31, 2020. Required: 1. Prepare the November 2020 adjusting entry for bad debts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the November 2020 adjusting entry for bad debts. Note: Enter debits before credits. 2. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts. 3. Prepare the December 31,2020 , adjusting entry. (If no entry is required for a transaction/event, select "No journal entry required' in the first account field.) Journal entry worksheet Record the December 2020 year-end adjusting entry for bad debts. Note: Enter debits before credits. 4. Show how the various accounts related to accounts receivable should be shown on the December 31,2020 , balance sheet. (Amounts to be deducted should be indicated with minus sign.)

Innovations Corp (IC) uses the percentage of credit sales method to estimate bad debts each month and then uses the aging method at year-end. During November 2020 , IC sold services on account for $121,000 and estimated that 1/2 of one percent of those sales would be uncollectible. At its December 31 year-end, total Accounts Receivable is $111,000, aged as follows: (1) 1 to 30 days old, $86,000; (2) 31 to 90 days old, $17,700; and (3) more than 90 days old, $7,300. Experience has shown that for each age group, the average rate of uncollectibility is (1) 1 percent, (2) 15 percent, and (3) 40 percent, respectively. Before the end-of-year adjusting entry is made, the Allowance for Doubtful Accounts has a $2,920 credit balance at December 31, 2020. Required: 1. Prepare the November 2020 adjusting entry for bad debts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the November 2020 adjusting entry for bad debts. Note: Enter debits before credits. 2. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts. 3. Prepare the December 31,2020 , adjusting entry. (If no entry is required for a transaction/event, select "No journal entry required' in the first account field.) Journal entry worksheet Record the December 2020 year-end adjusting entry for bad debts. Note: Enter debits before credits. 4. Show how the various accounts related to accounts receivable should be shown on the December 31,2020 , balance sheet. (Amounts to be deducted should be indicated with minus sign.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started