Question: @ You are considering two independent projects, Project A and Project B. The initial cash outlays associated with Project A and Project B is

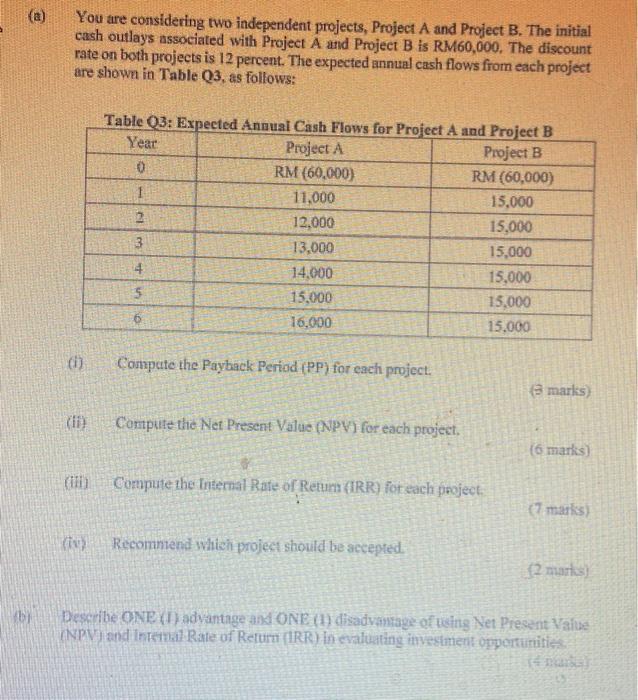

@ You are considering two independent projects, Project A and Project B. The initial cash outlays associated with Project A and Project B is RM60,000. The discount rate on both projects is 12 percent. The expected annual cash flows from each project are shown in Table Q3, as follows: (1) (11) (H) (iv) Table Q3: Expected Annual Cash Flows for Project A and Project B Year Project A Project B RM (60,000) 0 RM (60,000) 11,000 12,000 13,000 14,000 15,000 16,000 7 3 4 5 6 Compute the Payback Period (PP) for each project. Compute the Net Present Value (NPV) for each project. Compute the Internal Rate of Return (IRR) for each project. Recommend which project should be accepted. 15,000 15,000 15,000 15,000 15,000 15,000 (3 marks) (6 marks) (7 marks) (2 marks) Describe ONE (1) advantage and ONE (1) disadvantage of using Net Present Value (NPV) and Intemal Rate of Return (IRR) in evaluating investment opportunities. [(4 marka)

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

b One advantage of using NPV in evaluating investment opportuni... View full answer

Get step-by-step solutions from verified subject matter experts