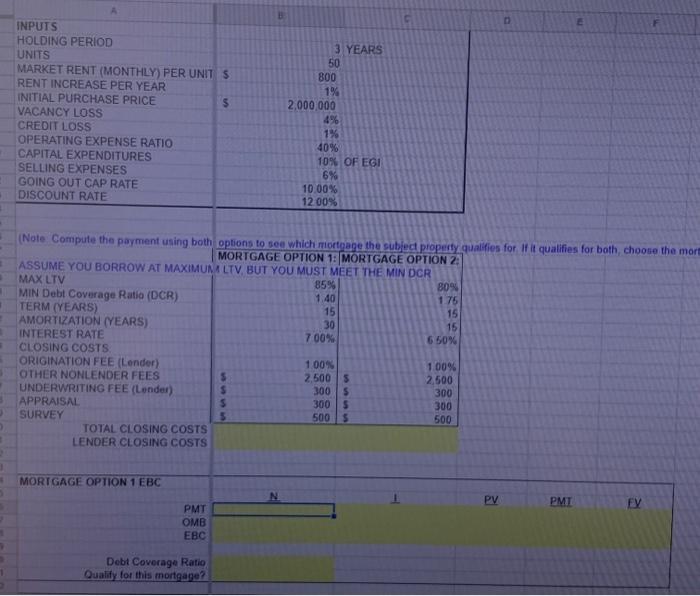

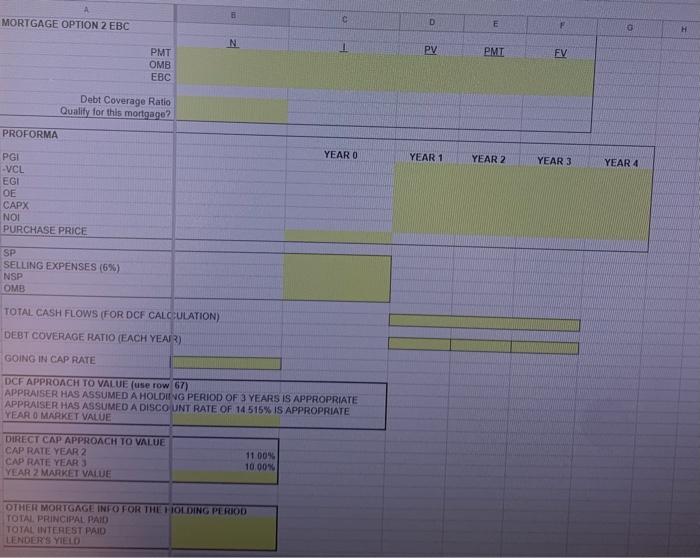

INPUTS HOLDING PERIOD UNITS MARKET RENT (MONTHLY) PER UNITS RENT INCREASE PER YEAR INITIAL PURCHASE PRICE VACANCY LOSS CREDIT LOSS OPERATING EXPENSE RATIO CAPITAL EXPENDITURES SELLING EXPENSES GOING OUT CAP RATE DISCOUNT RATE 3 YEARS 50 800 1% 2,000 000 4% 1% 40% 10% OF EGI 6% 10.00% 12.00% (Nole Compute the payment using both options to see which mortgage the subject property qualifies for If it qualifies for both, choose the mort MORTGAGE OPTION 1: MORTGAGE OPTION 2: ASSUME YOU BORROW AT MAXIMUMA LTV BUT YOU MUST MEET THE MIN DCR MAX LTV 85% 80% MIN Debt Coverage Ratio (DCR) 1.40 1.76 TERM (YEARS) 15 15 AMORTIZATION YEARS) 30 15 INTEREST RATE 700% 6 50% CLOSING COSTS ORIGINATION FEE (Lender) 100% 100% OTHER NONLENDER FEES 2.500 2,500 UNDERWRITING FEE (Lender) 300 5 300 APPRAISAL $ 3005 SURVEY 5 500 5 500 TOTAL CLOSING COSTS LENDER CLOSING COSTS 300 MORTGAGE OPTION 1 EBC PV PMI EV PMT OMB EBC Debt Coverage Ratio Qualify for this mortgage? MORTGAGE OPTION 2 EBC C D E F G H NA 1 PV PMT FV PMT OMB EBC Debt Coverage Ratio Quality for this mortgage? PROFORMA YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 PGI -VCL EGI OE CAPX NOI PURCHASE PRICE SP SELLING EXPENSES (6%) NSP OMB TOTAL CASH FLOWS (FOR DCF CALCULATION) DEBT COVERAGE RATIO (EACH YEAR) GOING IN CAP RATE DCF APPROACH TO VALUE (use row 67) APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14 515% IS APPROPRIATE YEAR O MARKET VALUE DIRECT CAP APPROACH TO VALUE CAP RATE YEAR 2 CAP RATE YEAR 3 YEAR 2 MARKET VALUE 11 00 10.00% OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD INPUTS HOLDING PERIOD UNITS MARKET RENT (MONTHLY) PER UNITS RENT INCREASE PER YEAR INITIAL PURCHASE PRICE VACANCY LOSS CREDIT LOSS OPERATING EXPENSE RATIO CAPITAL EXPENDITURES SELLING EXPENSES GOING OUT CAP RATE DISCOUNT RATE 3 YEARS 50 800 1% 2,000 000 4% 1% 40% 10% OF EGI 6% 10.00% 12.00% (Nole Compute the payment using both options to see which mortgage the subject property qualifies for If it qualifies for both, choose the mort MORTGAGE OPTION 1: MORTGAGE OPTION 2: ASSUME YOU BORROW AT MAXIMUMA LTV BUT YOU MUST MEET THE MIN DCR MAX LTV 85% 80% MIN Debt Coverage Ratio (DCR) 1.40 1.76 TERM (YEARS) 15 15 AMORTIZATION YEARS) 30 15 INTEREST RATE 700% 6 50% CLOSING COSTS ORIGINATION FEE (Lender) 100% 100% OTHER NONLENDER FEES 2.500 2,500 UNDERWRITING FEE (Lender) 300 5 300 APPRAISAL $ 3005 SURVEY 5 500 5 500 TOTAL CLOSING COSTS LENDER CLOSING COSTS 300 MORTGAGE OPTION 1 EBC PV PMI EV PMT OMB EBC Debt Coverage Ratio Qualify for this mortgage? MORTGAGE OPTION 2 EBC C D E F G H NA 1 PV PMT FV PMT OMB EBC Debt Coverage Ratio Quality for this mortgage? PROFORMA YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 PGI -VCL EGI OE CAPX NOI PURCHASE PRICE SP SELLING EXPENSES (6%) NSP OMB TOTAL CASH FLOWS (FOR DCF CALCULATION) DEBT COVERAGE RATIO (EACH YEAR) GOING IN CAP RATE DCF APPROACH TO VALUE (use row 67) APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14 515% IS APPROPRIATE YEAR O MARKET VALUE DIRECT CAP APPROACH TO VALUE CAP RATE YEAR 2 CAP RATE YEAR 3 YEAR 2 MARKET VALUE 11 00 10.00% OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD