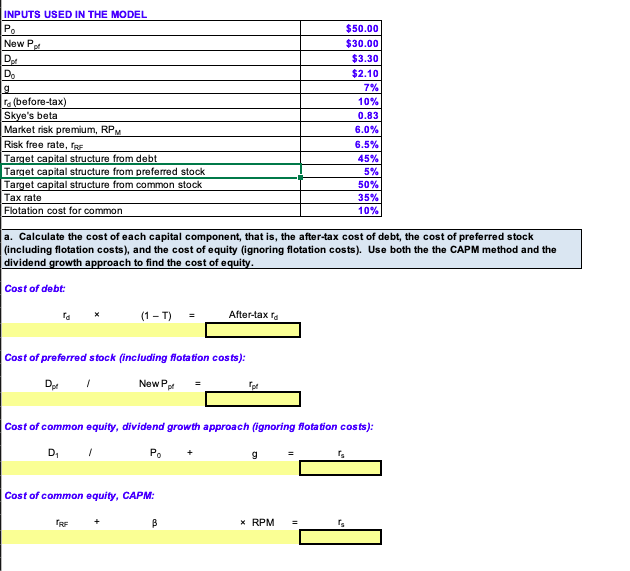

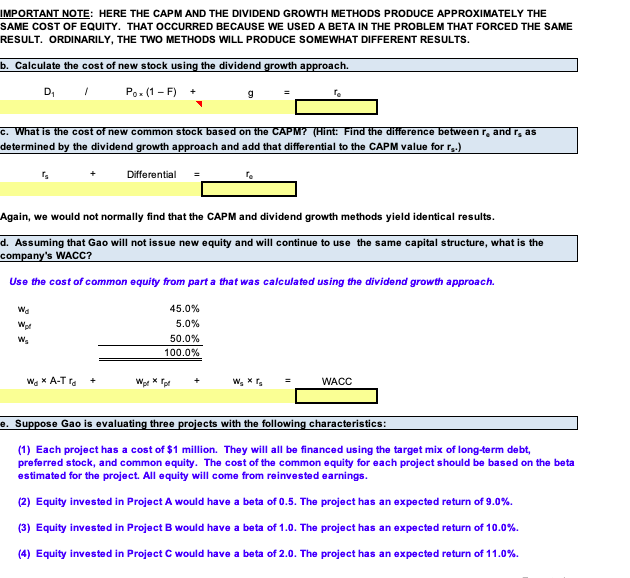

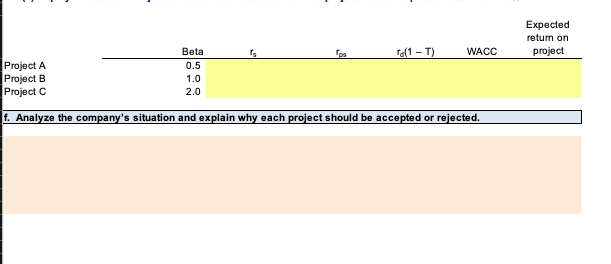

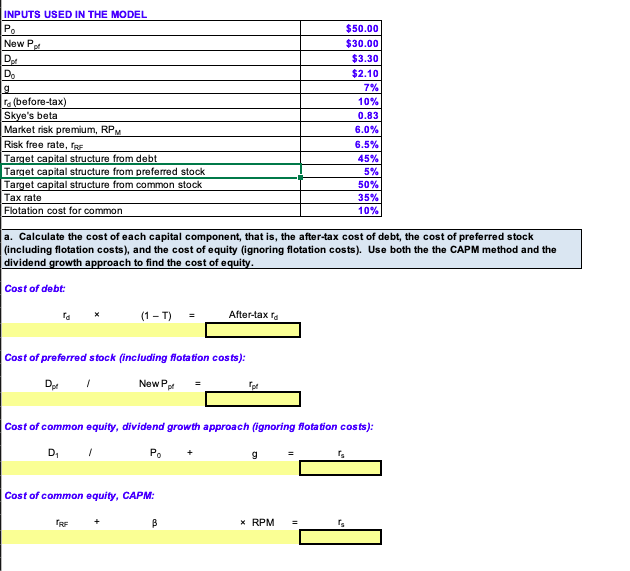

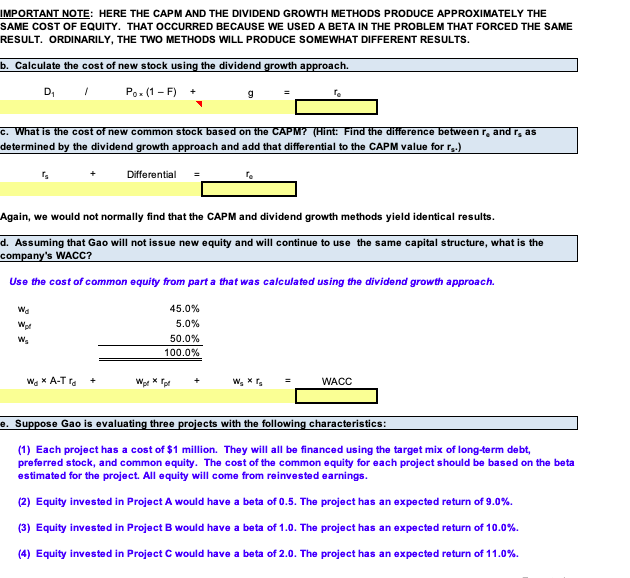

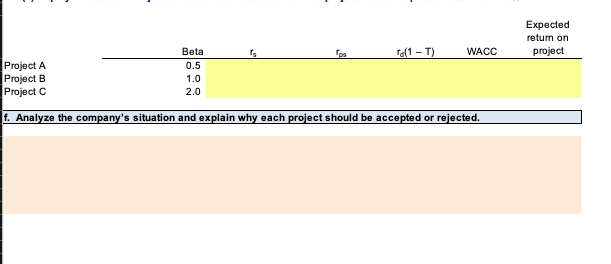

INPUTS USED IN THE MODEL $50.00 Po New Pet $30.00 Dgt $3.30 $2.10 Do 7% g ra (before-tax) Skye's beta Market risk premium, RPM 10% 0.83 6.0% Risk free rate, rRE 6.5% Target capital structure from debt Target capital structure from preferred stock Target capital structure from common stock 45% 5% 50% 35% Tax rate Flotation cost for common 10% a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). Use both the the CAPM method and the dividend growth approach to find the cost of equity. Cost of debt After-tax r (1 T) x Cost of preferred stock (including flotation costs): Dgt New Pf Cost of common equity, dividend growth approach (ignoring flotation costs) Po D1 r. g Cost of common equity, CAPM RE x RPM IMPORTANT NOTE: HERE THE CAPM AND THE DIVIDEND GROWTH METHODS PRODUCE APPROXIMATELY THE SAME COST OF EQUITY. THAT OCCURRED BECAUSE WE USED A BETA IN THE PROBLEM THAT FORCED THE SAME RESULT. ORDINARILY, THE TWO METHODS WILL PRODUCE SOMEWHAT DIFFERENT RESULTS b. Calculate the cost of new stock using the dividend growth approach. Po (1 F) D + c. What is the cost of new common stock based on the CAPM? (Hint: Find the difiference between r and r as determined by the dividend growth approach and add that differential to the CAPM value for r.) Differential Again, we would not normally find that the CAPM and dividend growth methods yield identical results d. Assuming that Gao will not issue company's WACC? new equity and will continue to use the same capital structure, what is the Use the cost of common equity from parta that was calculated using the dividend growth approach. 45.0% Wa 5.0% Wpt 50.0 % 100.0% wg A-T r WACC Wor ro Wr e. Suppose Gao is evaluating three projects with the following characteristics (1) Each project has a cost of $1 million. They will all be financed us ing the target mix of long-term debt, preferred stock, and common equity. The cost of the common equity for each project should be based on the beta estimated for the project. All equity will come from reinvested earnings (2) Equity invested in Project A would have a beta of 0.5. The project has an expected return of 9.0% (3) Equity invested in Project B would have a beta of 1.0. The project has an expected return of 10.0% (4) Equity invested in Project C would have a beta of 2.0. The project has an expected return of 1 1 .0% Expected retun on project Beta ra(1 T) WACC fos Project A Project B Project C 0.5 1.0 2.0 |f. Analyze the company's situation and explain why each project should be accepted or rejected