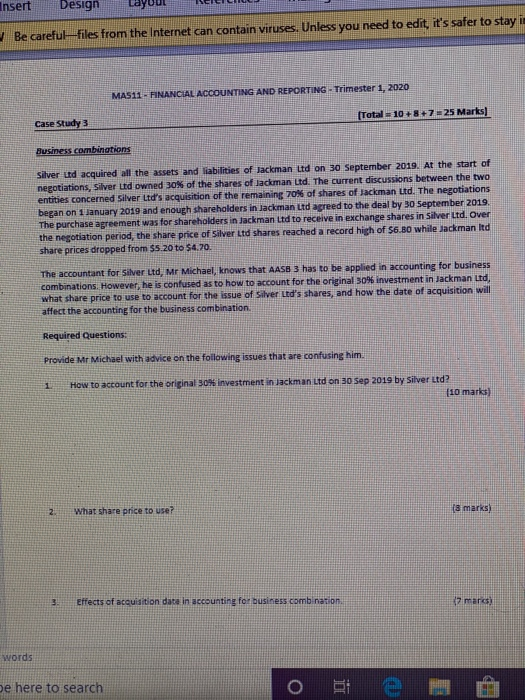

Insert Design Layo Be careful files from the Internet can contain viruses. Unless you need to edit, it's safer to stay i MAS11- FINANCIAL ACCOUNTING AND REPORTING - Trimester 1, 2020 (Total = 10 +8+7= 25 Marks Case Study 3 Business combinations Silver ud acquired all the assets and liabilities of Jackman Ltd on 30 September 2019. At the start of negotiations, Silver Ltd owned 30% of the shares of Jackman Ltd. The current discussions between the two entities concerned Silver Ltd's acquisition of the remaining 70% of shares of Jackman Ltd. The negotiations began on 1 January 2019 and enough shareholders in Jackman Utd agreed to the deal by 30 September 2019 The purchase agreement was for shareholders in Jackman Ltd to receive in exchange shares in Silver Ltd. Over the negotiation period, the share price of Silver Ltd shares reached a record high of $6.00 while Jackman Itd share prices dropped from $5.20 to $4.70. The accountant for Silver Ltd, Mr Michael, knows that AASB 3 has to be applied in accounting for business combinations. However, he is confused as to how to account for the original 30% investment in Jackman Ltd, what share price to use to account for the issue of Silver Ltd's shares, and how the date of acquisition will affect the accounting for the business combination Required Questions: Provide Mr Michael with advice on the following issues that are confusing him. 1 How to account for the original 30% Investment in Jackman Ltd on 30 sep 2019 by Silver Ltd? (10 marks) 2 What share price to use? (a marks) 3 Effects of acquisition date in accounting for business combination mar words be here to search ose Insert Design Layo Be careful files from the Internet can contain viruses. Unless you need to edit, it's safer to stay i MAS11- FINANCIAL ACCOUNTING AND REPORTING - Trimester 1, 2020 (Total = 10 +8+7= 25 Marks Case Study 3 Business combinations Silver ud acquired all the assets and liabilities of Jackman Ltd on 30 September 2019. At the start of negotiations, Silver Ltd owned 30% of the shares of Jackman Ltd. The current discussions between the two entities concerned Silver Ltd's acquisition of the remaining 70% of shares of Jackman Ltd. The negotiations began on 1 January 2019 and enough shareholders in Jackman Utd agreed to the deal by 30 September 2019 The purchase agreement was for shareholders in Jackman Ltd to receive in exchange shares in Silver Ltd. Over the negotiation period, the share price of Silver Ltd shares reached a record high of $6.00 while Jackman Itd share prices dropped from $5.20 to $4.70. The accountant for Silver Ltd, Mr Michael, knows that AASB 3 has to be applied in accounting for business combinations. However, he is confused as to how to account for the original 30% investment in Jackman Ltd, what share price to use to account for the issue of Silver Ltd's shares, and how the date of acquisition will affect the accounting for the business combination Required Questions: Provide Mr Michael with advice on the following issues that are confusing him. 1 How to account for the original 30% Investment in Jackman Ltd on 30 sep 2019 by Silver Ltd? (10 marks) 2 What share price to use? (a marks) 3 Effects of acquisition date in accounting for business combination mar words be here to search ose