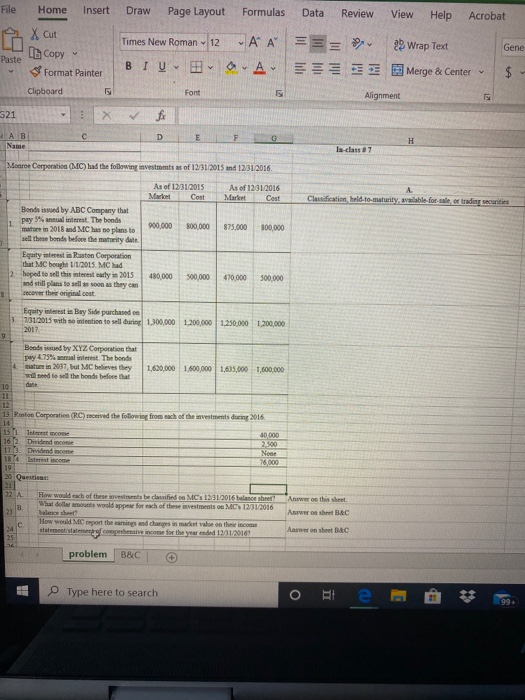

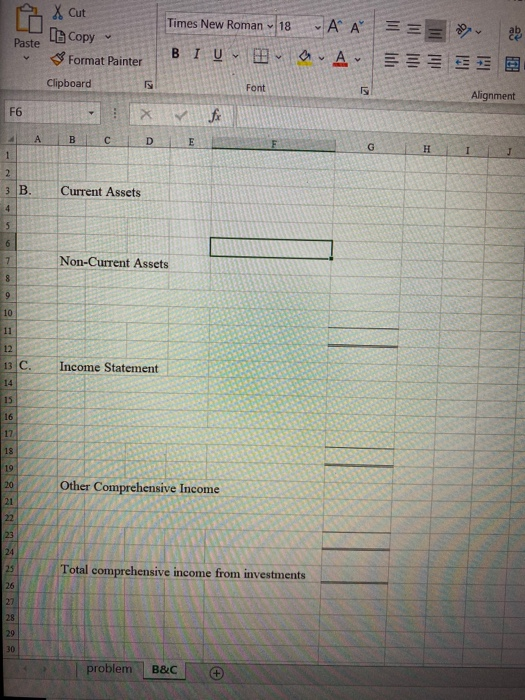

Insert Draw Page Layout Formulas Data Review View File Home AX Cut Help Acrobat = = = Gene Paste Copy Times New Roman BIU H 12 O A A A 2 Wrap Text Merge & Center Format Painter Clipboard Font Alignment 321 E Name Is-class 37 Monroe Corporation (MC) had the following investments as of 12/31/2015 and 12/01/2016 As of 12/31/2015 Maret Cost As of 12:31.2016 Market Cost Bonds issued by ABC Company that pay 3% annual rest. The bonds mature in 2018 and MC has no plans to sell these bonds before the maturity dat 900,000 300,000 875,000 300,000 Equity interest in Ruston Corporation that MC bought 1/1/2015. MC had hoped to sell this interest early in 2015 and still plans to w as soon as they can SDC the oricing at 480.000 500000 470.000 500.000 Equity Instis Bary Side purchased on 3.731/2015 with so intention to sell during 1,300,000 1.200.000 1.250.000 1.200,000 Bende inued by XYZ Corporation that pay 4.75% interest. The bonds cute in 2017, but MC believes they ed to the bonds before that 1,620.000 1.600.000 1,635,000 1,800,000 13 Ruston Corporation CRC) received the following from each of the investments during 2016 16 2. Dividend How would each of these investments be classified on MCs 1231/2016 balance sheet What dotter mots would appear for each of these investments on MC's 12/31/2016 balance sheet How MC report the a g and changes in market value on the income statements comprehensive income for the year 12/11/2016) Answer on this sheet. Answer on sheet B&C Awon sheetc problem B& C Type here to search o & Cut Copy Times New Roman 18 A A BIU - CA a Paste be $ Format Painter Clipboard Font Alignment F6 - 4 GHI 3 B. Current Assets Non-Current Assets . 13 C. Income Statement Other Comprehensive Income Total comprehensive income from investments problem B&C Insert Draw Page Layout Formulas Data Review View File Home AX Cut Help Acrobat = = = Gene Paste Copy Times New Roman BIU H 12 O A A A 2 Wrap Text Merge & Center Format Painter Clipboard Font Alignment 321 E Name Is-class 37 Monroe Corporation (MC) had the following investments as of 12/31/2015 and 12/01/2016 As of 12/31/2015 Maret Cost As of 12:31.2016 Market Cost Bonds issued by ABC Company that pay 3% annual rest. The bonds mature in 2018 and MC has no plans to sell these bonds before the maturity dat 900,000 300,000 875,000 300,000 Equity interest in Ruston Corporation that MC bought 1/1/2015. MC had hoped to sell this interest early in 2015 and still plans to w as soon as they can SDC the oricing at 480.000 500000 470.000 500.000 Equity Instis Bary Side purchased on 3.731/2015 with so intention to sell during 1,300,000 1.200.000 1.250.000 1.200,000 Bende inued by XYZ Corporation that pay 4.75% interest. The bonds cute in 2017, but MC believes they ed to the bonds before that 1,620.000 1.600.000 1,635,000 1,800,000 13 Ruston Corporation CRC) received the following from each of the investments during 2016 16 2. Dividend How would each of these investments be classified on MCs 1231/2016 balance sheet What dotter mots would appear for each of these investments on MC's 12/31/2016 balance sheet How MC report the a g and changes in market value on the income statements comprehensive income for the year 12/11/2016) Answer on this sheet. Answer on sheet B&C Awon sheetc problem B& C Type here to search o & Cut Copy Times New Roman 18 A A BIU - CA a Paste be $ Format Painter Clipboard Font Alignment F6 - 4 GHI 3 B. Current Assets Non-Current Assets . 13 C. Income Statement Other Comprehensive Income Total comprehensive income from investments problem B&C