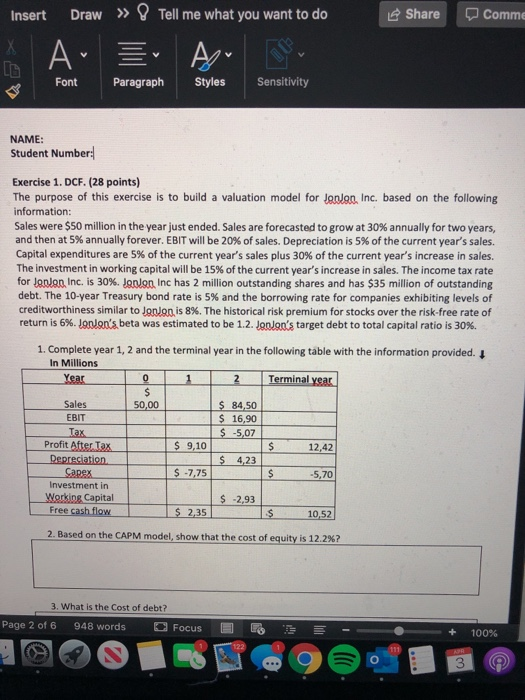

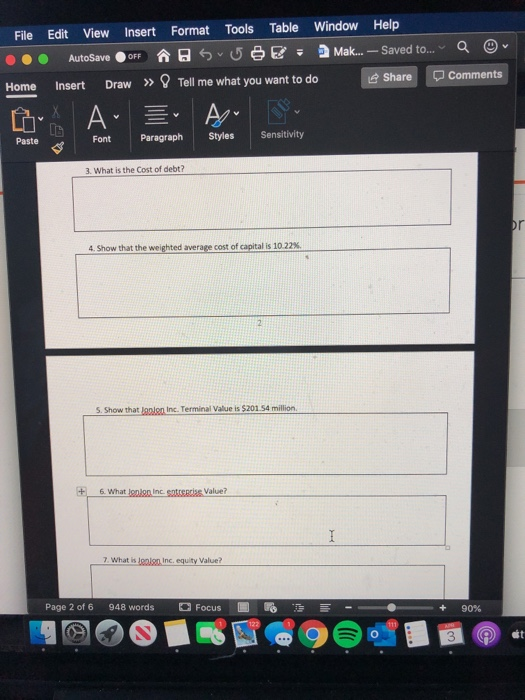

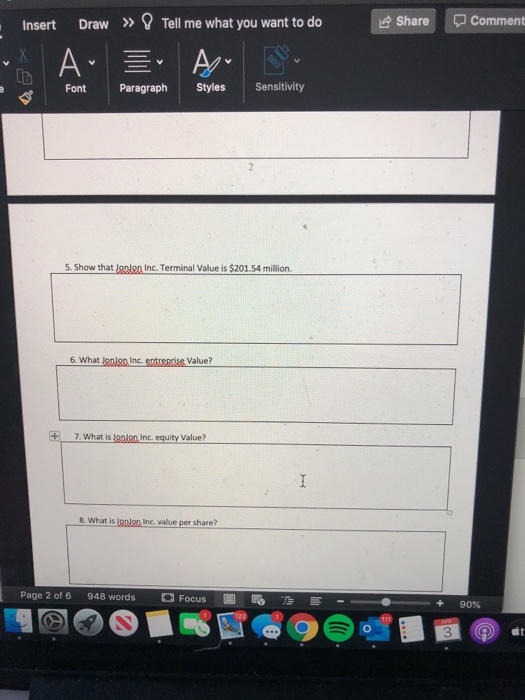

Insert Draw Tell me what you want to do Share Comme X A. Aguay Font P aragraph Styles Sensitivity NAME: Student Number: Exercise 1. DCF. (28 points) The purpose of this exercise is to build a valuation model for Jandan, Inc. based on the following information: Sales were $50 million in the year just ended. Sales are forecasted to grow at 30% annually for two years, and then at 5% annually forever. EBIT will be 20% of sales. Depreciation is 5% of the current year's sales. Capital expenditures are 5% of the current year's sales plus 30% of the current year's increase in sales. The investment in working capital will be 15% of the current year's increase in sales. The income tax rate for lonjon Inc. is 30%. Jgnon Inc has 2 million outstanding shares and has $35 million of outstanding debt. The 10-year Treasury bond rate is 5% and the borrowing rate for companies exhibiting levels of creditworthiness similar to Jonon is 8%. The historical risk premium for stocks over the risk-free rate of return is 6%. Jondon's beta was estimated to be 1.2. JoJon's target debt to total capital ratio is 30%. 1. Complete year 1, 2 and the terminal year in the following table with the information provided. In Millions Year 0 1 2 Terminal year 50,00 $ 84,50 $ 16,90 $ -5,07 $ 9,10 $ 12.42 Sales EBIT Tex Profit After Tax Depreciation Capex Investment in Working Capital Free cash flow $ 4,23 $ -7,75 $ -5,70 $ -2,93 $ 2,35 $ 10,52 2. Based on the CAPM model, show that the cost of equity is 12.2%? 3. What is the Cost of debt? Page 2 of 6 948 words Focus w a Oy Comments File Edit View Insert Format Tools Table Window Help AutoSave OFF $ 0 OE Mak... - Saved to... Home Insert Draw Tell me what you want to do A Font Paragraph Styles Sensitivity ' Paste 3. What is the cost of debt? Dr 4. Show that the weighted average cost of capital is 10.22% 5. Show that lonen Inc. Terminal value is $201.54 million + 6. What Jonion Inc. sptreprise Value? 7. What is Ionton Inc, equity Value? Page 2 of 6 948 words Focus 16 - + 90% Insert Draw Tell me what you want to do Share Comment XA. AS Font Paragraph Styles Sensitivity 5. Show that Joolon Inc. Terminal Value is $201.54 million 6. What Jonion Inc. entreprise Value? - 7. What is Jonjon Inc, equity Value? 8. What is Jonion Inc. value per share? Page 2 of 6 948 words C Focus 18 - + 90%