Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Insert Format Tools Add-ons Help Last edit was made 6 minutes ago by Tony Gonzalez 100% Noring text Arial 11 BIU A CD 13 E

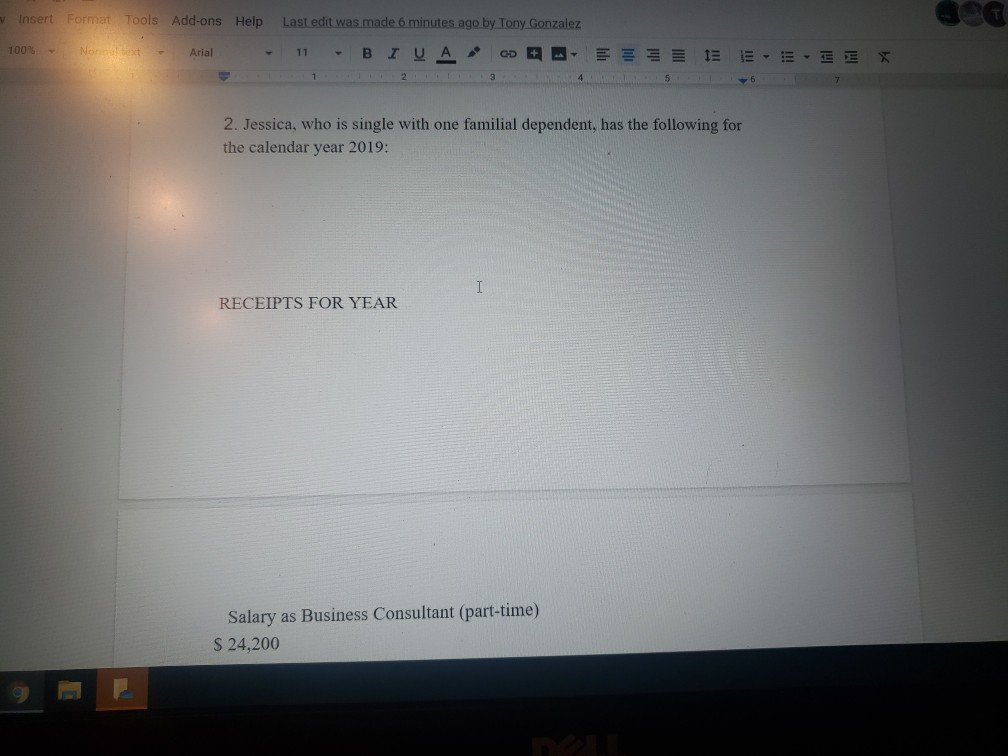

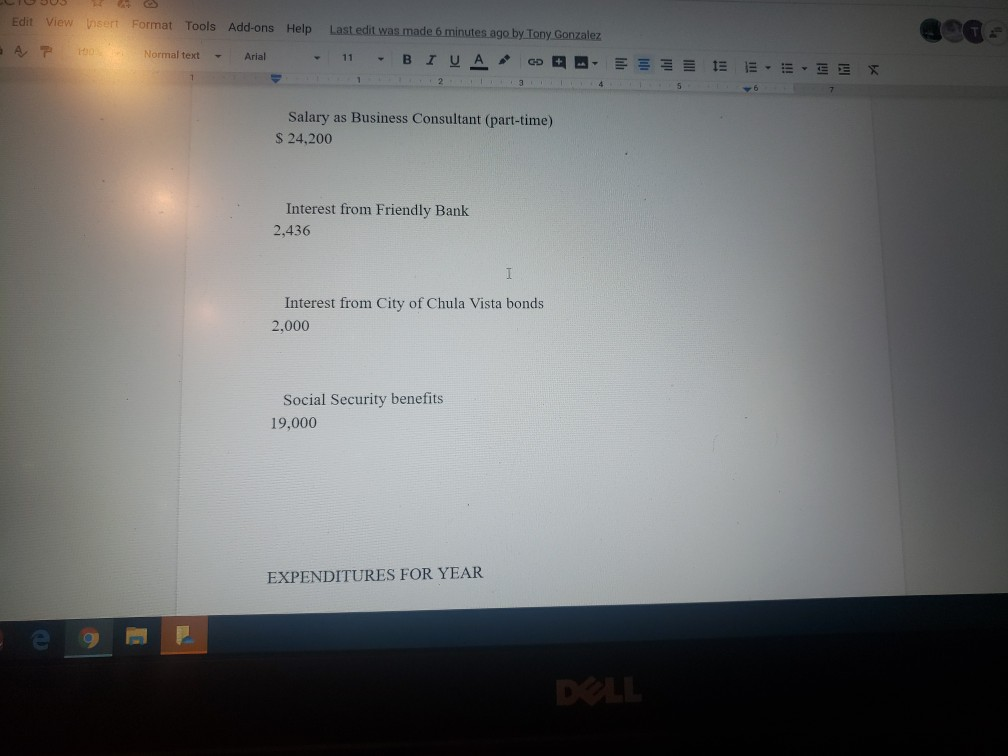

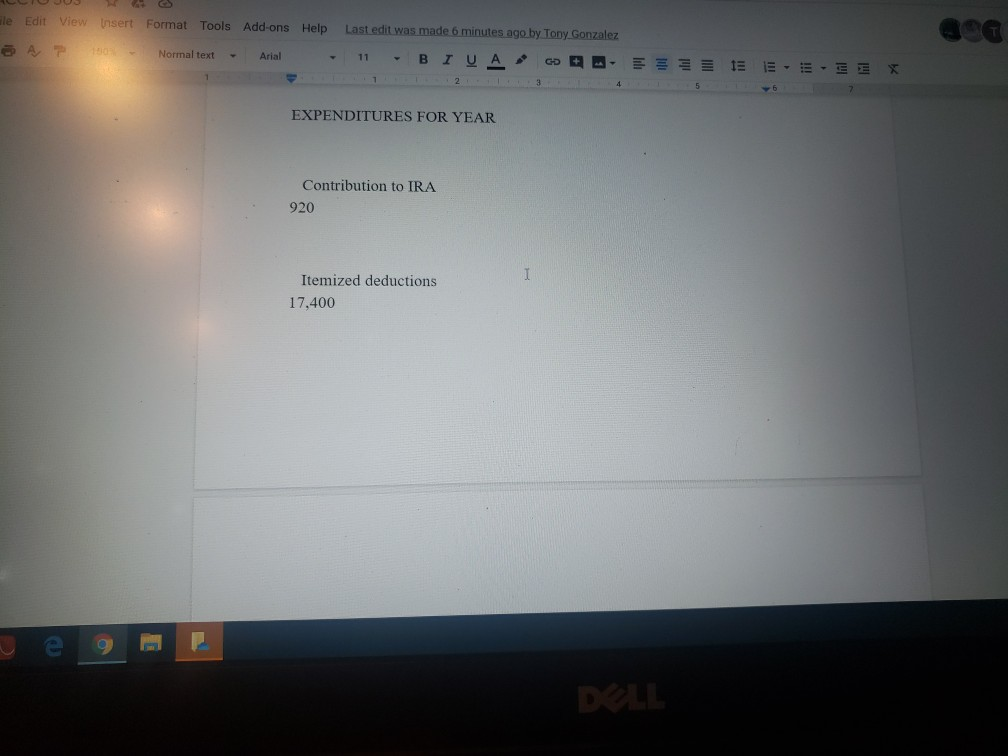

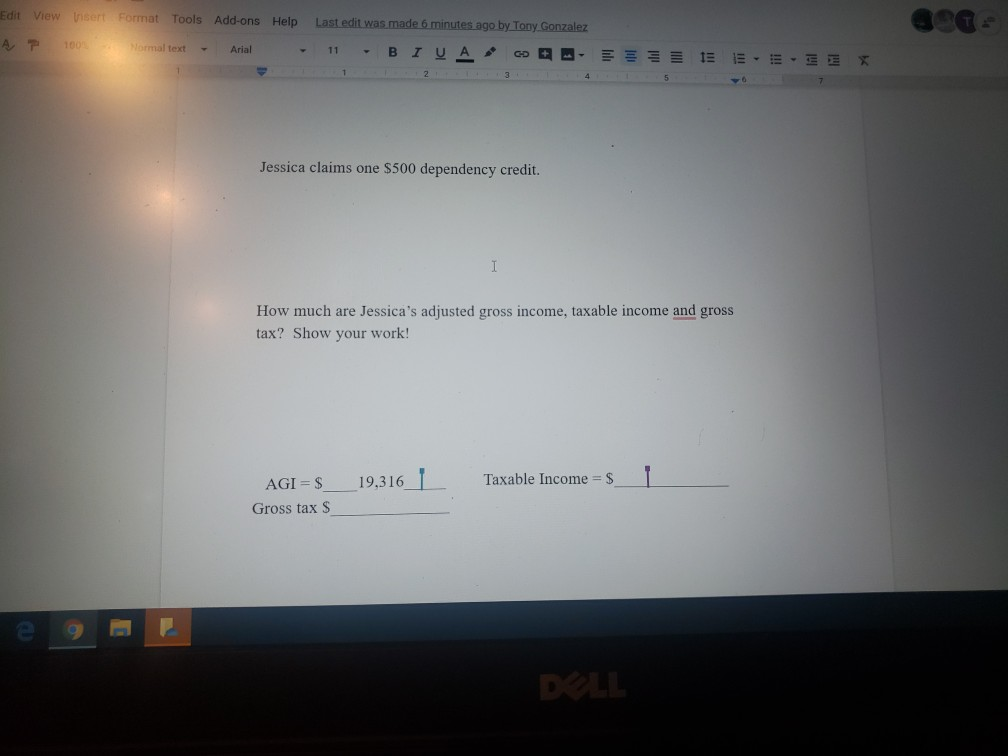

Insert Format Tools Add-ons Help Last edit was made 6 minutes ago by Tony Gonzalez 100% Noring text Arial 11 BIU A CD 13 E - E-EEX 2. Jessica, who is single with one familial dependent, has the following for the calendar year 2019: I RECEIPTS FOR YEAR Salary as Business Consultant (part-time) S 24,200 Edit View Insert Format Tools Add-ons Help Last edit was made 6 minutes ago by Tony Gonzalez I P Normal text Arial 11 B I U CD 1 E - E- Salary as Business Consultant (part-time) $ 24,200 Interest from Friendly Bank 2,436 Interest from City of Chula Vista bonds 2.000 Social Security benefits 19,000 EXPENDITURES FOR YEAR DLL ile Edit View insert Format Tools Add-ons Help Last edit was made 6 minutes ago by Tony Gonzalez Normal text Arial 11 E 13 15 - - 3 EXPENDITURES FOR YEAR Contribution to IRA 920 I Itemized deductions 17,400 DLL Edit View insert Format Tools Add-ons Help Last edit was made 6 minutes ago by Tony Gonzalez 100 - Normal text Arial 11 ' EEE 13 EE-EE Jessica claims one $500 dependency credit. I How much are Jessica's adjusted gross income, taxable income and gross tax? Show your work! 19,316 | Taxable Income = $ AGI = $ Gross tax S DLL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started