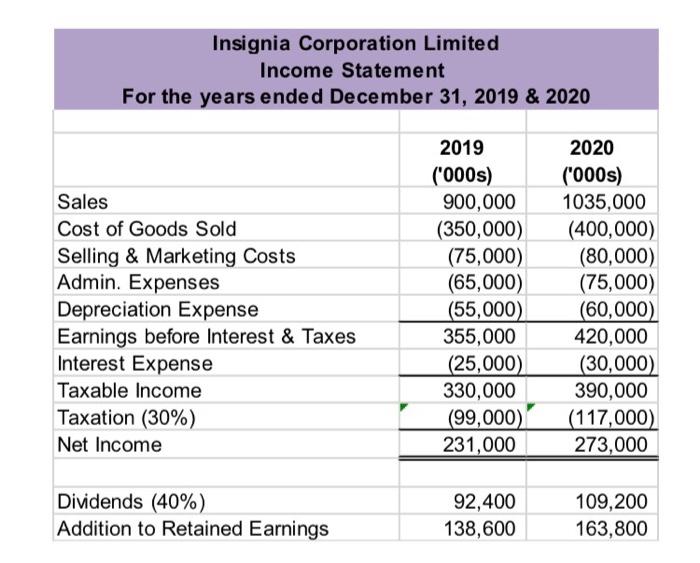

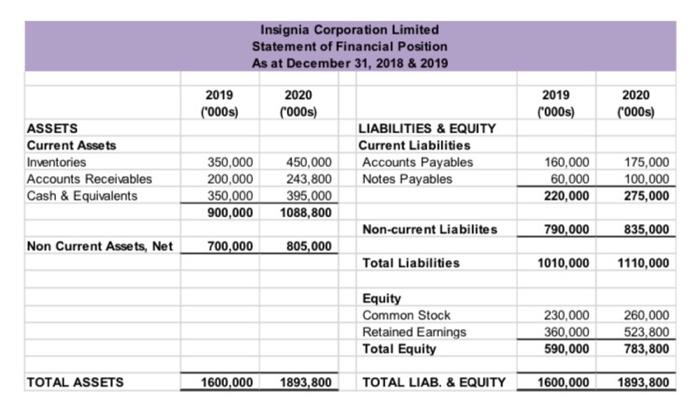

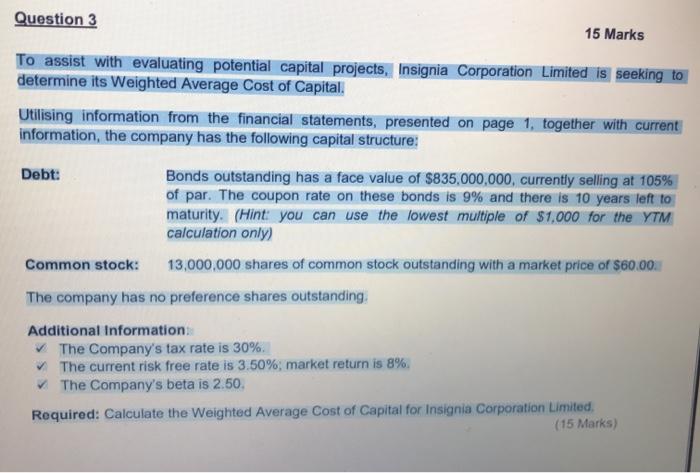

Insignia Corporation Limited Income Statement For the years ended December 31, 2019 & 2020 Sales Cost of Goods Sold Selling & Marketing Costs Admin. Expenses Depreciation Expense Earnings before Interest & Taxes Interest Expense Taxable income Taxation (30%) Net Income 2019 ('000s) 900,000 (350,000) (75,000) (65,000) (55,000) 355,000 (25,000) 330,000 (99,000) 231,000 2020 ('000) 1035,000 (400,000) (80,000) (75,000) (60,000) 420,000 (30,000) 390,000 (117,000) 273,000 Dividends (40%) Addition to Retained Earnings 92,400 138,600 109,200 163,800 2019 ('000s) 2020 (000s) ASSETS Current Assets Inventories Accounts Receivables Cash & Equivalents Insignia Corporation Limited Statement of Financial Position As at December 31, 2018 & 2019 2019 2020 ('000) ('000) LIABILITIES & EQUITY Current Liabilities 350,000 450,000 Accounts Payables 200,000 243,800 Notes Payables 350,000 395,000 900,000 1088,800 Non-current Liabilites 700,000 805,000 Total Liabilities 160,000 60,000 220,000 175,000 100,000 275,000 790,000 835,000 Non Current Assets, Net 1010,000 1110,000 Equity Common Stock Retained Earnings Total Equity 230,000 360,000 590,000 260,000 523,800 783,800 TOTAL ASSETS 1600,000 1893,800 TOTAL LIAB. & EQUITY 1600,000 1893,800 Question 3 15 Marks To assist with evaluating potential capital projects, Insignia Corporation Limited is seeking to determine its weighted Average Cost of Capital. Utilising information from the financial statements, presented on page 1, together with current information, the company has the following capital structure: Debt: Bonds outstanding has a face value of $835,000,000, currently selling at 105% of par. The coupon rate on these bonds is 9% and there is 10 years left to maturity. (Hint: you can use the lowest multiple of $1,000 for the YTM calculation only) Common stock: 13,000,000 shares of common stock outstanding with a market price of $60.00 The company has no preference shares outstanding Additional Information The Company's tax rate is 30%. The current risk free rate is 3.50%; market return is 8% The Company's beta is 2.50. Required: Calculate the Weighted Average Cost of Capital for Insignia Corporation Limited, (15 Marks)