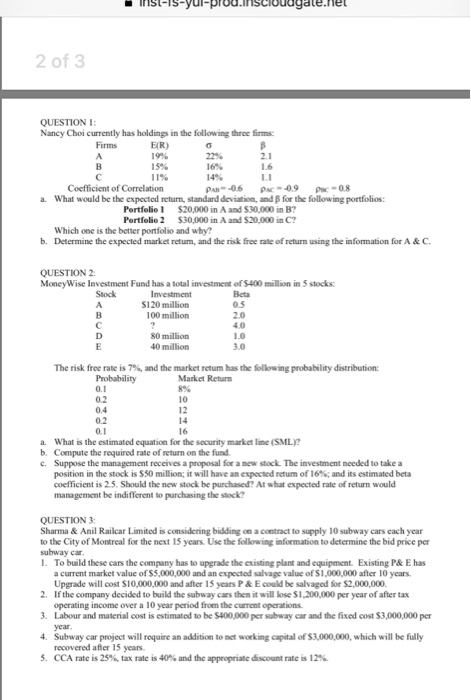

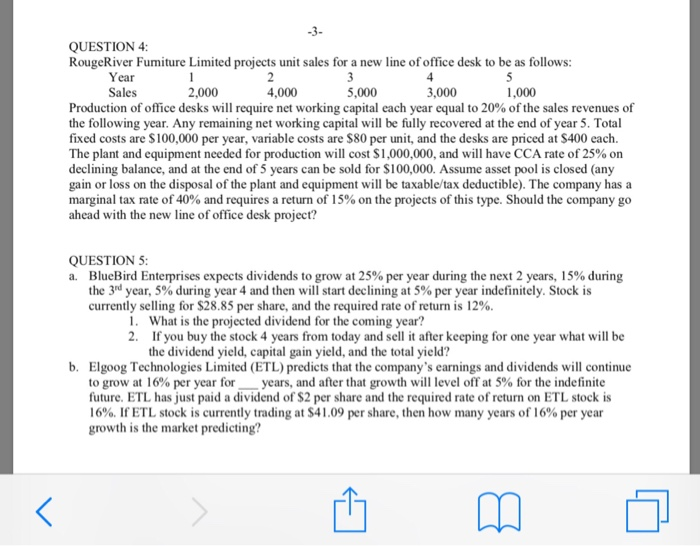

inSL-ls-yu-prod.inscioudgate.ne 2 of 3 QUESTION Nancy Choi currently has holdings E R) 19% 15% 11% in the following thrce firms 1.6 Coefficient of Correlation What would be the expected teturn, standard deviation, and fr the following portfolios: a. Portfelio $20,000 in A and $30,000 in B7 Pertfolio 2 $30,000 in A and $20,000 in C? Which one is the better portfolio and why? Determine the expected market retum, and the risk free rate of return using the information for A & C b. QUESTION 2 MoneyWise Investment Fund has a total investment of S400 million in 5 stocks: S120 million 100 million 0.5 2.0 4.0 1.0 3.0 80 million 40 million The risk free rate is 7%, and the market etum has the following probability distribution: 0.1 0.2 0.4 0.2 Market Return 10 14 16 a. What is the estimated equation for the security market line (SML? b. Compute the required rate of return on the fund c. Suppose the management receives a proposal for a new stock. The investment needed to take a position in the stock is S50 million; it will have an expected return of 16%; and its estimated beta coefficient is 2.5. Should the new stock be purchased? At what expected rate of return would management be indiffcrent to purchasing the stock? QUESTION 3 Sharma & Anil Railcar Limited is considering bidding on a contract to supply 10 subway cars each year to the City of Montreal for the next 15 years. Use the following information to determine the bid price per subway car 1. To build these cars the company has to upgrade the existing plant and equipment. Existing P& E has a current market value of $5,000,000 and an expected salvage value of $1,000,000 after 10 year. Upgrade will cost $10,000,000 and after 15 years P & E could be salvaged for $2,000,000. 2. If the company decided to build the subway cars then it will lose $1,200,000 per year of after tax 3. Labour and material cost is estimated to be $400,000 per subway car and the fixed cost $3,000,000 per 4. Subway car project will require an addition to nct working capital of $3,000,000, which will be fully 5. CCA rate is 25% tax rate is40% and thc apprepnatcscount rate is 12% operating income over a 10 year period from the current operations recovered after 15 years QUESTION 4: RougeRiver Fumiture Limited projects unit sales for a new line of office desk to be as follows: Year Sales 2,000 4,000 5,000 3,000 1,000 Production of office desks will require net working capital each year equal to 20% of the sales revenues of the following year. Any remaining net working capital will be fully recovered at the end of year 5. Total fixed costs are $100,000 per year, variable costs are $80 per unit, and the desks are priced at $400 each. The plant and equipment needed for production will cost $1,000,000, and will have CCA rate of 25% on declining balance, and at the end of 5 years can be sold for S100,000. Assume asset pool is closed (any gain or loss on the disposal of the plant and equipment will be taxable/tax deductible). The company has a marginal tax rate of 40% and requires a return of 15% on the projects of this type. Should the company go ahead with the new line of office desk project? QUESTION 5 a. BlueBird Enterprises expects dividends to grow at 25% per year during the next 2 years, 5% during the 3rd year, 5% during year 4 and then will start declining at 5% per year indefinitely. Stock is currently selling for $28.85 per share, and the required rate of return is 12%. 1. 2. What is the projected dividend for the coming year? If you buy the stock 4 years from today and sell it after keeping for one year what will be the dividend yield, capital gain yield, and the total yield? b. Elgoog Technologies Limited (ETL) predicts that the company's earnings and dividends will continue to grow at 16% per year for years, and after that growth will level off at 5% for the indefinite future. ETL has just paid a dividend of $2 per share and the required rate of return on ETL stock is 16%. If ETL stock is currently trading at $41.09 per share, then how many years of 16% per year growth is the market predicting