Answered step by step

Verified Expert Solution

Question

1 Approved Answer

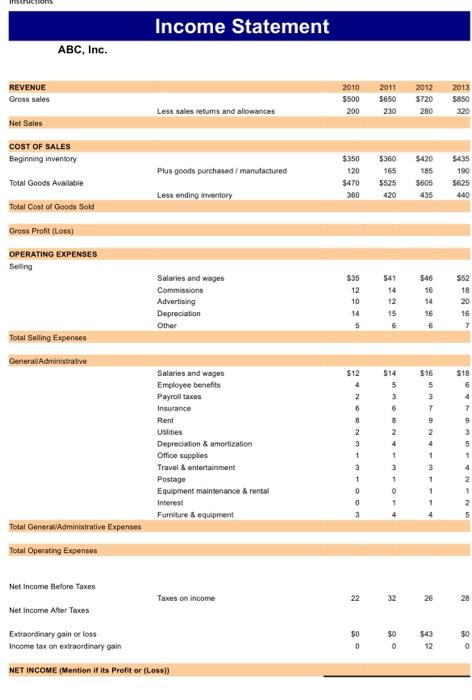

Inst REVENUE Gross sales Net Sales ABC, Inc. COST OF SALES Beginning inventory Total Goods Available Total Cost of Goods Sold Gross Profit (Loss) OPERATING

Inst REVENUE Gross sales Net Sales ABC, Inc. COST OF SALES Beginning inventory Total Goods Available Total Cost of Goods Sold Gross Profit (Loss) OPERATING EXPENSES Selling Total Selling Expenses General/Administrative Total General/Administrative Expenses Total Operating Expenses Net Income Before Taxes Net Income After Taxes Extraordinary gain or loss Income tax on extraordinary gain Income Statement Less sales returns and allowances Plus goods purchased / manufactured Less ending inventory Salaries and wages Commissions Advertising Depreciation Other Salaries and wages Employee benefits Payroll taxes Insurance Rent Utilities Depreciation & amortization Office supplies Travel & entertainment Postage Equipment maintenance & rental Interest Furniture & equipment Taxes on income NET INCOME (Mention if its Profit or (Loss)) 2010 $500 200 $350 120 $470 360 $35 12 10 14 5 $12 wo w - w N 00 ON AN 6 22 $0 0 2011 $650 230 $360 165 $525 420 $41 14 12 15 6 $14 5 w o 3 6 8 2 4 1 3 1 0 1 32 $0 0 2012 $720 280 $420 185 $605 435 $46 16 14 16 6 $16 537924 1 3 1 1 1 4 26 $43 12 2013 $850 320 $435 190 $625 440 $52 18 20 16 7 $18 6 4 7 9 3 5 1 4 2 1 2 5 28 $0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started