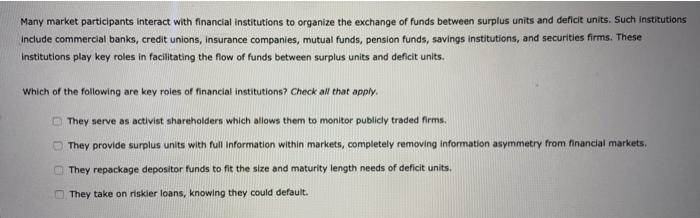

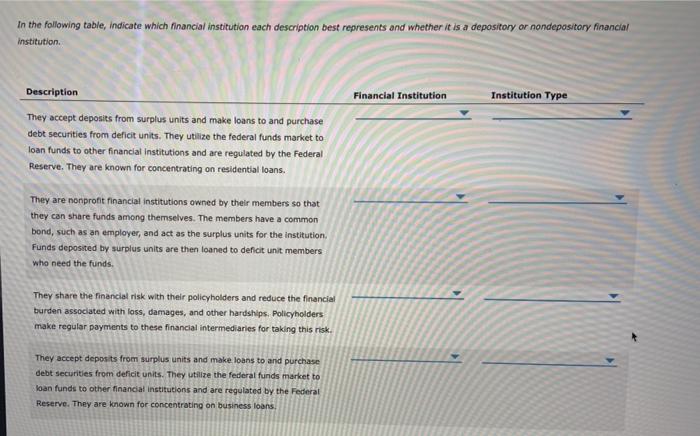

Many market participants interact with financial institutions to organize the exchange of funds between surplus units and deficit units. Such Institutions Include commercial banks, credit unions, insurance companies, mutual funds, pension funds, savings institutions, and securities firms. These Institutions play key roles in facilitating the flow of funds between surplus units and deficit units. Which of the following are key roles of financial institutions? Check all that apply. They serve as activist shareholders which allows them to monitor publicly traded firms. They provide surplus units with full information within markets, completely removing information asymmetry from financial markets. They repackage depositor funds to fit the size and maturity length needs of deficit units. They take on riskier loans, knowing they could default. In the following table, indicate which financial institution each description best represents and whether it is a depository or nondepository financial institution Description Financial Institution Institution Type They accept deposits from surplus units and make loans to and purchase debt securities from deficit units. They utilize the federal funds market to loan funds to other financial institutions and are regulated by the Federal Reserve. They are known for concentrating on residential loans. They are nonprofit financial institutions owned by their members so that they can share funds among themselves. The members have a common bond, such as an employer, and act as the surplus units for the institution Funds deposited by surplus units are then loaned to deficit unit members who need the funds. They share the financial risk with their policyholders and reduce the financial burden associated with loss, damages, and other hardships. Policyholders make regular payments to these financial intermediaries for taking this risk. They accept deposits from surplus units and make loans to and purchase debt securities from deficit units. They utilize the federal funds market to loan funds to other financial institutions and are regulated by the Federal Reserve. They are known for concentrating on business loans Many market participants interact with financial institutions to organize the exchange of funds between surplus units and deficit units. Such Institutions Include commercial banks, credit unions, insurance companies, mutual funds, pension funds, savings institutions, and securities firms. These Institutions play key roles in facilitating the flow of funds between surplus units and deficit units. Which of the following are key roles of financial institutions? Check all that apply. They serve as activist shareholders which allows them to monitor publicly traded firms. They provide surplus units with full information within markets, completely removing information asymmetry from financial markets. They repackage depositor funds to fit the size and maturity length needs of deficit units. They take on riskier loans, knowing they could default. In the following table, indicate which financial institution each description best represents and whether it is a depository or nondepository financial institution Description Financial Institution Institution Type They accept deposits from surplus units and make loans to and purchase debt securities from deficit units. They utilize the federal funds market to loan funds to other financial institutions and are regulated by the Federal Reserve. They are known for concentrating on residential loans. They are nonprofit financial institutions owned by their members so that they can share funds among themselves. The members have a common bond, such as an employer, and act as the surplus units for the institution Funds deposited by surplus units are then loaned to deficit unit members who need the funds. They share the financial risk with their policyholders and reduce the financial burden associated with loss, damages, and other hardships. Policyholders make regular payments to these financial intermediaries for taking this risk. They accept deposits from surplus units and make loans to and purchase debt securities from deficit units. They utilize the federal funds market to loan funds to other financial institutions and are regulated by the Federal Reserve. They are known for concentrating on business loans