Question

Instead of contributing the inventory to Shadow upon formation, Alicia has also considered selling the inventory on the open market and just contributing $2,100,000 in

Instead of contributing the inventory to Shadow upon formation, Alicia has also considered selling the inventory on the open market and just contributing $2,100,000 in cash to Shadow in exchange for 300 shares (instead of contributing inventory).

Assume Alicia faces an ordinary tax rate of 35% and a long-term capital gains rate of 20%, and that any inventory gain in subject to ordinary tax rates while the sale of stock is eligible for capital treatment.

a) If Alicia instead sells the inventory, how much recognized and realized gain or loss would Alicia have on the sale of the inventory (assuming the FMV and basis listed in the facts), and what would be the nature of the gain or loss?

b) How much tax expense or benefit would Alicia incur on the sale of the inventory?

c) Assuming the original structure (with Alicia contributing inventory), if Alicia holds the Shadow stock for 1 year and sells it for $2,100,000, what is her total (or net) tax liability (i.e., combined tax expense and/or benefit from the initial formation, if any, and the subsequent sale of Shadow stock, if any)?

d) Ignoring the one-year time value of money, which structure results in a lower overall tax liability for Alicia? What is the key driver for this answer?

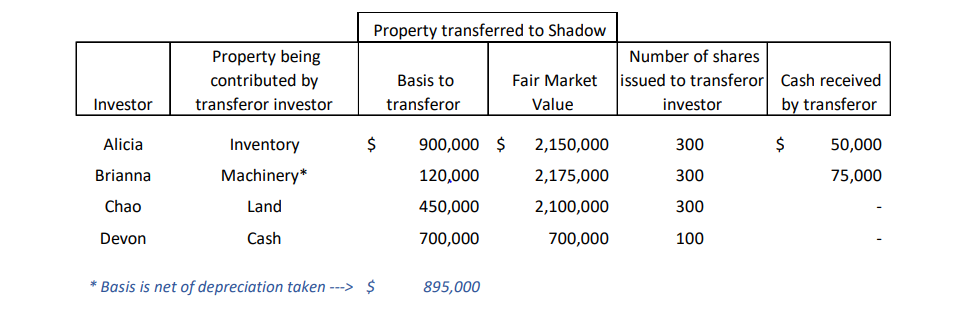

Property transferred to Shadow Property being contributed by transferor investor Basis to transferor Fair Market Value Number of shares issued to transferor Cash received investor by transferor Investor Alicia $ 900,000 $ 2,150,000 300 $ Inventory Machinery* 50,000 75,000 Brianna 120,000 300 2,175,000 2,100,000 Chao Land 450,000 300 Devon Cash 700,000 700,000 100 * Basis is net of depreciation taken ---> $ 895,000 Property transferred to Shadow Property being contributed by transferor investor Basis to transferor Fair Market Value Number of shares issued to transferor Cash received investor by transferor Investor Alicia $ 900,000 $ 2,150,000 300 $ Inventory Machinery* 50,000 75,000 Brianna 120,000 300 2,175,000 2,100,000 Chao Land 450,000 300 Devon Cash 700,000 700,000 100 * Basis is net of depreciation taken ---> $ 895,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started