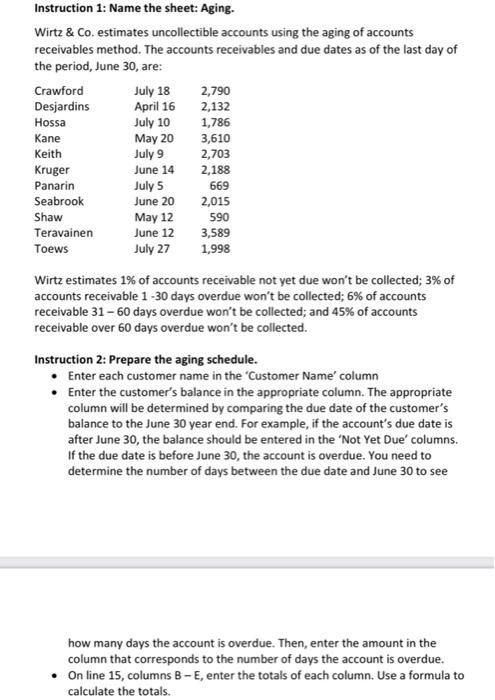

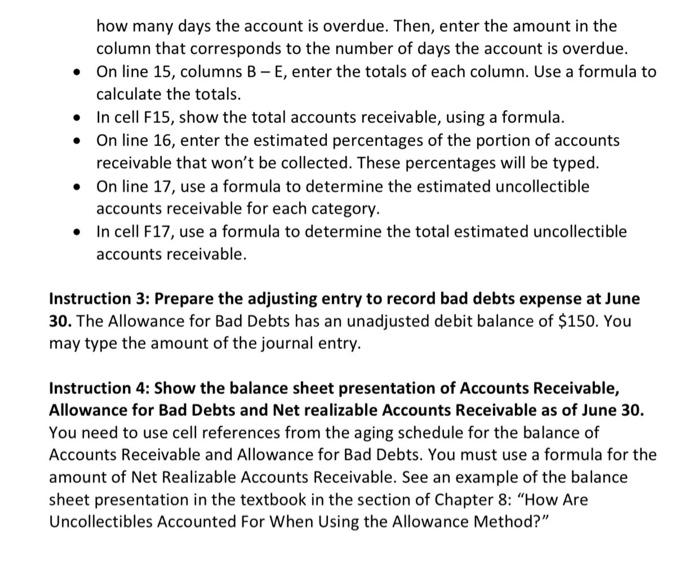

Instruction 1: Name the sheet: Aging. Wirtz & Co. estimates uncollectible accounts using the aging of accounts receivables method. The accounts receivables and due dates as of the last day of the period, June 30, are: Crawford July 18 2,790 Desjardins April 16 2,132 Hossa July 10 1,786 Kane May 20 3,610 Keith July 9 2,703 Kruger June 14 2,188 Panarin July 5 669 Seabrook June 20 2,015 Shaw May 12 590 Teravainen June 12 3,589 Toews July 27 1,998 Wirtz estimates 1% of accounts receivable not yet due won't be collected; 3% of accounts receivable 1 -30 days overdue won't be collected; 6% of accounts receivable 31 -60 days overdue won't be collected; and 45% of accounts receivable over 60 days overdue won't be collected. Instruction 2: Prepare the aging schedule. Enter each customer name in the Customer Name' column Enter the customer's balance in the appropriate column. The appropriate column will be determined by comparing the due date of the customer's balance to the June 30 year end. For example, if the account's due date is after June 30, the balance should be entered in the 'Not Yet Due' columns. If the due date is before June 30, the account is overdue. You need to determine the number of days between the due date and June 30 to see how many days the account is overdue. Then, enter the amount in the column that corresponds to the number of days the account is overdue. On line 15, columns B-E, enter the totals of each column. Use a formula to calculate the totals. how many days the account is overdue. Then, enter the amount in the column that corresponds to the number of days the account is overdue. On line 15, columns B - E, enter the totals of each column. Use a formula to calculate the totals. In cell F15, show the total accounts receivable, using a formula. On line 16, enter the estimated percentages of the portion of accounts receivable that won't be collected. These percentages will be typed. On line 17, use a formula to determine the estimated uncollectible accounts receivable for each category. In cell F17, use a formula to determine the total estimated uncollectible accounts receivable. Instruction 3: Prepare the adjusting entry to record bad debts expense at June 30. The Allowance for Bad Debts has an unadjusted debit balance of $150. You may type the amount of the journal entry. Instruction 4: Show the balance sheet presentation of Accounts Receivable, Allowance for Bad Debts and Net realizable Accounts Receivable as of June 30. You need to use cell references from the aging schedule for the balance of Accounts Receivable and Allowance for Bad Debts. You must use a formula for the amount of Net Realizable Accounts Receivable. See an example of the balance sheet presentation in the textbook in the section of Chapter 8: "How Are Uncollectibles Accounted For When Using the Allowance Method