Prepare a Form 1120 Corporate Tax Return for 2020. The following forms must be completed:

* Form 1120: U.S. Corporation Income Tax Return

* Schedule D (for Form 1120): Capital Gains and Losses

* Form 1125-A: Cost of Goods Sold

* Form 1125-E: Compensation of Officers

* Form 4562: Depreciation

* Form 4797: Sales of Business Property

* Form 8949: Sales and Dispositions of Capital Assets

In addition, you must attach supporting schedules for line items in the tax return whenever required, e.g., Line 26 of Form 1120. DO NOT complete Form 2220: Underpayment of Estimated Tax by Corporations.

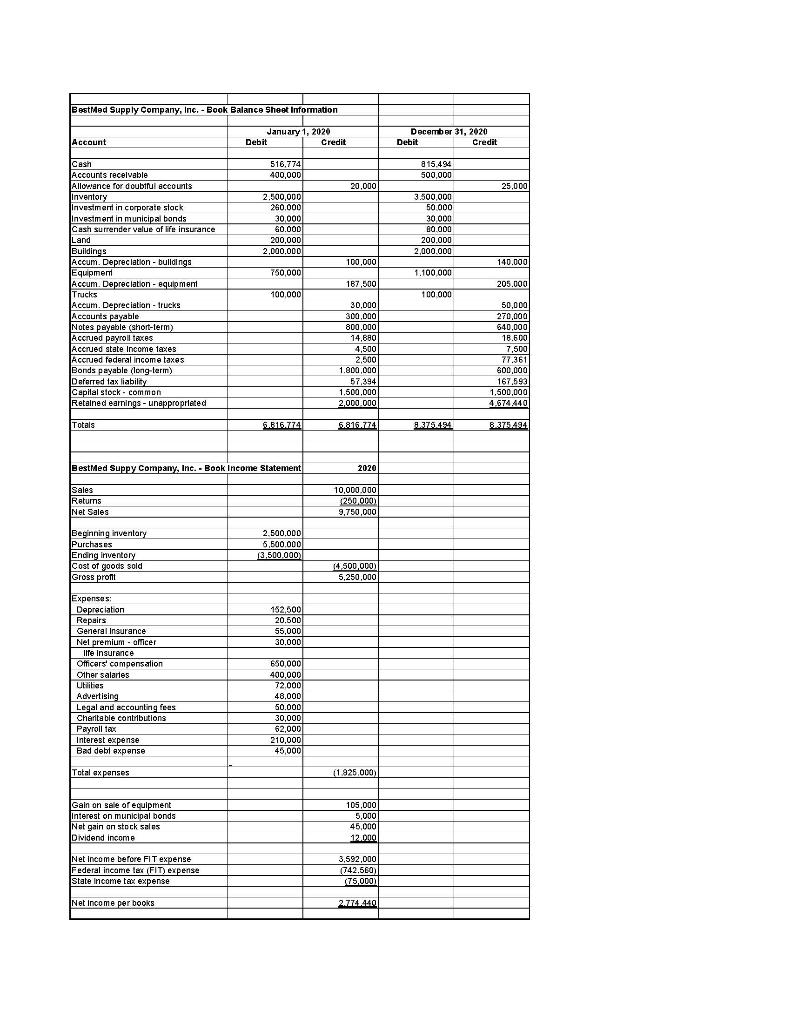

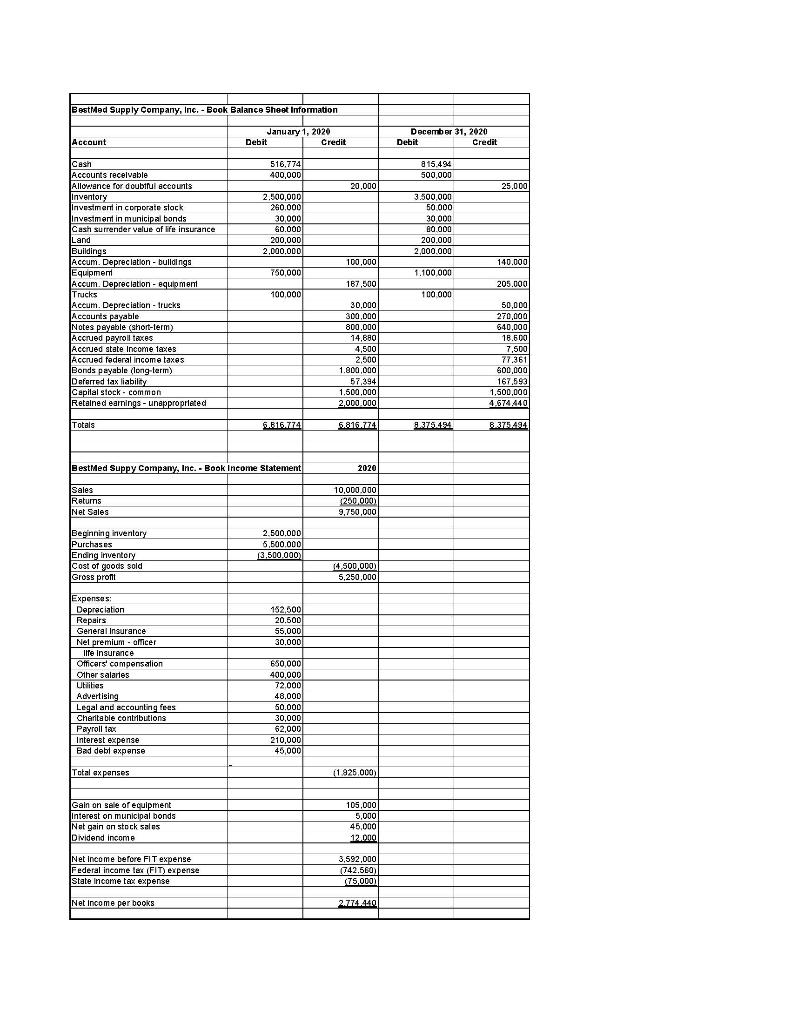

BestMed Supply Company, Inc. - Book Balance Sheet Information January 1, 2020 Debit Credit JAccount December 31, 2020 Debit Credit 516,774 400,000 a 15.494 500,000 20,000 25.000 2,500,000 260.000 30,000 G0.000 200,000 2,000,000 3.500.000 50 000 30 000 80.000 200.000 2,000,000 100,000 140.000 750,000 1.100 000 Cash Accounts receivable Allorance for doubtful accounts Inventory Investment in corporate stock Investment in municipal bonds Cash surrender value of life insurance Land Buildings Accum. Depreciation - buildings Equipment Accum. Depreciation - equipment Trucks Accum. Depreciation - trucks Accounts payable Notes peyeble (short-term) Accrued payroll laces Accrued state Income taxes Accrued federal income taxes Bonds payable (long-larin) Deferred tax liability Cepilal stock. common Retained earnings - unappropriated 167,500 205.000 100,000 100 000 30.000 300,000 800,000 14.680 4,500 2,500 1.800,000 57.394 1.500.000 2.000.000 50,000 270,000 640,000 18.500 7.500 77.361 600,000 167,593 1,500,000 4.674.440 Totals 6.316.774 6.816.774 9375494 8.375.494 BestMed Suppy Company, Inc. - Book Income Statement 2020 Sales Returns Net Sales 10,000.000 1290,000) 9,750,000 Beginning inventory Purchases Ending Inventory Cost of goods sold Gross pront 2.500.000 6,500,000 13,500,000) 14.500.000) 5,250,000 152.000 20.500 55,000 30,000 Expenses: Depreciation Repairs General Insurance Nel premium - Officer life Insurance Officers' compensation Other salaries Utilities Advertising Legal and accounting fees Charitable contributions Payroll tax Interest expense Bad debl expense 680,000 400,000 72.000 48.000 50.000 30,000 62,000 210,000 45,000 Total axpanses (1.925,000) Gain on sale of equipment Interest on municipal bonds Nat gain on stock sales Onidend income 105,000 5,000 45,000 12.000 Net Income before FIT expense Federal income tex (FIT) expense State income tax expense 3,592,000 (742.560) (75.000) Net Income per books 2.77.440 BestMed Supply Company, Inc. - Book Balance Sheet Information January 1, 2020 Debit Credit JAccount December 31, 2020 Debit Credit 516,774 400,000 a 15.494 500,000 20,000 25.000 2,500,000 260.000 30,000 G0.000 200,000 2,000,000 3.500.000 50 000 30 000 80.000 200.000 2,000,000 100,000 140.000 750,000 1.100 000 Cash Accounts receivable Allorance for doubtful accounts Inventory Investment in corporate stock Investment in municipal bonds Cash surrender value of life insurance Land Buildings Accum. Depreciation - buildings Equipment Accum. Depreciation - equipment Trucks Accum. Depreciation - trucks Accounts payable Notes peyeble (short-term) Accrued payroll laces Accrued state Income taxes Accrued federal income taxes Bonds payable (long-larin) Deferred tax liability Cepilal stock. common Retained earnings - unappropriated 167,500 205.000 100,000 100 000 30.000 300,000 800,000 14.680 4,500 2,500 1.800,000 57.394 1.500.000 2.000.000 50,000 270,000 640,000 18.500 7.500 77.361 600,000 167,593 1,500,000 4.674.440 Totals 6.316.774 6.816.774 9375494 8.375.494 BestMed Suppy Company, Inc. - Book Income Statement 2020 Sales Returns Net Sales 10,000.000 1290,000) 9,750,000 Beginning inventory Purchases Ending Inventory Cost of goods sold Gross pront 2.500.000 6,500,000 13,500,000) 14.500.000) 5,250,000 152.000 20.500 55,000 30,000 Expenses: Depreciation Repairs General Insurance Nel premium - Officer life Insurance Officers' compensation Other salaries Utilities Advertising Legal and accounting fees Charitable contributions Payroll tax Interest expense Bad debl expense 680,000 400,000 72.000 48.000 50.000 30,000 62,000 210,000 45,000 Total axpanses (1.925,000) Gain on sale of equipment Interest on municipal bonds Nat gain on stock sales Onidend income 105,000 5,000 45,000 12.000 Net Income before FIT expense Federal income tex (FIT) expense State income tax expense 3,592,000 (742.560) (75.000) Net Income per books 2.77.440