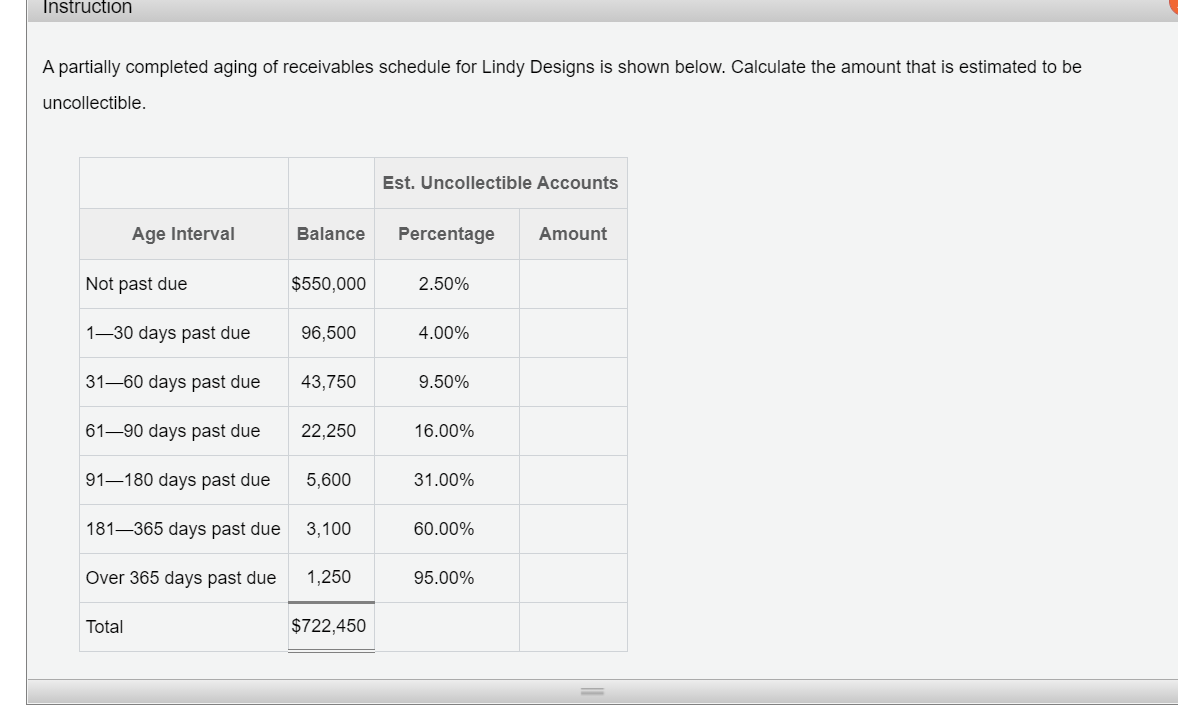

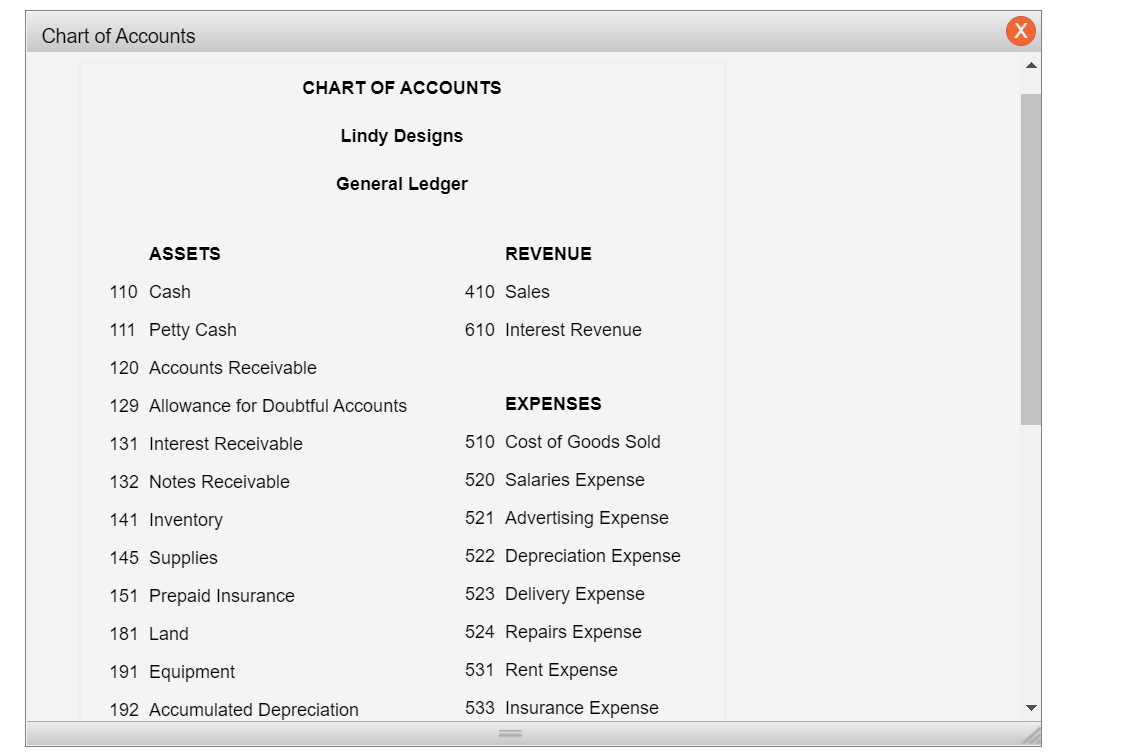

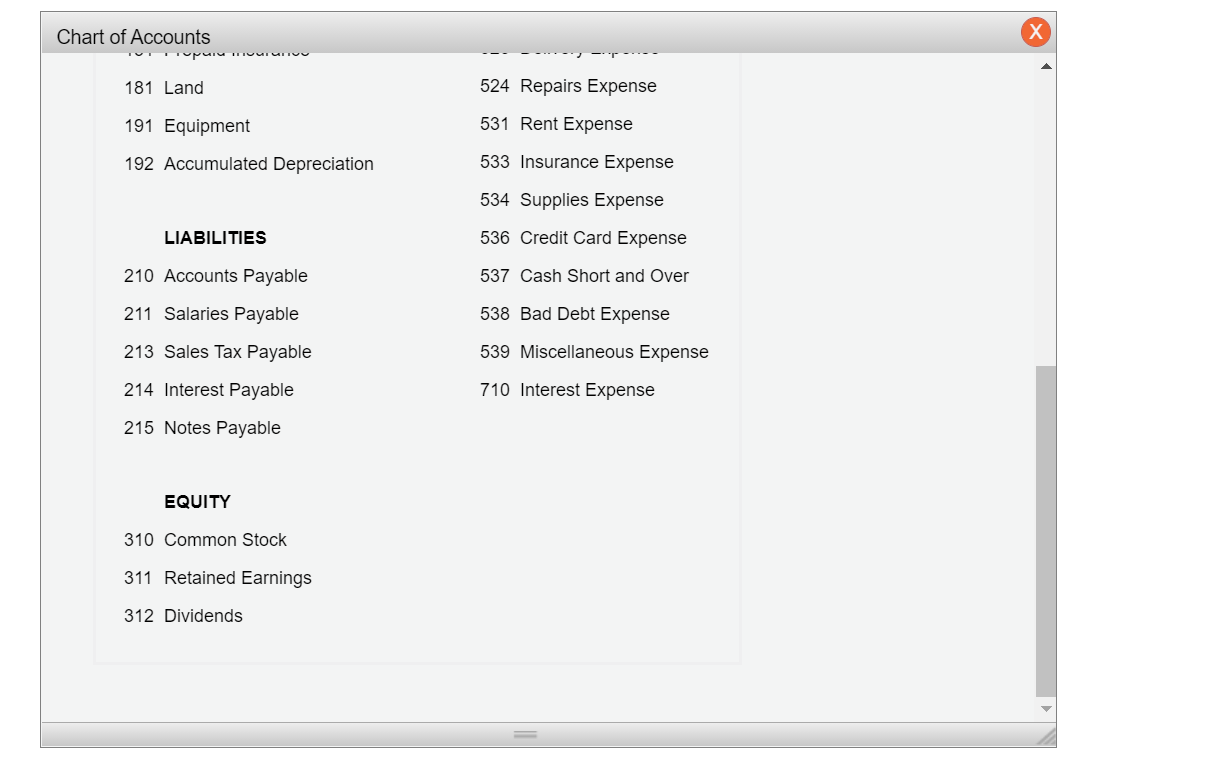

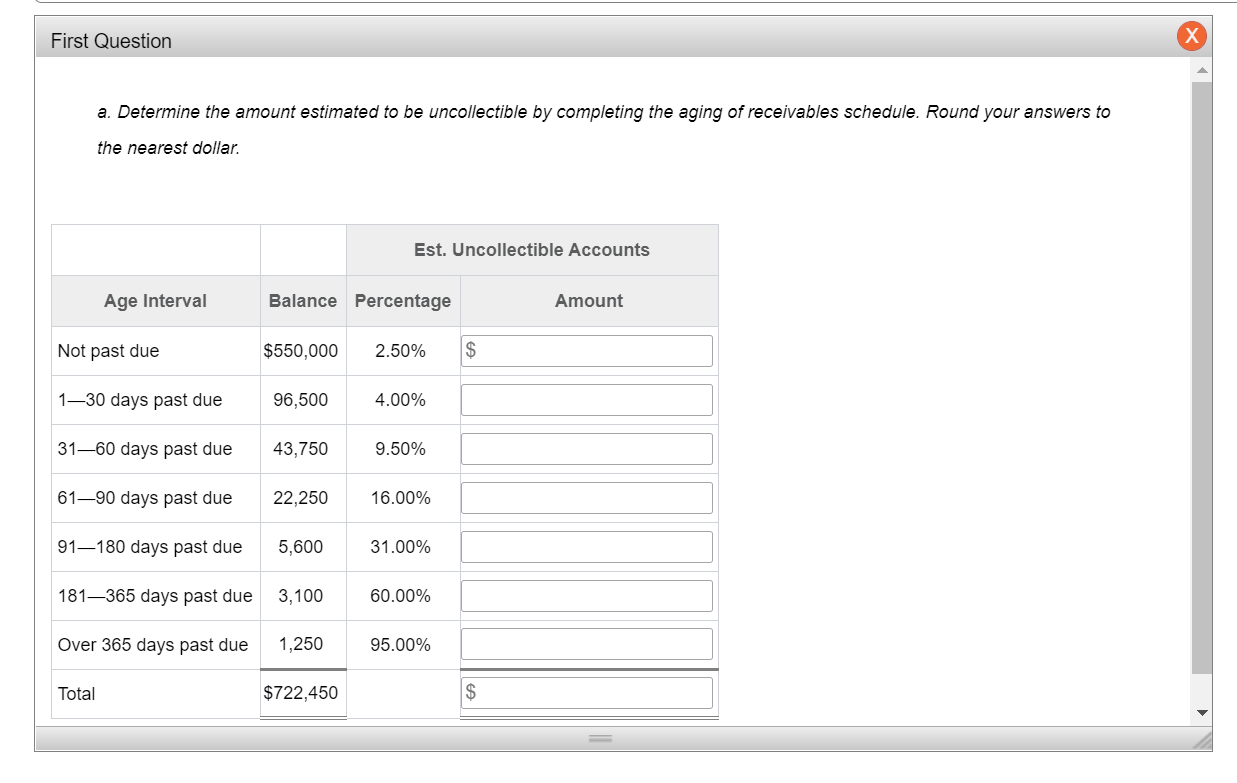

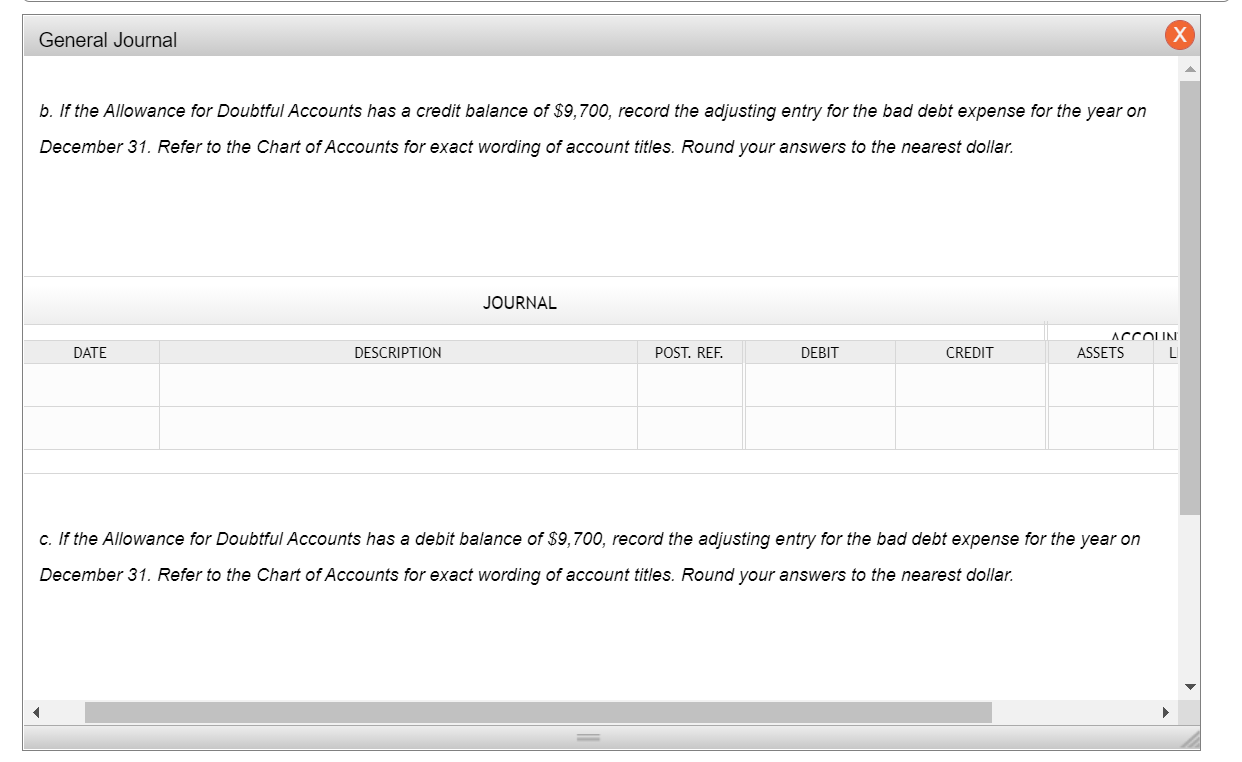

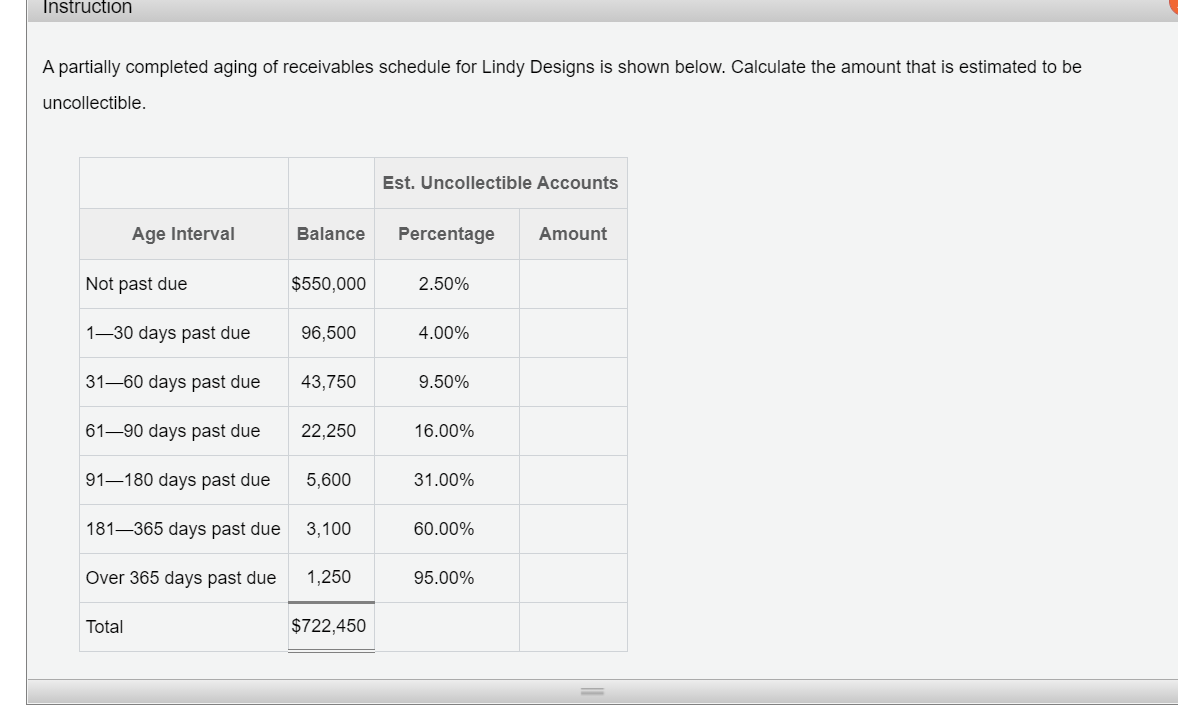

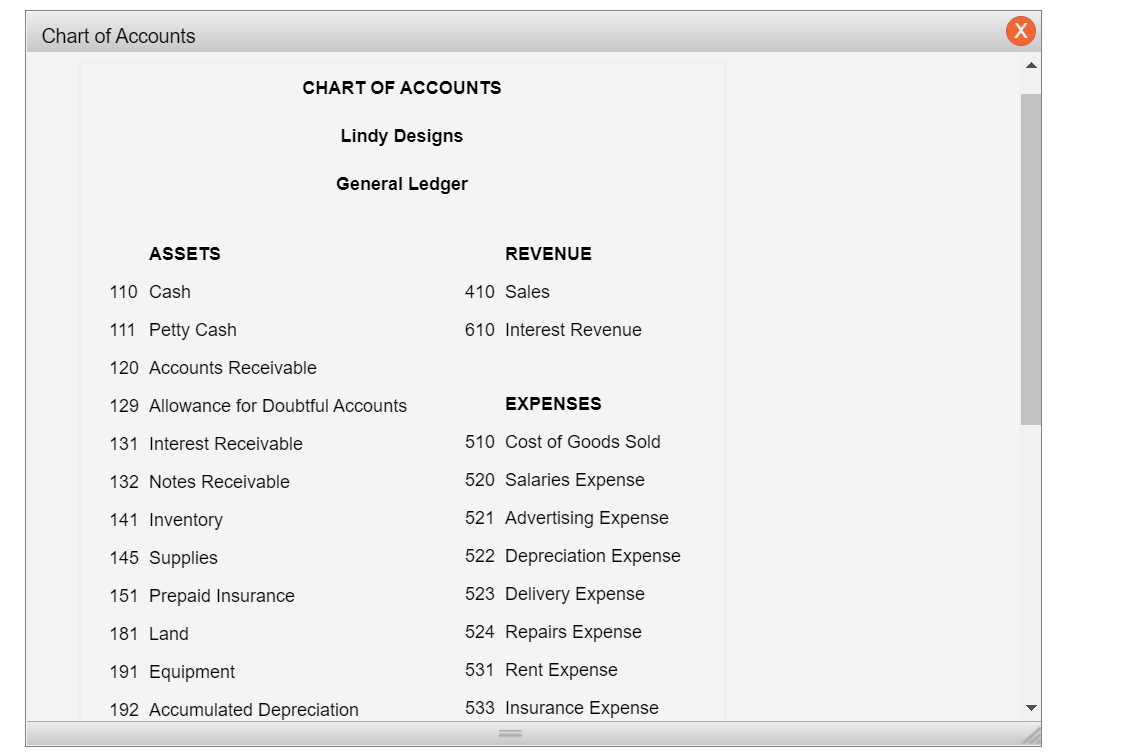

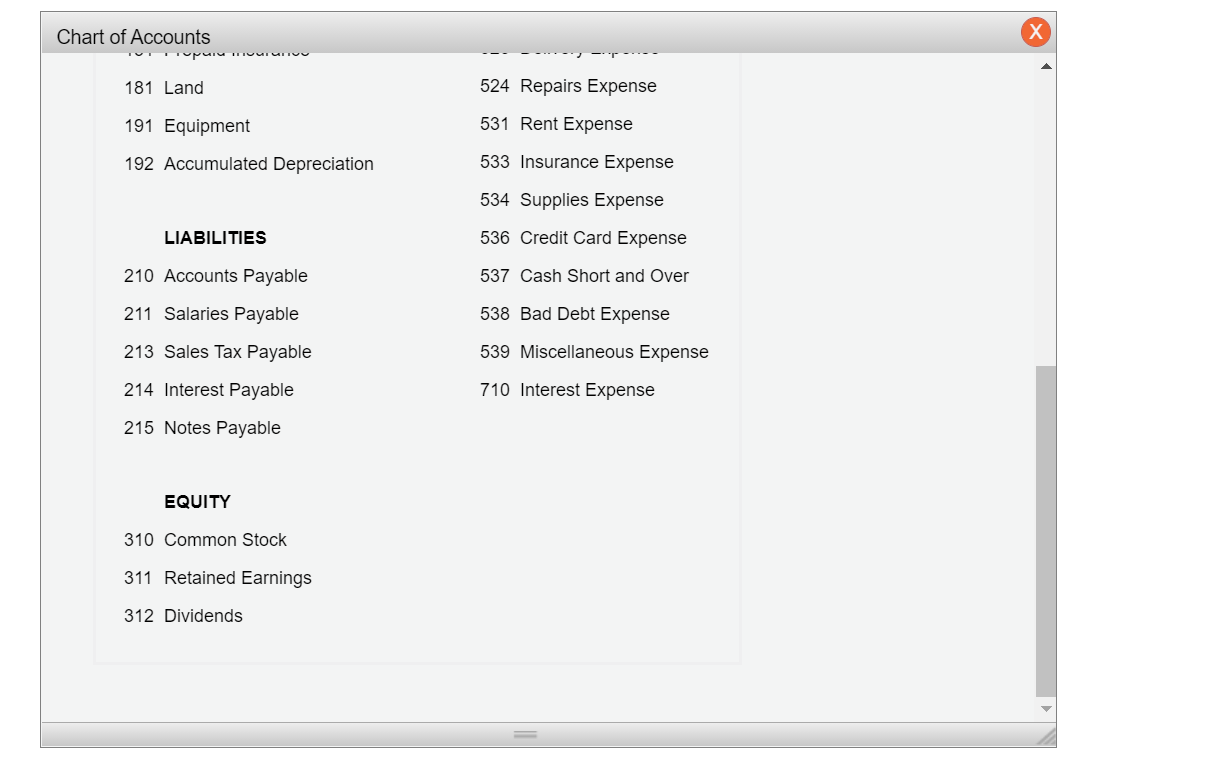

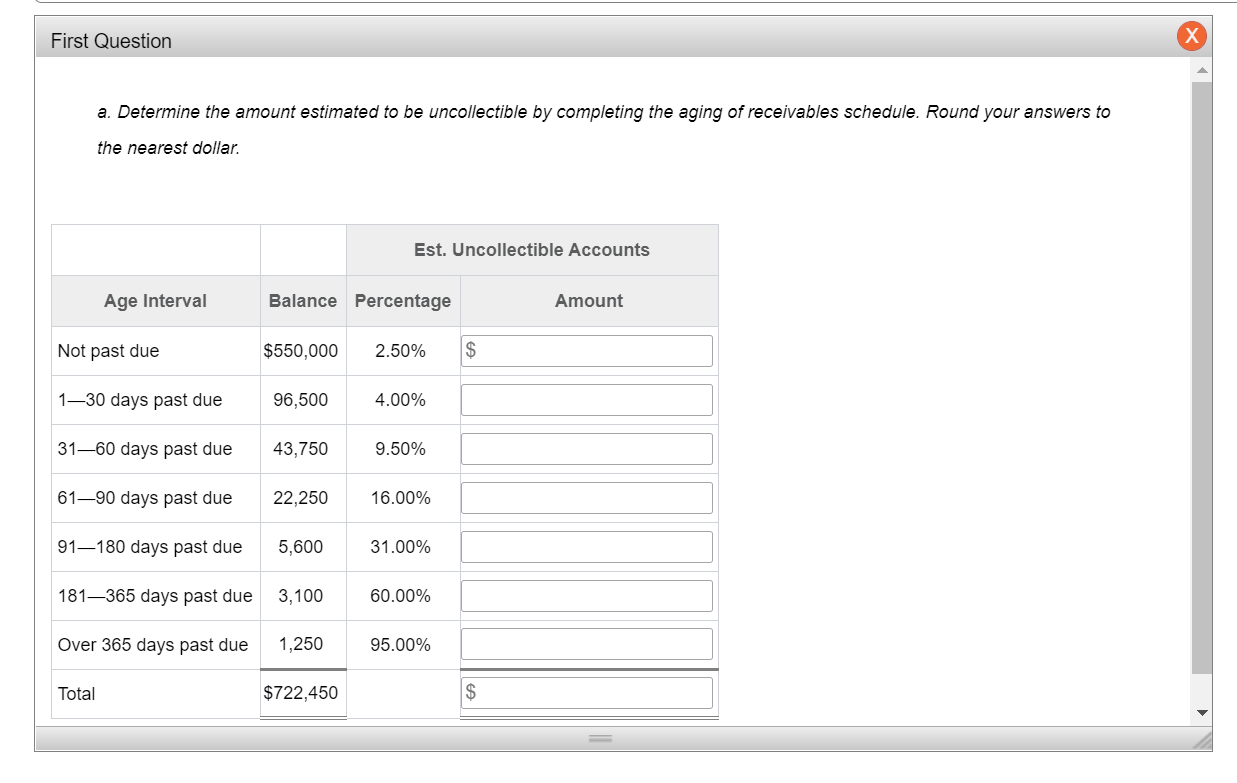

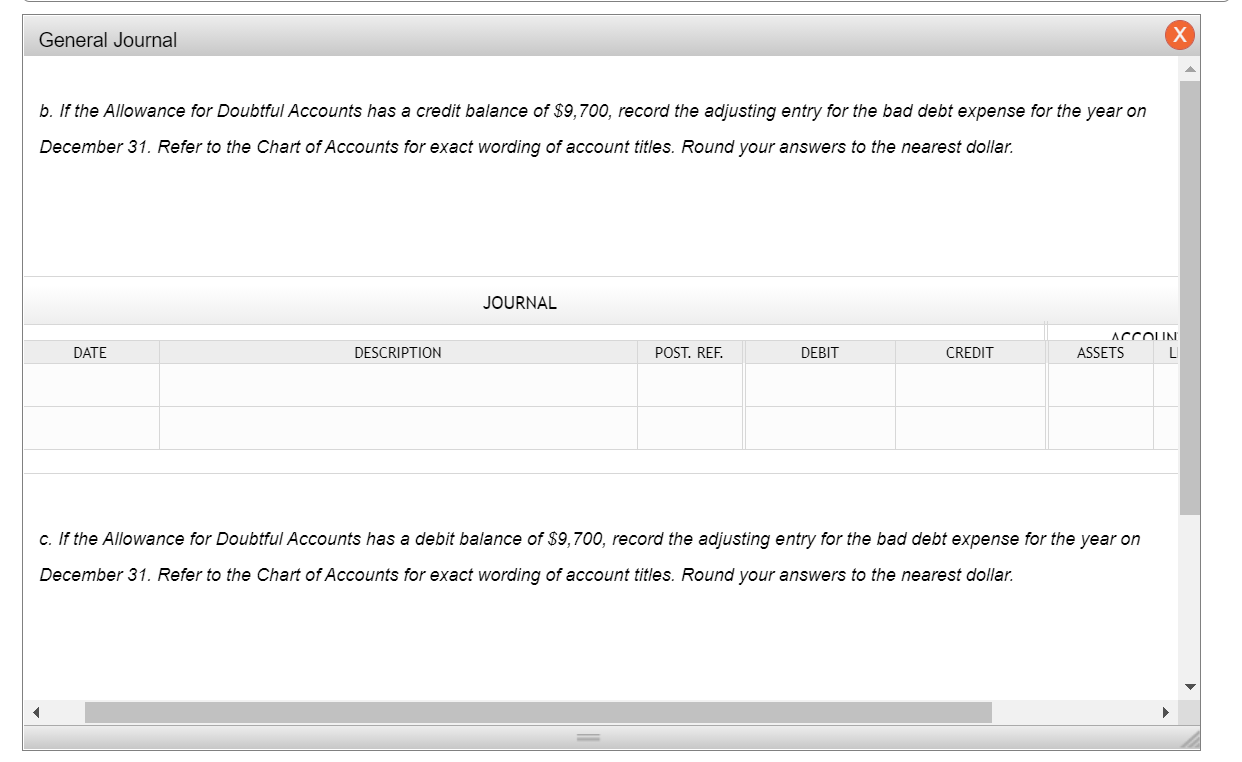

Instruction A partially completed aging of receivables schedule for Lindy Designs is shown below. Calculate the amount that is estimated to be uncollectible. Est. Uncollectible Accounts Age Interval Balance Percentage Amount Not past due $550,000 2.50% 130 days past due 96,500 4.00% 3160 days past due 43,750 9.50% 6190 days past due 22,250 16.00% 91180 days past due 5,600 31.00% 181365 days past due 3,100 60.00% Over 365 days past due 1,250 95.00% Total $722,450 Chart of Accounts CHART OF ACCOUNTS Lindy Designs General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Petty Cash 610 Interest Revenue 120 Accounts Receivable 129 Allowance for Doubtful Accounts EXPENSES 131 Interest Receivable 510 Cost of Goods Sold 132 Notes Receivable 520 Salaries Expense 141 Inventory 145 Supplies 521 Advertising Expense 522 Depreciation Expense 523 Delivery Expense 151 Prepaid Insurance 181 Land 524 Repairs Expense 191 Equipment 531 Rent Expense 192 Accumulated Depreciation 533 Insurance Expense Chart of Accounts Pau MUUUU 181 Land 524 Repairs Expense 191 Equipment 531 Rent Expense 192 Accumulated Depreciation 533 Insurance Expense 534 Supplies Expense LIABILITIES 536 Credit Card Expense 210 Accounts Payable 537 Cash Short and Over 211 Salaries Payable 538 Bad Debt Expense 213 Sales Tax Payable 539 Miscellaneous Expense 214 Interest Payable 710 Interest Expense 215 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends First Question a. Determine the amount estimated to be uncollectible by completing the aging of receivables schedule. Round your answers to the nearest dollar. Est. Uncollectible Accounts Age Interval Balance Percentage Amount Not past due $550,000 2.50% $ 130 days past due 96,500 4.00% 3160 days past due 43,750 9.50% 6190 days past due 22,250 16.00% 91180 days past due 5,600 31.00% 181365 days past due 3,100 60.00% Over 365 days past due 1,250 95.00% Total $722,450 $ General Journal b. If the Allowance for Doubtful Accounts has a credit balance of $9,700, record the adjusting entry for the bad debt expense for the year on December 31. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to the nearest dollar. JOURNAL DATE DESCRIPTION POST. REF. DEBIT CREDIT ACCOLIN ASSETS L c. If the Allowance for Doubtful Accounts has a debit balance of $9,700, record the adjusting entry for the bad debt expense for the year on December 31. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to the nearest dollar