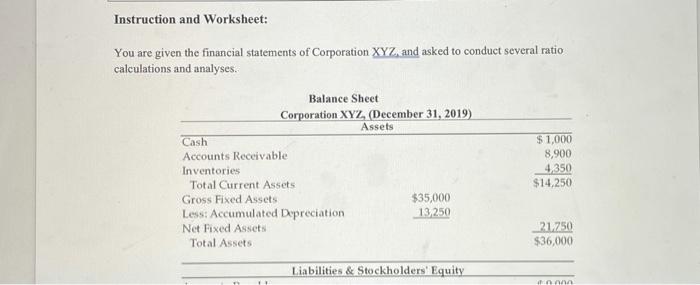

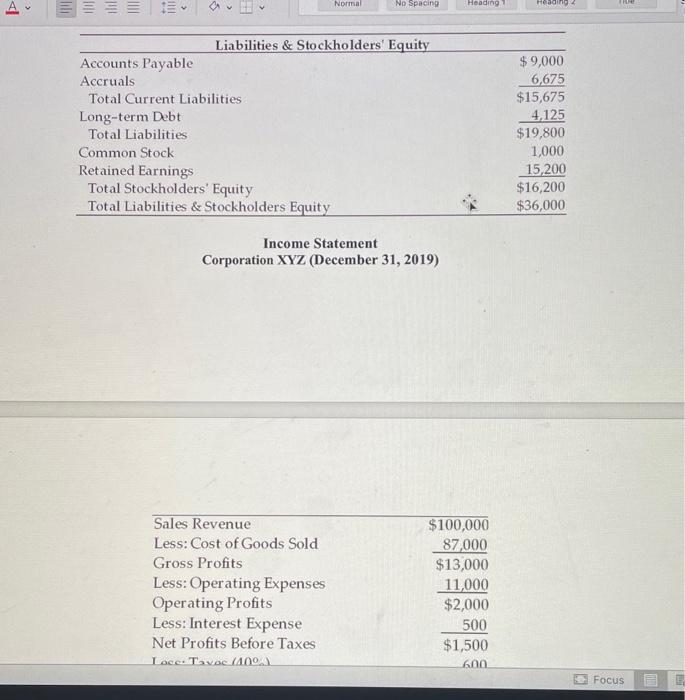

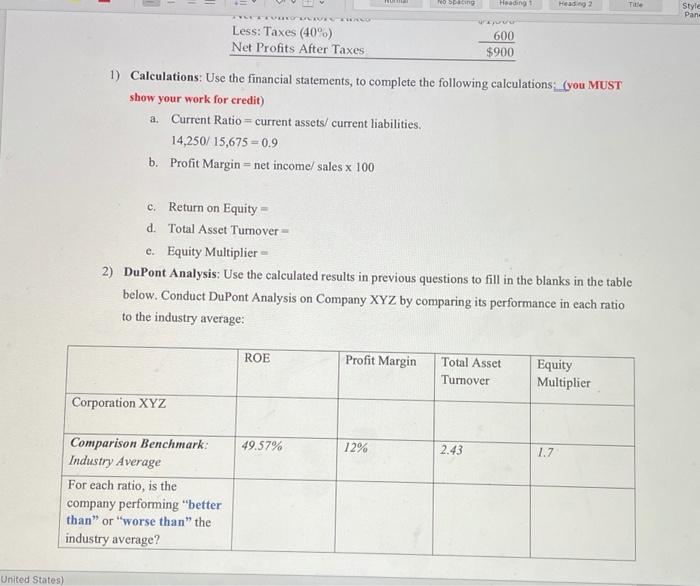

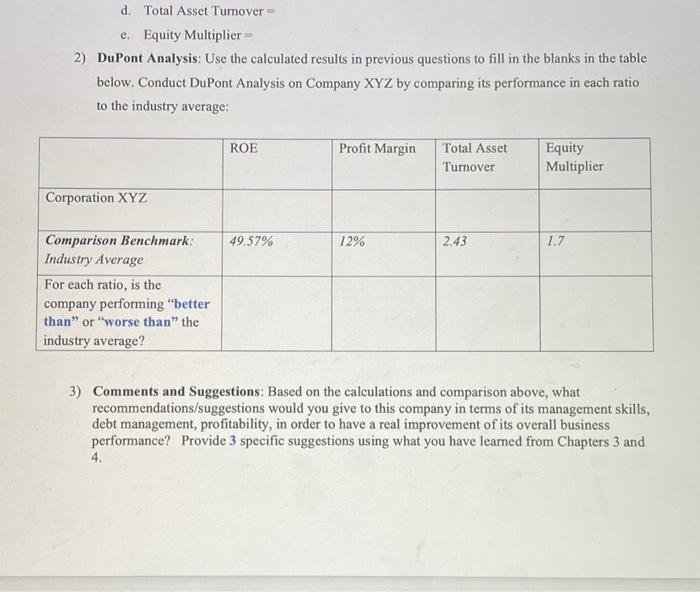

Instruction and Worksheet: You are given the financial statements of Corporation XYZ and asked to conduct several ratio calculations and analyses. Balance Sheet Corporation XYZ (December 31, 2019) Assets Cash Accounts Receivable Inventories Total Current Assets Gross Fixed Assets $35,000 Less: Accumulated Depreciation 13,250 Net Fixed Assets Total Assets $1,000 8,900 4,350 $14,250 21.750 $36,000 Liabilities & Stockholders' Equity 2010 11 Normal No Spacing Heading Heading Liabilities & Stockholders' Equity Accounts Payable Accruals Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders Equity $ 9,000 6,675 $15,675 4,125 $19,800 1,000 15,200 $16,200 $36,000 Income Statement Corporation XYZ (December 31, 2019) Sales Revenue Less: Cost of Goods Sold Gross Profits Less: Operating Expenses Operating Profits Less: Interest Expense Net Profits Before Taxes $100,000 87,000 $13,000 11,000 $2,000 500 $1,500 600 Loce. Tavoe (1004 Focus spacing Heading Tare Style Pan ELE ETALO Less: Taxes (40%) Net Profits After Taxes WE 600 $900 1) Calculations: Use the financial statements, to complete the following calculations (you MUST show your work for credit) a. Current Ratio = current assets/ current liabilities. 14,250/15,675=0.9 b. Profit Margin= net income/ sales x 100 c. Return on Equity - d. Total Asset Tumover e Equity Multiplier 2) DuPont Analysis: Use the calculated results in previous questions to fill in the blanks in the table below. Conduct DuPont Analysis on Company XYZ by comparing its performance in each ratio to the industry average: ROE Profit Margin Total Asset Turnover Equity Multiplier Corporation XYZ 49.57% 12% 2.43 1.7 Comparison Benchmark: Industry Average For each ratio, is the company performing "better than" or "worse than the industry average? United States) d. Total Asset Turnover = e. Equity Multiplier 2) DuPont Analysis: Use the calculated results in previous questions to fill in the blanks in the table below. Conduct DuPont Analysis on Company XYZ by comparing its performance in each ratio to the industry average! ROE Profit Margin Total Asset Turnover Equity Multiplier Corporation XYZ 49.57% 12% 2.43 1.7 Comparison Benchmark: Industry Average For each ratio, is the company performing "better than" or "worse than the industry average? 3) Comments and Suggestions: Based on the calculations and comparison above, what recommendations/suggestions would you give to this company in terms of its management skills, debt management, profitability, in order to have a real improvement of its overall business performance? Provide 3 specific suggestions using what you have learned from Chapters 3 and 4