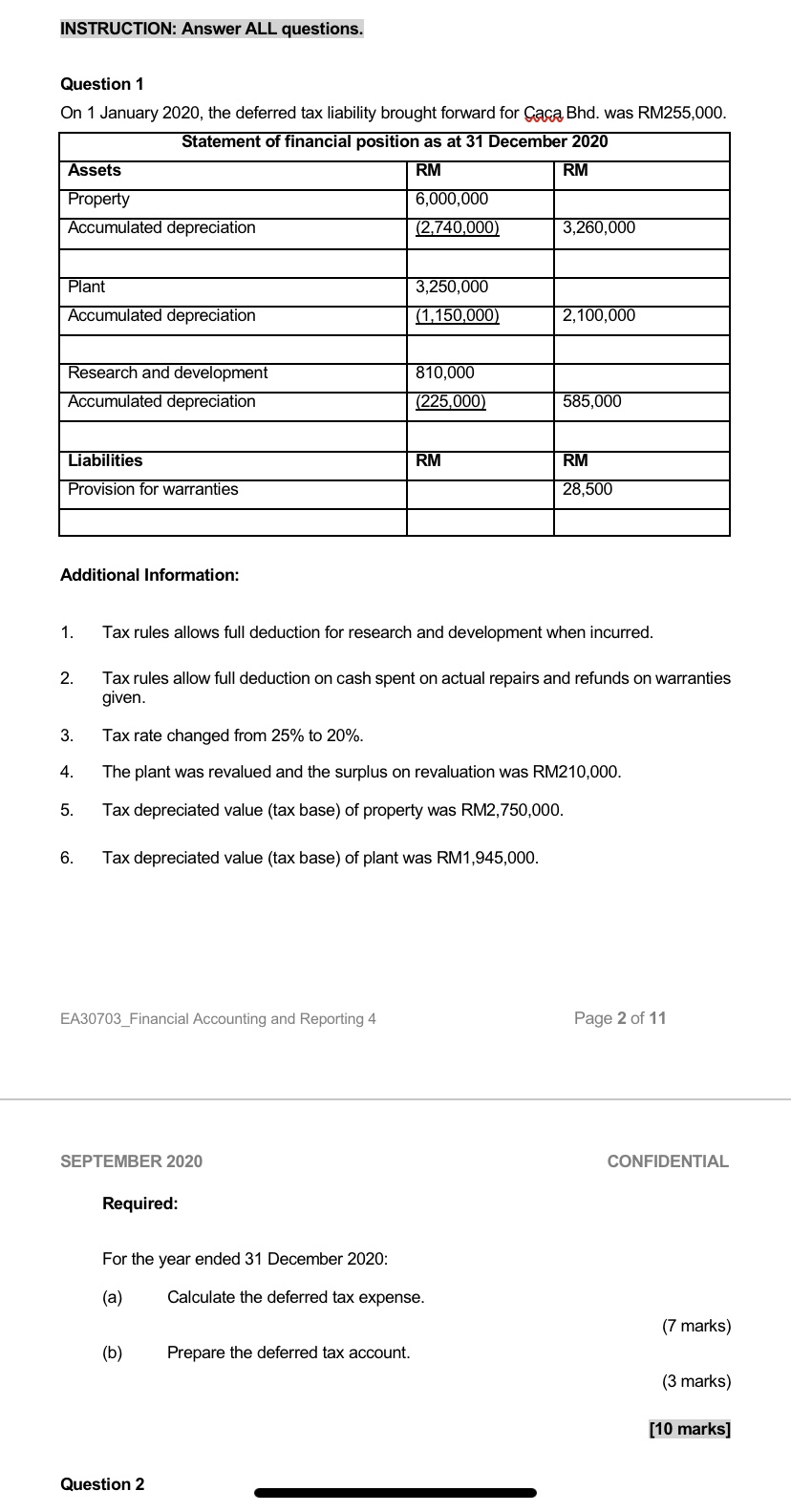

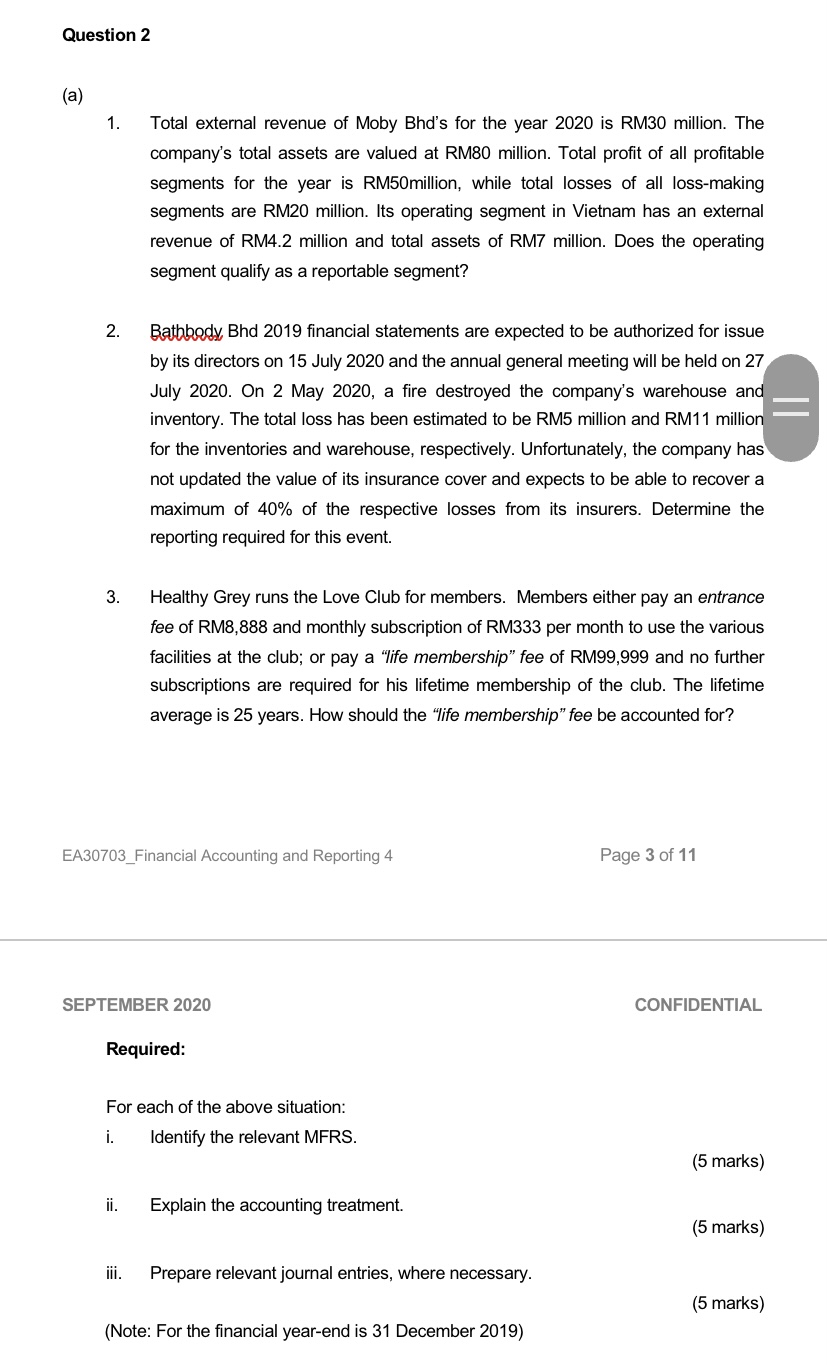

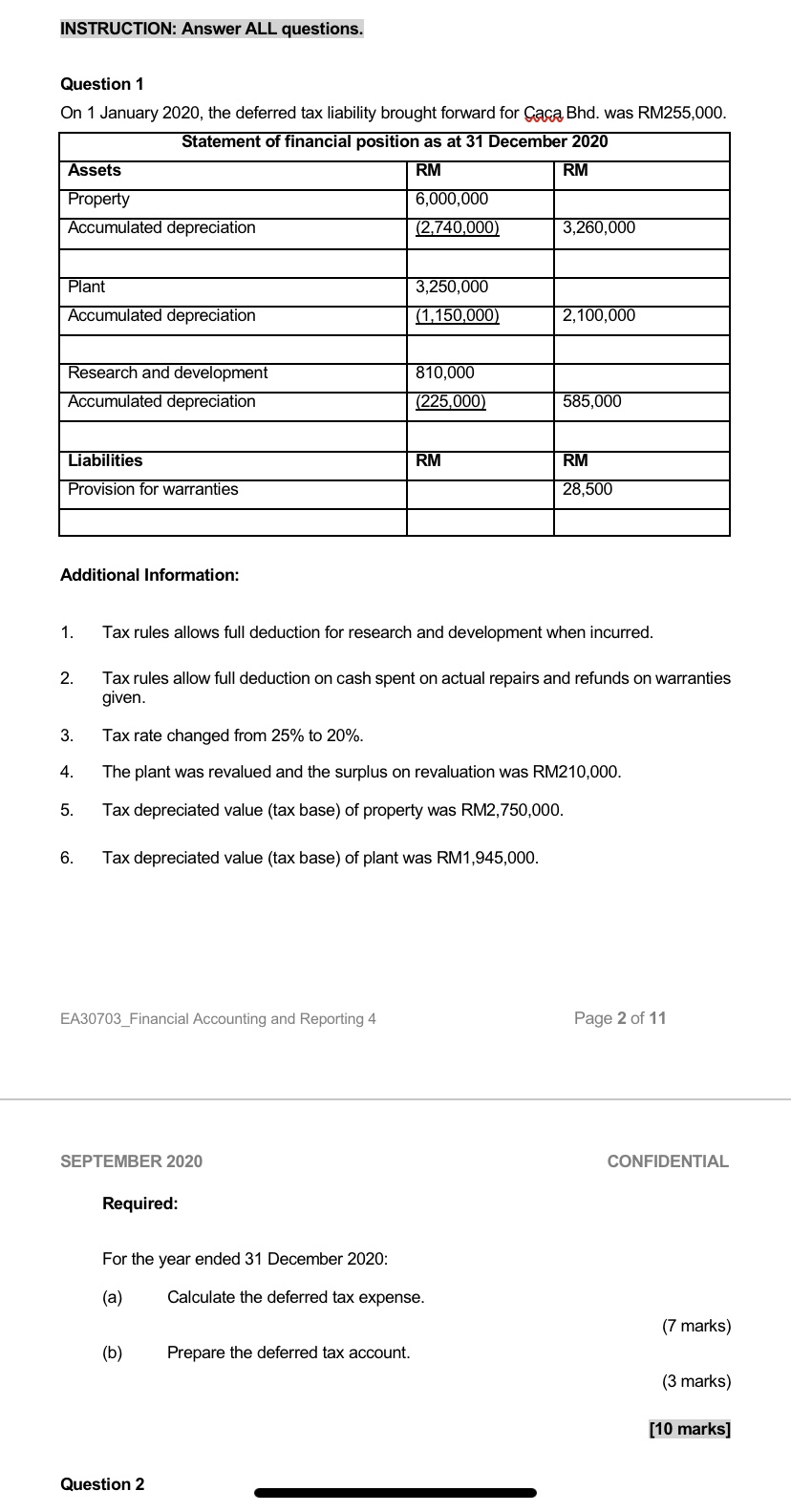

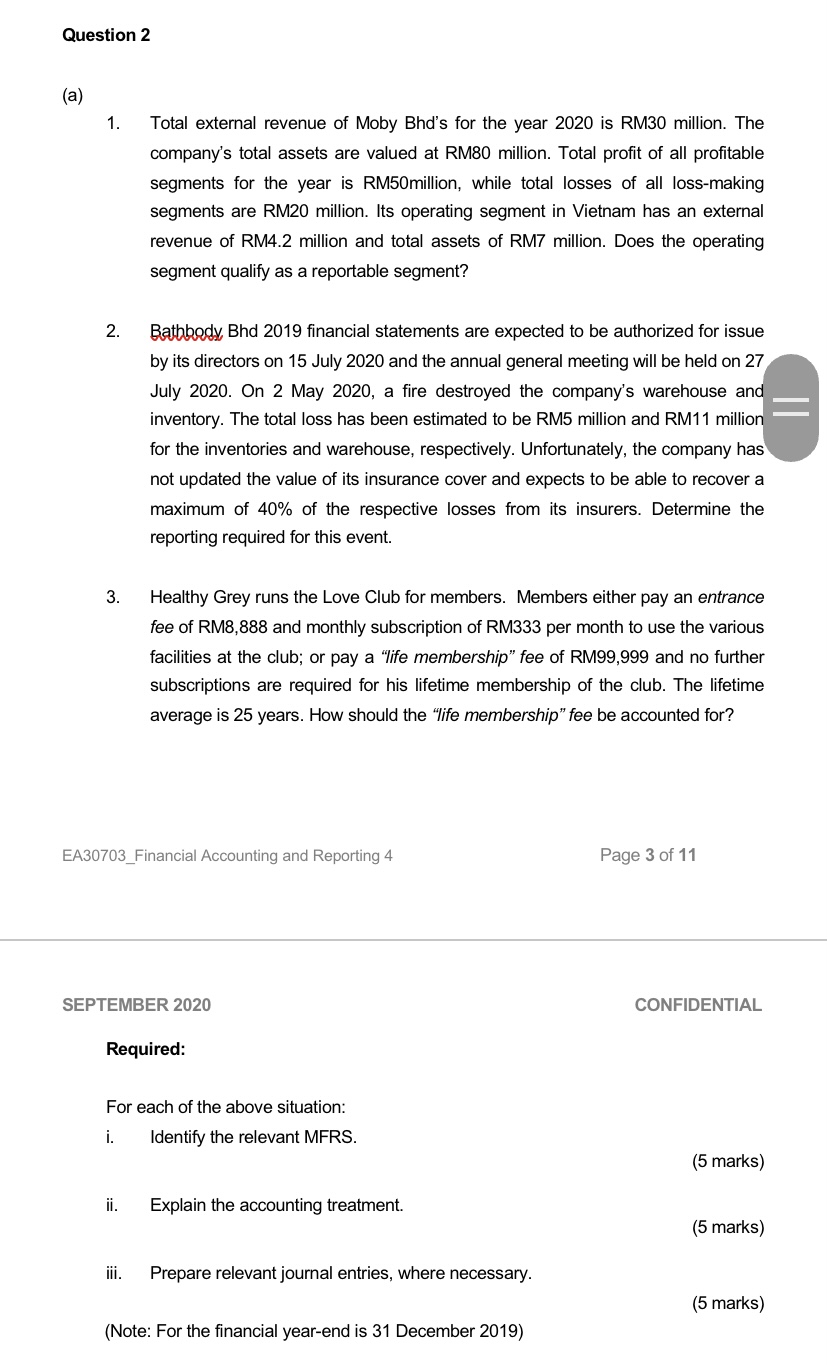

INSTRUCTION: Answer ALL questions. Question 1 On 1 January 2020, the deferred tax liability brought forward for Cac Bhd. was RM255,000. Statement of financial position as at 31 December 2020 RM RM Assets Property Accumulated depreciation 6,000,000 (2.740,000) 3,260,000 Plant 3,250,000 Accumulated depreciation (1,150,000) 2,100,000 Research and development Accumulated depreciation 810,000 (225,000) 585,000 Liabilities RM RM Provision for warranties 28,500 Additional Information: 1. Tax rules allows full deduction for research and development when incurred. 2. Tax rules allow full deduction on cash spent on actual repairs and refunds on warranties given. 3. Tax rate changed from 25% to 20%. 4. The plant was revalued and the surplus on revaluation was RM210,000. 5. Tax depreciated value (tax base) of property was RM2,750,000. 6. Tax depreciated value (tax base) of plant was RM1,945,000. EA30703 Financial Accounting and Reporting 4 Page 2 of 11 SEPTEMBER 2020 CONFIDENTIAL Required: For the year ended 31 December 2020: (a) Calculate the deferred tax expense. (7 marks) (b) Prepare the deferred tax account. (3 marks) [10 marks] Question 2 Question 2 (a) 1. Total external revenue of Moby Bhd's for the year 2020 is RM30 million. The company's total assets are valued at RM80 million. Total profit of all profitable segments for the year is RM50million, while total losses of all loss-making segments are RM20 million. Its operating segment in Vietnam has an external revenue of RM4.2 million and total assets of RM7 million. Does the operating segment qualify as a reportable segment? 2. = Bathbody Bhd 2019 financial statements are expected to be authorized for issue by its directors on 15 July 2020 and the annual general meeting will be held on 27 July 2020. On 2 May 2020, a fire destroyed the company's warehouse and inventory. The total loss has been estimated to be RM5 million and RM11 million for the inventories and warehouse, respectively. Unfortunately, the company has not updated the value of its insurance cover and expects to be able to recover a maximum of 40% of the respective losses from its insurers. Determine the reporting required for this event. 3. Healthy Grey runs the Love Club for members. Members either pay an entrance fee of RM8,888 and monthly subscription of RM333 per month to use the various facilities at the club; or pay a "life membership" fee of RM99,999 and no further subscriptions are required for his lifetime membership of the club. The lifetime average is 25 years. How should the "life membership fee be accounted for? EA30703_Financial Accounting and Reporting 4 Page 3 of 11 SEPTEMBER 2020 CONFIDENTIAL Required: For each of the above situation: i. Identify the relevant MFRS. (5 marks) ii. Explain the accounting treatment. (5 marks) iii. Prepare relevant journal entries, where necessary. (5 marks) (Note: For the financial year-end is 31 December 2019)