Question

Instruction: Please answer all questions below including the ratios and the intrepretation for each ratio. I have attached the financial statement for Sprint Corp. I

Instruction: Please answer all questions below including the ratios and the intrepretation for each ratio. I have attached the financial statement for Sprint Corp. I can't award credit if all sections are not answered.

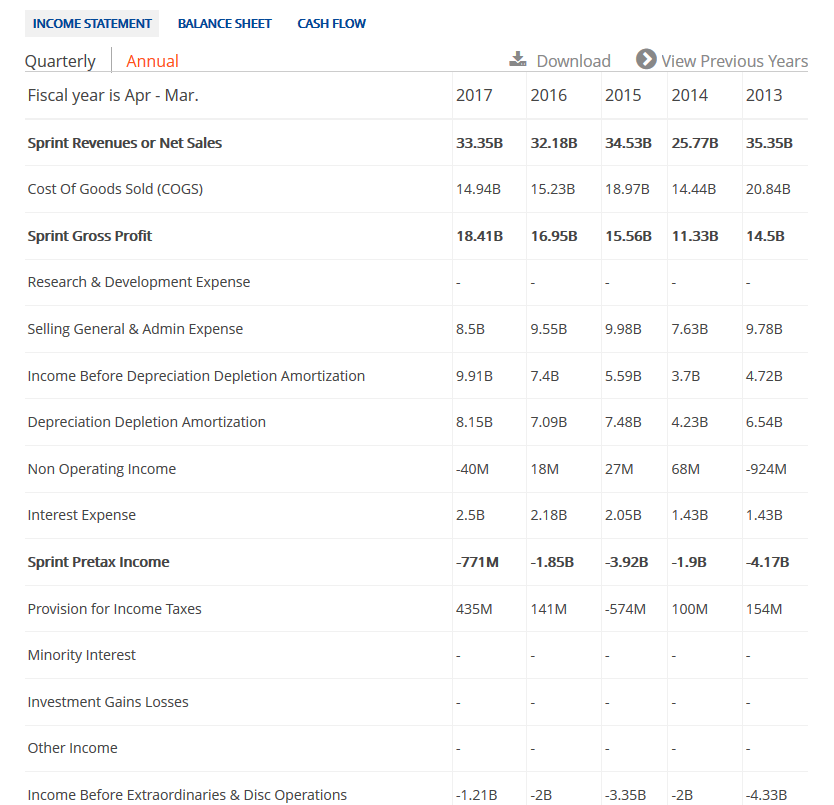

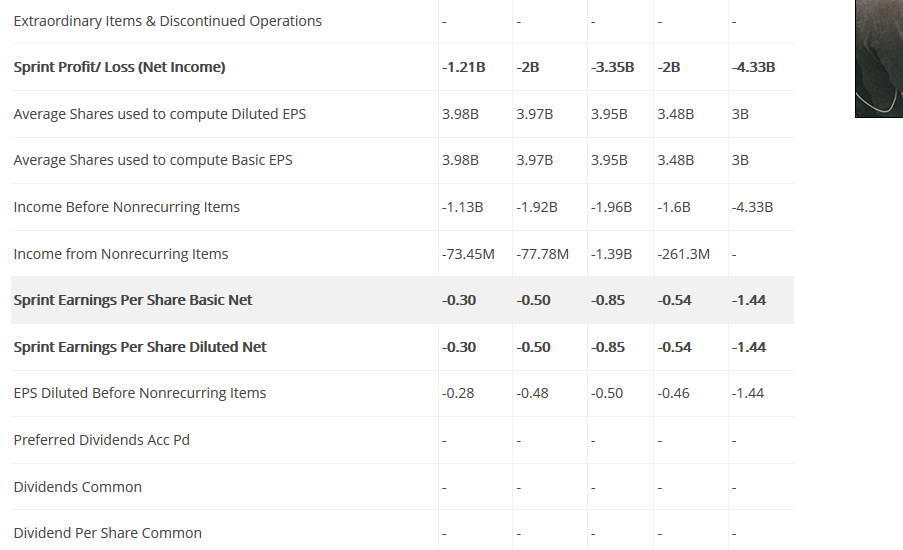

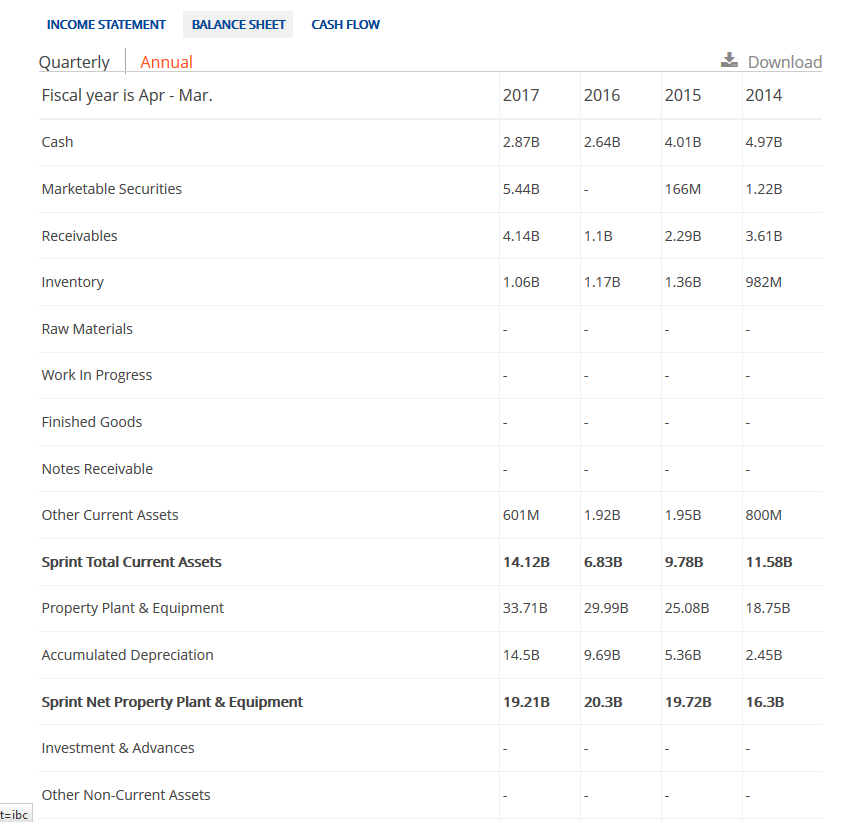

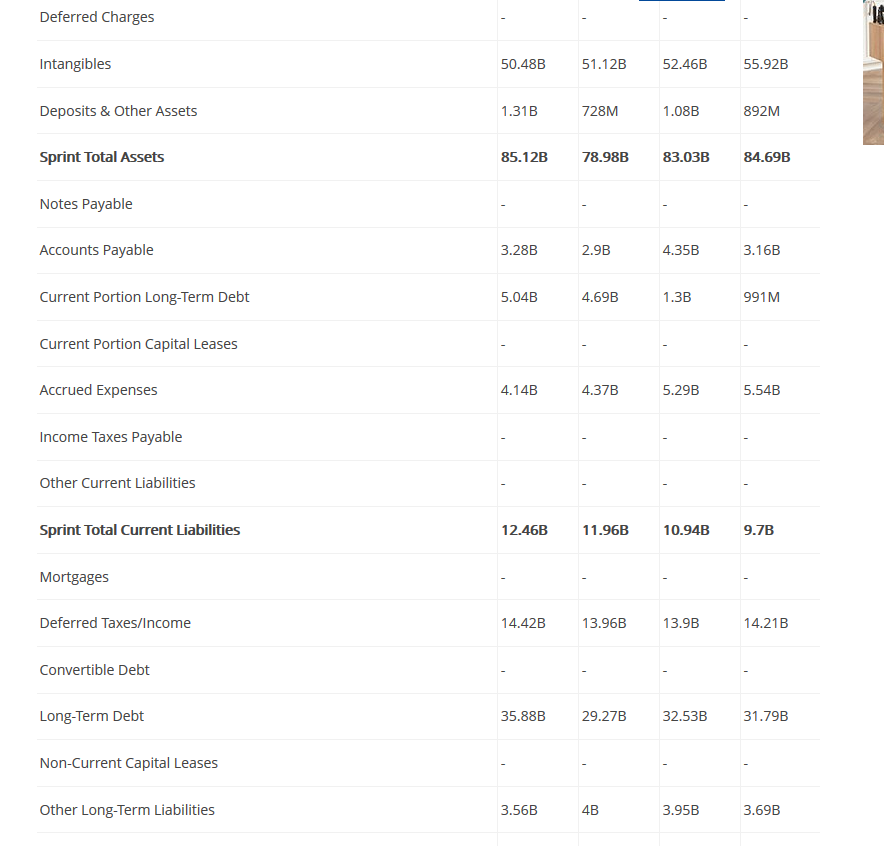

1] Please search a company (example as Google, facebook, Macys and others) with a set of current financial statements and apply the ratios listed above to analyze a company financial performance

2] Please provide the interpretation on each ratio analysis reflecting a company current financial situation.

3) Using the following ratios to analyze a company financial performance.

-Profitability Analysis

-Profit Margin Analysis

-Asset Turnover

-Fixed Asset Turnover

-Rate of Return on Common Shareholders Equity

-Earning Per Common Share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started