Question

Instruction: -Please follow the instruction from these questions to analysis the level of risk for company and interpret your analysis result. -Please answer all questions

Instruction: -Please follow the instruction from these questions to analysis the level of risk for company and interpret your analysis result.

-Please answer all questions completely because I can't award full credit if directions are not followed completely.

Question 1

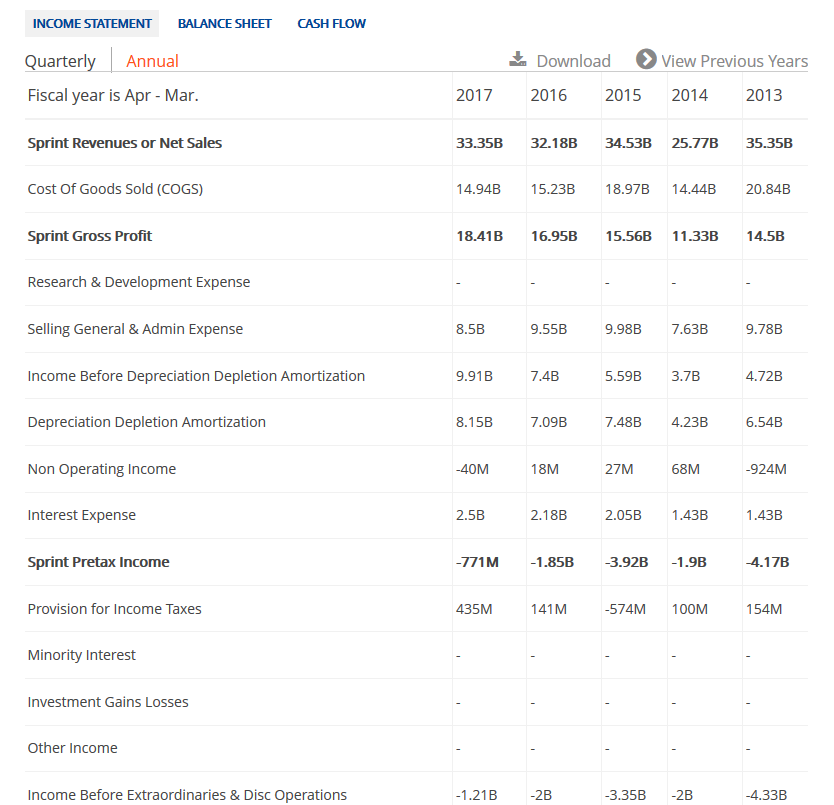

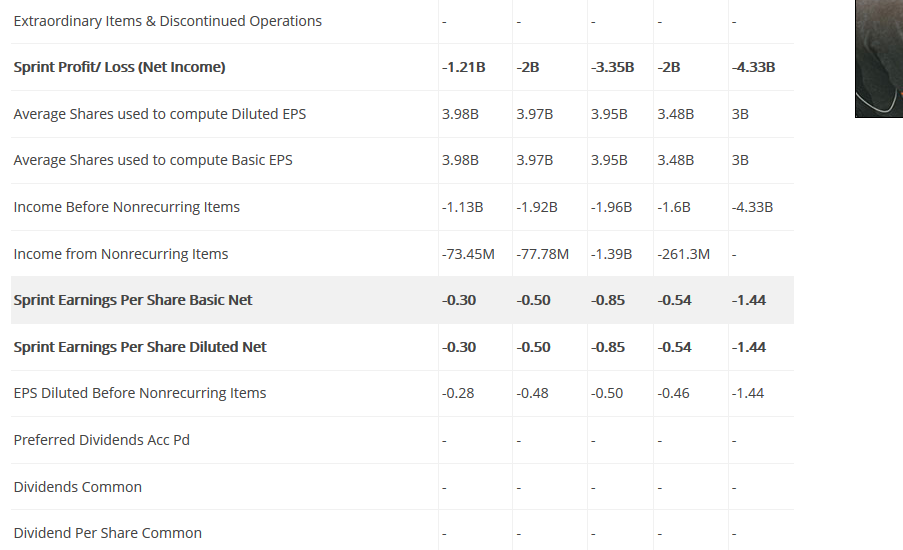

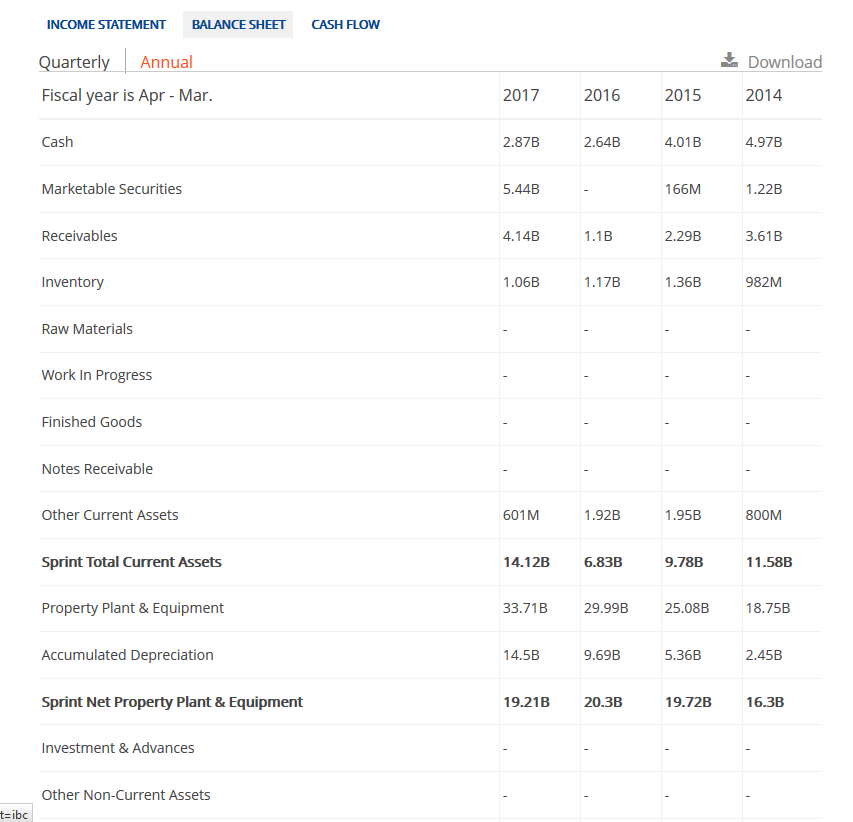

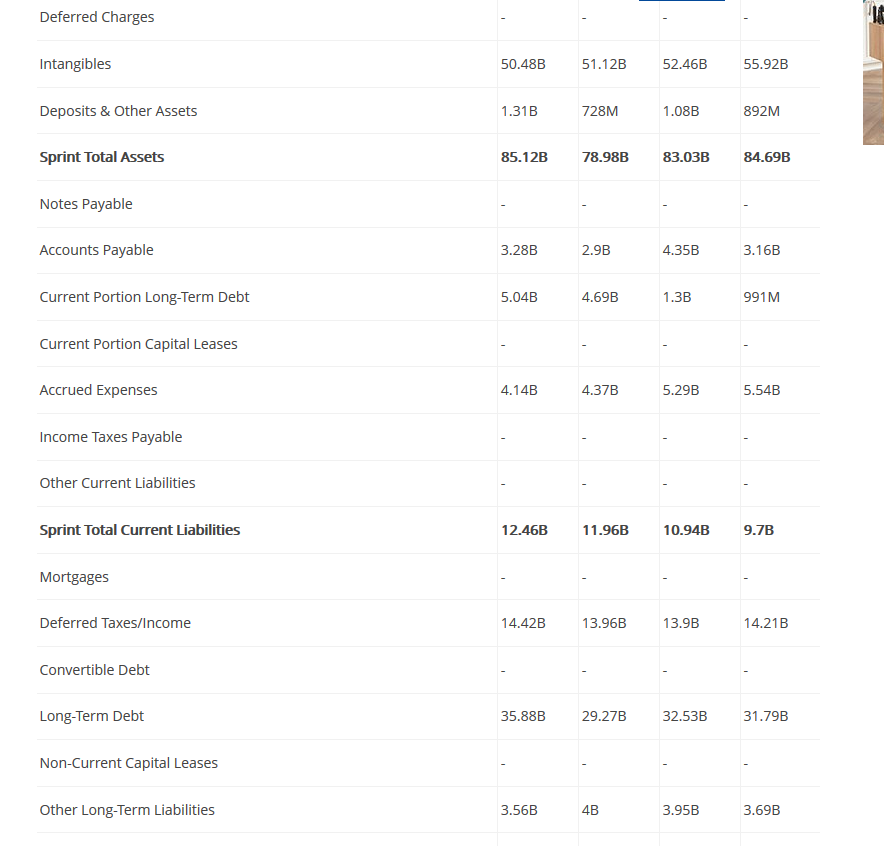

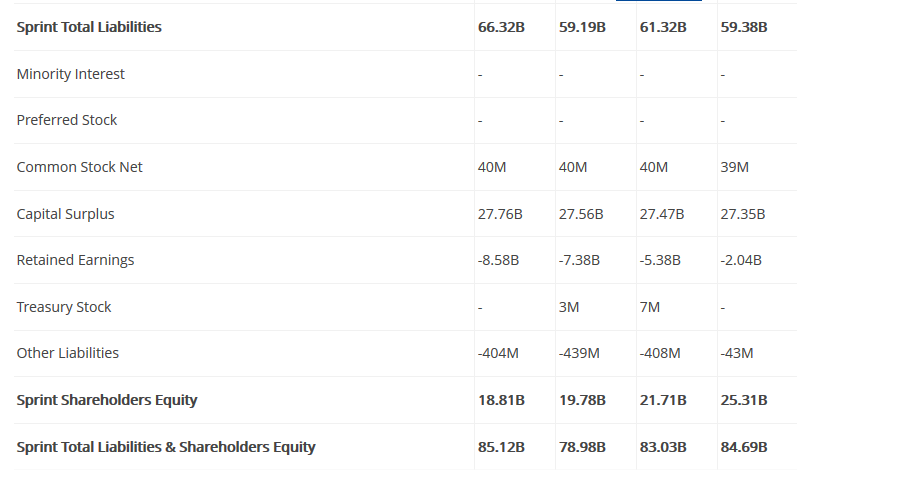

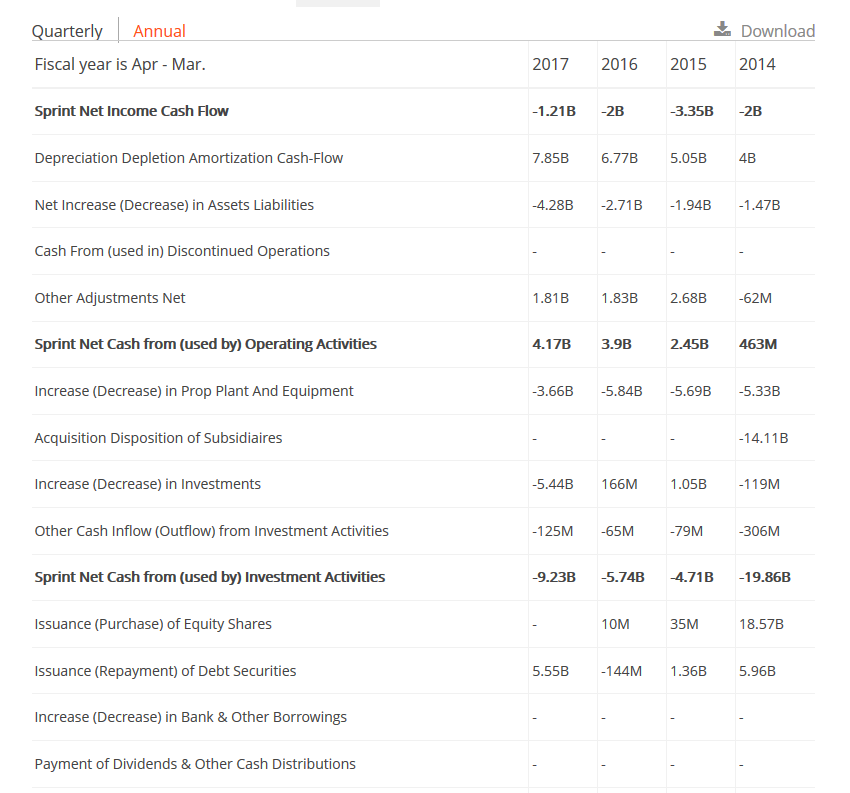

Please use images of Sprint's balance sheet, income statement, and cash flow to apply the below ratios to analyze this company financial position and provide clear interpretation on each ratio.

a. Current Ratio b. Quick Ratio c. Days Accounts Receivable d. Day Inventory e. Days Accounts Payable f. Liabilities to Asset Ratio g. Liabilities to Shareholders Equity Ratio h. Long Term Debt Ratio to Long-Term Capital Ratio i. Operating Cash Flow to Total Liabilities Ratio j. Interest Coverage Ratio

Question 2:

Please use the below images of Sprint's balance sheet, income statement and cash flow to analyze this companys possibility to file Bankruptcy by using the Z-score.

*** formula and detail information can be found from this chapter 5

***Please provide interpretation example for this interpretation also can be found on this chapter.

INCOME STATEMENT BALANCE SHEET CASH FLOWW Annual Download View Previous Years Quarter Fiscal year is Apr - Mar. Sprint Revenues or Net Sales Cost Of Goods Sold (COGS) 2017 2016 2015 2014 2013 33.35B 32.18B 34.53B 25.77B 35.35B 4.94B 15.23B 18.97B 14.44B 20.84B Sprint Gross Profit Research & Development Expense Selling General & Admin Expense Income Before Depreciation Depletion Amortization Depreciation Depletion Amortization 18.41B 16.95B 15.56B 11.33B 14.5B 8.5B 9.55B 9.98B 7.63B 9.78B 9.91B 7.4B 5.59B 3.7B 4.72B 8.15B 7.09B 7.48B 4.23B 6.54B Non Operating Income 40M 18M 27M 68M 924M Interest Expense 2.5B 2.18B 2.05B 1.43B 1.43B Sprint Pretax Income 1.85B 3.92B 1.9B -4.17B Provision for Income Taxes 435M 141 M 574M 100MM 154M Minority Interest Investment Gains Losses Other Income Income Before Extraordinaries & Disc Operations 1.21B-2B .35B -2B -4.33B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started