Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instruction Problem Information needed to solve the problem PLEASE SEND A PICTURE OF THE MICROSOFT EXCEL AND MICROSOFT WORD SOLUTION THANK YOU IN ADVANCE Solve

Instruction

Problem

Information needed to solve the problem

PLEASE SEND A PICTURE OF THE MICROSOFT EXCEL AND MICROSOFT WORD SOLUTION

THANK YOU IN ADVANCE

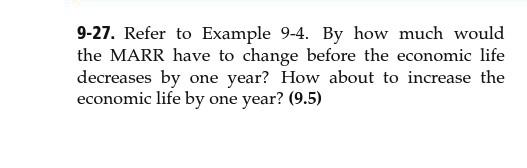

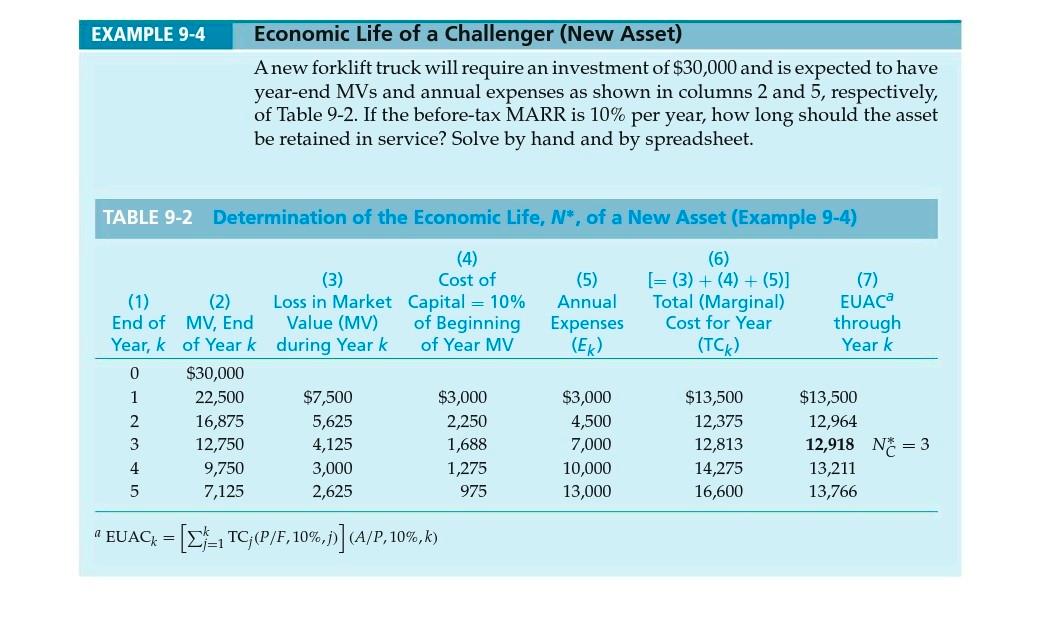

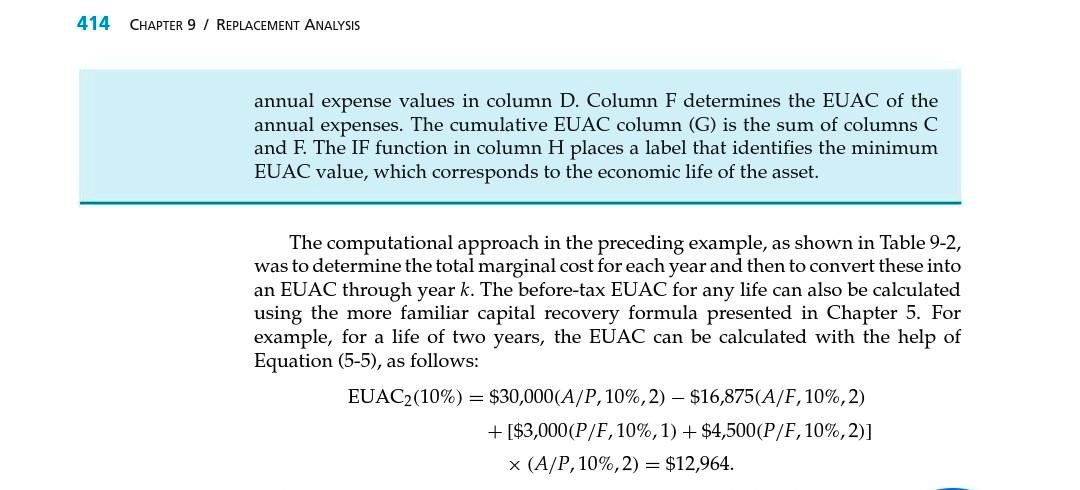

Solve and document your solutions to the problems to be posted. Solutions must be detailed (documenting it in a word file explaining per cell in the excel file). 9-27. Refer to Example 9-4. By how much would the MARR have to change before the economic life decreases by one year? How about to increase the economic life by one year? (9.5) Economic Life of a Challenger (New Asset) A new forklift truck will require an investment of $30,000 and is expected to have year-end MVs and annual expenses as shown in columns 2 and 5, respectively, of Table 9-2. If the before-tax MARR is 10% per year, how long should the asset be retained in service? Solve by hand and by spreadsheet. EXAMPLE 9-4 TABLE 9-2 Determination of the Economic Life, N*, of a New Asset (Example 9-4) (6) (3) (5) Annual (1) (2) MV, End (4) Cost of Capital = 10% of Beginning of Year MV [= (3) + (4) + (5)] Total (Marginal) Cost for Year (7) EUACa Loss in Market Value (MV) during Year k End of through Year, k of Year k Expenses (Ek) (TCK) Year k 0 $30,000 1 22,500 $7,500 $3,000 $3,000 $13,500 2 16,875 5,625 2,250 4,500 12,375 3 12,750 4,125 1,688 7,000 12,813 4 9,750 3,000 1,275 10,000 14,275 5 7,125 2,625 975 13,000 16,600 EUACk = [C}_1 TC; (P/F, 10%,j)] (A/P, 10%,k) j=1 $13,500 12,964 12,918 N = 3 13,211 13,766 Solution by Hand The solution to this problem is obtained by completing columns 3, 4, 6 [Equation (9-2)], and 7 of Table 9-2. In the solution, the customary year-end occurrence of all cash flows is assumed. The loss in MV during year k is simply the difference between the beginning-of-year market value, MVk-1, and the end-of-year market value, MVk. The opportunity cost of capital in year k is 10% of the capital unrecovered (invested in the asset) at the beginning of each year. The values in column 7 are the EUACs that would be incurred each year (1 to k) if the asset were retained in service through year k and then replaced (or retired) at the end of the year. The minimum EUAC occurs at the end of year No. It is apparent from the values shown in column 7 that the new forklift truck will have a minimum EUAC if it is kept in service for only three years (i.e., N = 3). Spreadsheet Solution Figure 9-1 illustrates the use of a spreadsheet to solve for the economic life of the asset described in Example 9-4. The capital recovery formula in column C uses absolute addressing for the original capital investment and relative addressing to obtain the current year market value. Column E calculates the PW of the = D5 / (1+ $B$1) A5 = PMT($B$1, A5,- ($B$4-B5)) + B5 * $B$1 = PMT($B$1, A5,- SUM($E$5:E5)) B C D E F G H A MARR 1 10% 2 End of Year MV Annual Expense PW of Annual Exp. EOY EUAC of Ann.Exp. Cumulative EUAC 3 CR Amount 4 0 5 1 6 2 $ 30,000 $ 22,500 $ 10,500 $ 3,000 $ $ 16,875 $ 9,250 $ 4,500 $ $ 12,750 $ 8,211 $ 7,000 $ $ 9,750 $ 7,363 $ 10,000 $ $ 13,000 $ 7 3 2,727 $3,000 $ 13,500 3,719 $ 3,714 $ 12,964 5,259 $ 4,707 $ 12,918Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started