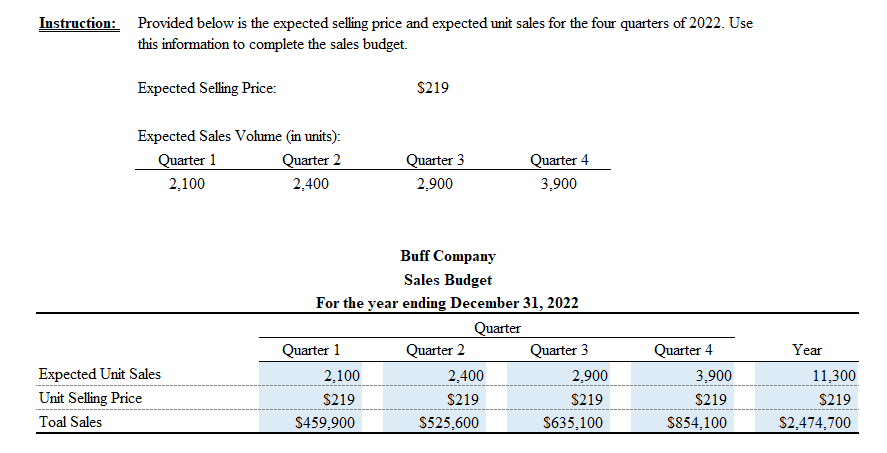

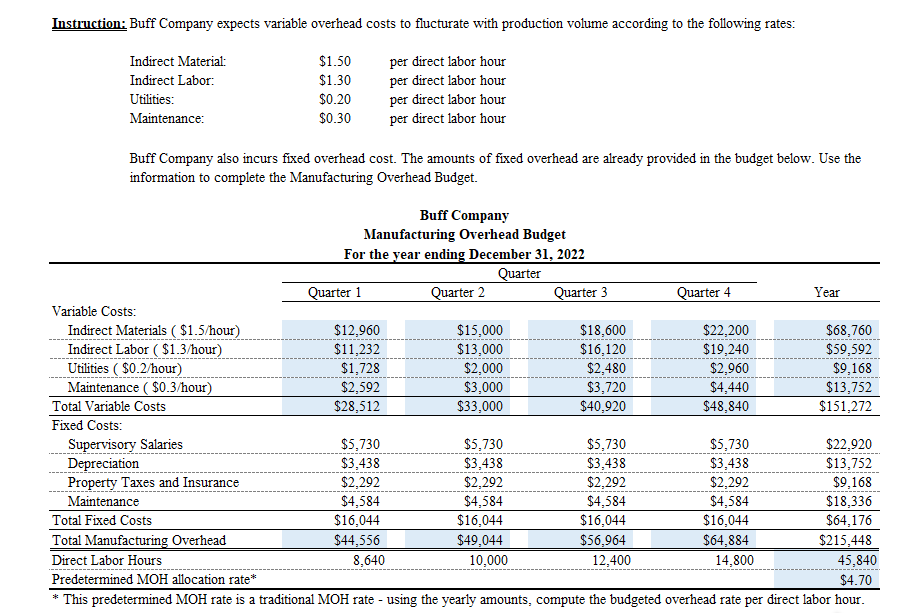

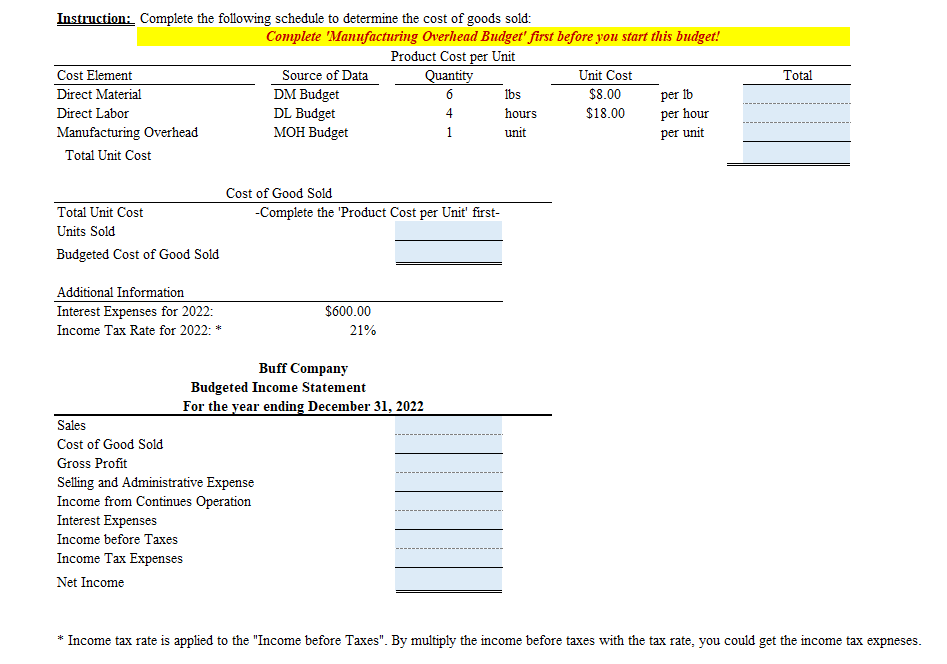

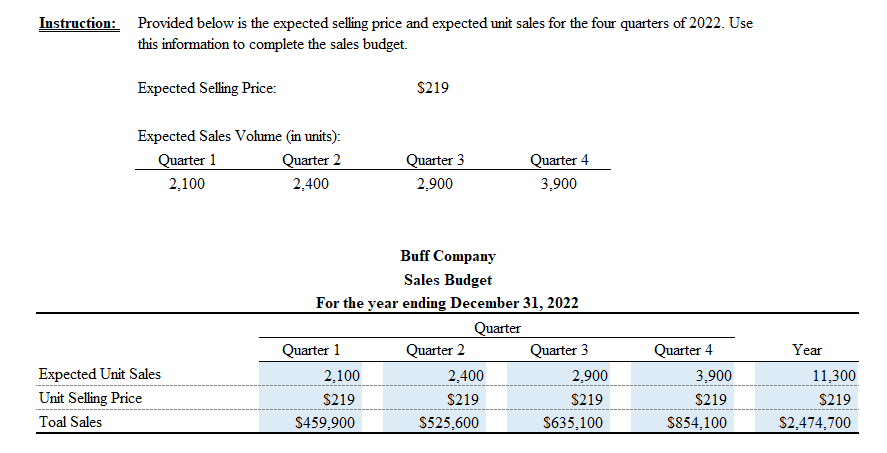

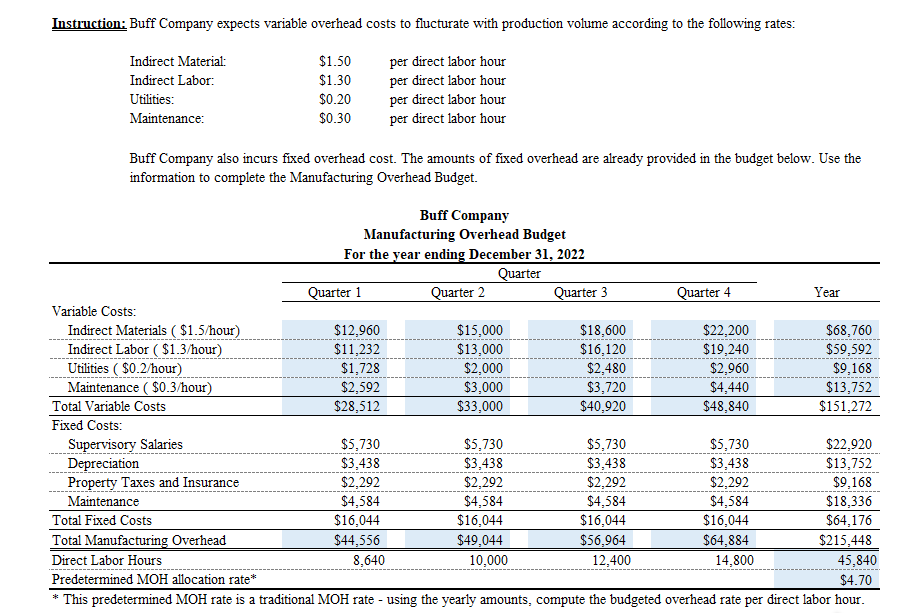

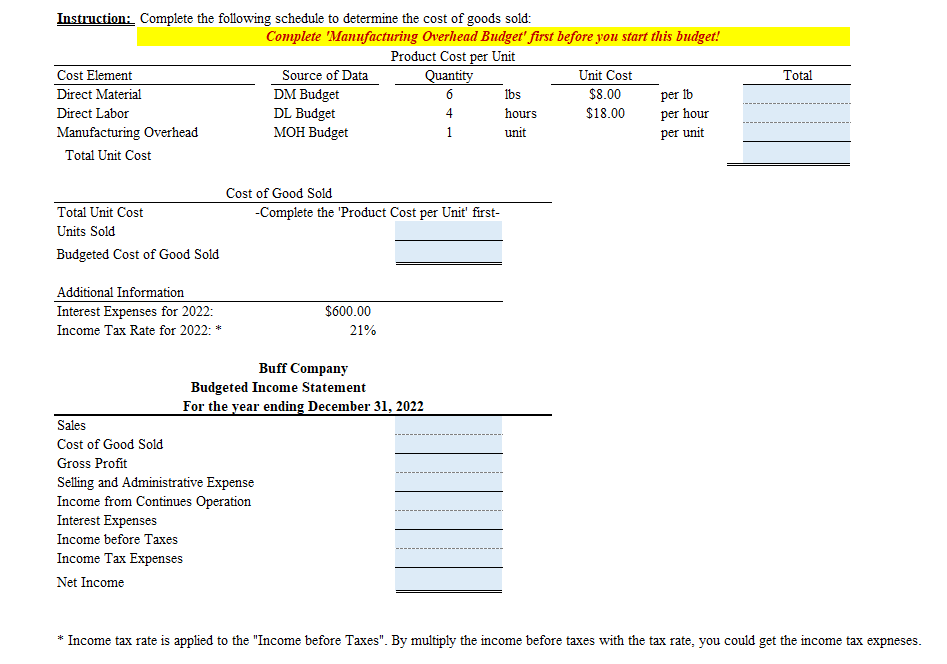

Instruction: Provided below is the expected selling price and expected unit sales for the four quarters of 2022. Use this information to complete the sales budget. Expected Selling Price: $219 Expected Sales Volume (in units): Quarter 1 Quarter 2 2.100 2.400 Quarter 3 2.900 Quarter 4 3.900 Buff Company Sales Budget For the year ending December 31, 2022 Quarter Quarter 1 Quarter 2 Quarter 3 2.100 2,400 2.900 $219 $219 $219 $459.900 $525,600 $635.100 Expected Unit Sales Unit Selling Price Toal Sales Quarter 4 3,900 $219 $854.100 Year 11,300 $219 $2,474,700 Instruction: Buff Company expects variable overhead costs to flucturate with production volume according to the following rates: Indirect Material: Indirect Labor: Utilities: Maintenance: $1.50 $1.30 $0.20 $0.30 per direct labor hour per direct labor hour per direct labor hour per direct labor hour Buff Company also incurs fixed overhead cost. The amounts of fixed overhead are already provided in the budget below. Use the information to complete the Manufacturing Overhead Budget. Buff Company Manufacturing Overhead Budget For the year ending December 31, 2022 Quarter Quarter 1 Quarter 2 Quarter 3 Quarter 4 Year Variable Costs: Indirect Materials ( $1.5/hour) $12.960 $15,000 $18,600 $22,200 $68,760 Indirect Labor ( $1.3/hour) $11,232 $13,000 $16,120 $19,240 $59,592 Utilities ( $0.2/hour) $1,728 $2,000 $2,480 $2.960 $9,168 Maintenance ( $0.3/hour) $2,592 $3,000 $3,720 $4,440 $13,752 Total Variable Costs $28,512 $33,000 $40,920 $48,840 $151,272 Fixed Costs: Supervisory Salaries $5,730 $5,730 $5,730 $5,730 $22,920 Depreciation $3,438 $3,438 $3,438 $3,438 $13,752 Property Taxes and Insurance $2,292 $2,292 $2,292 $2,292 $9,168 Maintenance $4,584 $4,584 $4,584 $4,584 $18,336 Total Fixed Costs $16,044 $16,044 $16,044 $16,044 $64,176 Total Manufacturing Overhead $44,556 $49,044 $56,964 $64.884 $215,448 Direct Labor Hours 8,640 10,000 12,400 14,800 45,840 Predetermined MOH allocation rate* $4.70 This predetermined MOH rate is a traditional MOH rate - using the yearly amounts, compute the budgeted overhead rate per direct labor hour. Total Instruction: Complete the following schedule to determine the cost of goods sold: Complete 'Manufacturing Overhead Budget' first before you start this budget! Product Cost per Unit Cost Element Source of Data Quantity Unit Cost Direct Material DM Budget 6 Ibs $8.00 Direct Labor DL Budget 4 hours $18.00 Manufacturing Overhead MOH Budget 1 unit per unit Total Unit Cost per 10 per hour Cost of Good Sold Total Unit Cost - Complete the 'Product Cost per Unit' first- Units Sold Budgeted Cost of Good Sold Additional Information Interest Expenses for 2022: Income Tax Rate for 2022: * $600.00 21% Buff Company Budgeted Income Statement For the year ending December 31, 2022 Sales Cost of Good Sold Gross Profit Selling and Administrative Expense Income from Continues Operation Interest Expenses Income before Taxes Income Tax Expenses Net Income * Income tax rate is applied to the "Income before Taxes". By multiply the income before taxes with the tax rate, you could get the income tax expneses