Answered step by step

Verified Expert Solution

Question

1 Approved Answer

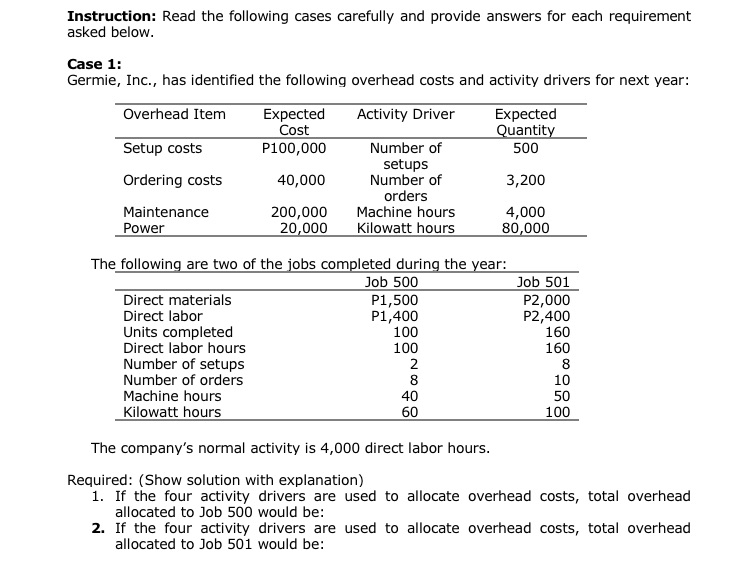

Instruction: Read the following cases carefully and provide answers for each requirement asked below. Case 1: Germie, Inc., has identified the following overhead costs

Instruction: Read the following cases carefully and provide answers for each requirement asked below. Case 1: Germie, Inc., has identified the following overhead costs and activity drivers for next year: Overhead Item Expected Cost Activity Driver Expected Quantity Setup costs P100,000 Number of 500 setups Ordering costs 40,000 Number of 3,200 orders Maintenance Power 200,000 Machine hours 4,000 20,000 Kilowatt hours 80,000 The following are two of the jobs completed during the year: Direct materials Direct labor Units completed Direct labor hours Number of setups Number of orders Machine hours Kilowatt hours Job 500 Job 501 P1,500 P2,000 P1,400 P2,400 100 160 100 160 2 8 8 10 40 50 60 100 The company's normal activity is 4,000 direct labor hours. Required: (Show solution with explanation) 1. If the four activity drivers are used to allocate overhead costs, total overhead allocated to Job 500 would be: 2. If the four activity drivers are used to allocate overhead costs, total overhead allocated to Job 501 would be:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly I can help you solve this problem on overhead cost allocation Overhead Cost Allocation Overhead costs are indirect costs that cannot be directly attributed to a specific product or service I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started